Abu Dhabi - Abu Dhabi Commercial Bank PJSC ("ADCB" or the "Bank") today reported its financial results for the year ended 31 December 2015.

Financial highlights (31 December 2015)

1.

2. Record level of net profit despite a challenging business environment

(2015 vs. 2014)

- Net profit up 17% to AED 4.927 bn

- Net profit attributable to equity shareholders up 22% to AED 4.924 bn

- Operating income up 10% to AED 8.260 bn, with net interest and Islamic financing income up 11% at AED 6.206 bn and non-interest income up 6% at AED 2.055 bn

- Net fees and commission income up 16% to AED 1.438 bn

- Operating profit before impairment allowances up 9% at AED 5.434 bn

- Cost to income ratio for 2015 was 34.2%, within our target range

3. Continue to focus on strategic drivers of measured and sustainable growth

- Net loans and advances increased 9% year on year to AED 154 bn as at 31 December 2015

- Deposits from customer increased 14% year on year to AED 144 bn as at 31 December 2015

- As at 31 December 2015, CASA* deposits comprised 44.1% of total deposits

4. Strong asset quality metrics

- As at 31 December 2015, NPL and provision coverage ratios were 3.0% and 128.5% respectively

- Collective impairment allowance balance was 1.89% of credit risk weighted assets as at 31 December 2015

5. Robust capital position and continued emphasis on liquidity

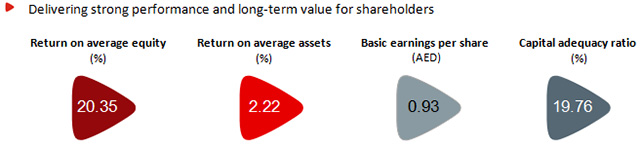

- As at 31 December 2015, capital adequacy ratio was 19.76% and tier 1 ratio was 16.29%

- As at 31 December 2015, the Bank was a net lender of AED 22 bn in the interbank markets and investment securities totaled AED 21 bn

As a result of the Bank's record performance in 2015, the Board of Directors has recommended a cash dividend of 45 fils per share, translating to a pay out of AED 2.3392 bn (excluding treasury shares) equivalent to 47% of net profit.

Commenting on the results, Eissa Mohamed Al Suwaidi, Chairman said:

"2015 was another record year for the Bank and our ability to produce such accomplishments in an environment buffeted by lower oil prices and other economic headwinds reflects our differentiation. This "ADCB Difference" is supported by a well-defined and well-executed strategy that we have pursued consistently over the past five years which enabled us to deliver significant growth and rising profitability. While 2016 is expected to be a more challenging year for financial services globally, the Bank will continue to monitor conditions closely and will take action as necessary.

ADCB's sharp focus on serving the UAE is one of the major differentiating strengths. Our strategy is steady and consistent, yet agile and responsive to new opportunities and challenges. Building on our strategy, we have established a better way to bank and our ambition is to create the most valuable bank in the UAE. Going forward we will stay committed to our clients and customers in our core geography and core businesses. Whilst lower oil prices pose a challenge, the UAE's economy remains robust and diversified."

The Chairman also noted ADCB's focus on other key areas including governance and Emiratisation initiatives:

"Throughout 2015, the Bank's aim to excel in corporate governance continued. Our governance philosophy was explored in an in-depth story in the Hawkamah Journal in 2015. We are pleased that the Bank now meets or exceeds nearly all of the Basel Committee's guidelines on corporate governance.

We remain committed to attracting, training, and retaining high-calibre UAE national talent across all levels of the Bank. At the end of the year 40% of the Bank's staff were UAE nationals. A year after starting 'Tamooha', one of our core Emiratisation initiatives, a first of its kind program designed to bring more Emirati women into the workforce, ADCB is seeing excellent results, reflected in the increasing number of women joining the programme.

The Bank remains committed to contributing to the development of the UAE banking sector and the country, and on behalf of the Board, I thank His Highness Sheikh Khalifa Bin Zayed Al Nahyan, the UAE President and Ruler of Abu Dhabi, His Highness Sheikh Mohamed Bin Zayed Al Nahyan, Abu Dhabi Crown Prince and Deputy Supreme Commander of the UAE Armed Forces, His Highness Sheikh Mansour Bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs, and the UAE Central Bank for their continued support for ADCB and the future development of the UAE economy. I would also like to extend my gratitude and appreciation to our shareholders, valued customers and the ADCB executive management team and employees."

The Difference Is Ambition + Discipline

Commenting on the Bank's performance, Ala'a Eraiqat, Member of the Board and Group Chief Executive Officer said:

"We are pleased to report a record year of strong financial results. As in the past years, our success was the result of ambition and discipline. Our ambition is to serve our customers' needs and to become the most valuable bank in the UAE and our discipline mandates that we pursue responsible, sustainable and profitable growth."

Financial strength

"We continue to deliver strong results and all of our businesses have made a significant contribution to the bottom line, setting records in many key measures. As at 31 December 2015, total assets reached a record of AED 228 bn, up 12% from the prior year. Net profit in 2015 also set a record, rising 17% year on year to AED 4.927 bn, whilst net profit attributable to equity shareholders grew 22% year on year to AED 4.924 bn. Fee income was up 16% over the prior year at AED 1.438 bn, reflection of our increased emphasis on non-interest income generation. Our return on average equity for the year was an industry leading 20.3%. Our margins in 2015 were slightly higher year on year, mainly as a result of our diversified asset base and granular build to our balance sheet."

Strong balance sheet

"A strong balance sheet is a vital defence against economic turbulence, and another differentiator for ADCB. We have built a robust capital structure, with a capital adequacy ratio of 19.76% and tier I ratio of 16.29% as at 31 December 2015. We run a stable and resilient business and strive to create a sustainable liability structure supported by stable and cost-effective CASA (current and savings account) deposits. Our CASA deposits comprised 44% of total customer deposits as at 31 December 2015. Our funding approach remains disciplined with any future growth funded by an increase in customer deposits. Year on year, total customer deposits grew 14% and loans grew 9%. Islamic Banking continued to be a key driver of growth, with Islamic financing assets up 32% and Islamic deposits up 9% over 2014. We remain selective about the sectors to which we lend and remain prudent about our provisioning. As at 31 December 2015, our provision coverage ratio was 128.5%."

Customer-first culture

"ADCB culture places the needs of our