Saudi Arabian local Quick Serve Restaurant (QSR) chains have proven they can compete locally with global power brands. Some of Saudi’s better known local brands in the QSR industry are chains like Al Baik and Al Tajaz – imperial long-standing brands that have dominated the market for years, proving the Saudi market values home-grown offerings. The same trend can be seen in Saudi’s pizza market, where much smaller newcomers like Maestro Pizza are able to equally compete against international pizza brands.

Having launched in 2013, Maestro Pizza’s six years in the Saudi market has been evidently well received. YouGov’s daily brand tracker, BrandIndex, shows Maestro Pizza’s overall Brand Health at 16.3, at par with one of its biggest competitors- Pizza Hut, with an Index score of 16.6, when looking at a year’s worth of data since July 2018. Taking a closer look at the BrandIndex data, Maestro Pizza has raised its overall Brand Health score year on year by +2.3 points, ranking second most-improved in Dining sector in Saudi Arabia.

Disrupting the Saudi pizza market with its low-price strategy, the difference between Maestro Pizza and Pizza Hut’s Value perception amongst different nationality groups is even more evident. When Arab residents (Saudi and Arab Expats) were asked whether they believe the brand offers good/poor value for money, respondents scored Maestro Pizza with 13.0 points, +6.6 points higher when compared to Pizza Hut’s Value score of 6.4 amongst the same audience. When looking at other expats (Western, Asian, and other expats), they scored Pizza Hut at 19.4 compared to Maestro’s 15.6 Value score – a +3.8 difference between brands. This demonstrates a clear distinction in perception between these two audiences, and by focusing on the Arab audience which makes up the majority of the population, Maestro has successfully disrupted the overall Pizza sector in KSA.

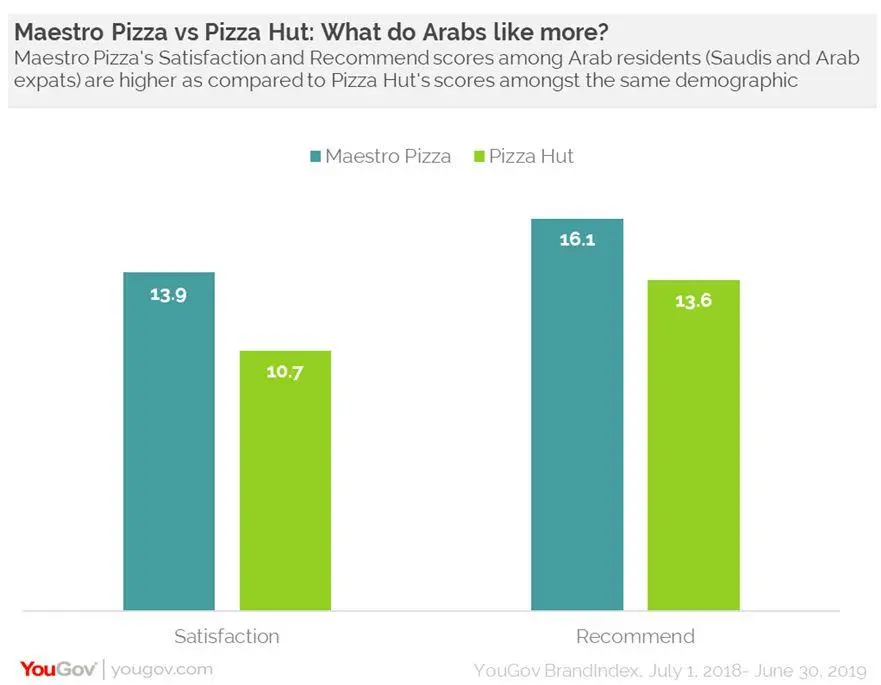

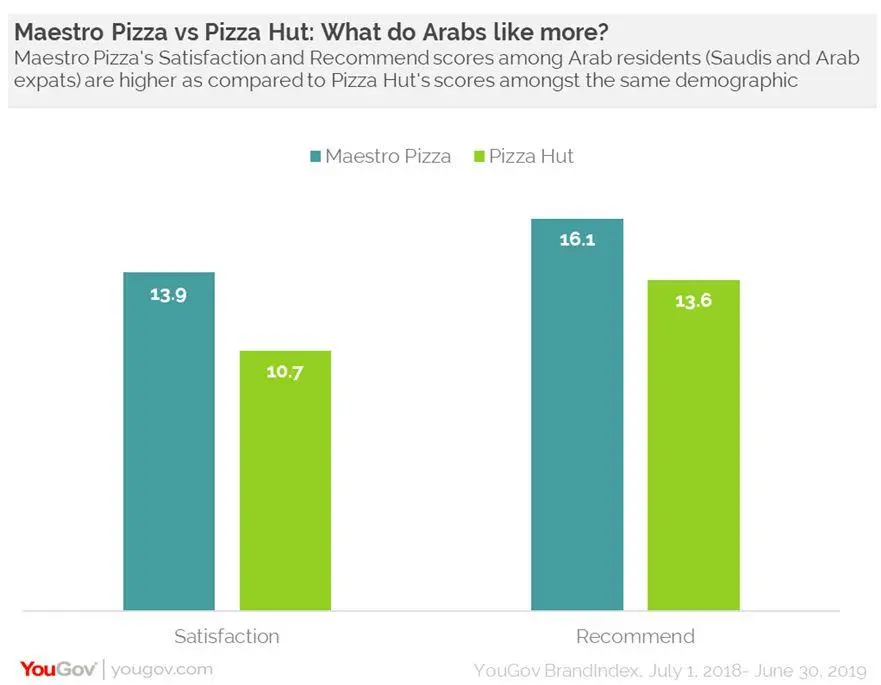

Looking closer, Maestro Pizza’s mission “to Master Saudi Pizza” comes to life when we examine YouGov’s BrandIndex data and see the difference in Satisfaction scores between Arabs and Other expats. On the Satisfaction metric, this local brand scores 13.9 amongst Arabs, while Pizza Hut scores 10.7 in the same metric amongst the same demographic – a 3.2 point different between brands. Conversely, other expats give Pizza Hut a higher Satisfaction score at 19.8 versus Maestro’s 10.3.

Additionally, when thinking about whether or not they would recommend this brand to a friend or tell them to avoid it, Arabs rank Maestro Pizza at 16.1 in the Recommend score. Whereas Pizza Hut’s recommend score stands at 13.6 points amongst the same demographic, -2.5 lower than Maestro. This may be driven by the higher Value perception amongst Arabs in a time when consumers are more price sensitive. Being the vast majority of the Saudi population, Arabs’ preferences in the QSR market could present a great opportunity for smaller local brands competing with international brands to make their mark in the market.

YouGov Spokesperson

Scott Booth

Head of Data Products- MENA

Scott.Booth@yougov.com

Media Enquiries:

Bhawna Singh

Bhawna.Singh@yougov.com

Mobile: +919769803043

About BrandIndex

BrandIndex is the authoritative measure of brand perception. Unlike any other brand intelligence service, it continuously measures public perception of thousands of brands across dozens of sectors. We interview thousands of consumers every day, yielding over 2.5 million interviews a year. BrandIndex operates at national and international levels, allowing you to track brand perception in just one country, compare across multiple countries or monitor a global picture.

About YouGov

YouGov is an international data and analytics group. Our core offering of opinion data is derived from our highly participative panel of 5 million people worldwide. We combine this continuous stream of data with our deep research expertise and broad industry experience into a systematic research and marketing platform.

Our suite of syndicated, proprietary data products include YouGov BrandIndex, the daily brand perception tracker, and market-leading YouGov Omnibus which provides a fast and cost-effective service for obtaining answers to research questions from both national and selected samples. With 31 offices in 21 countries and panel members in 38 countries, YouGov has one of the world’s top ten international market research networks. For further information visit mena.yougov.com

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.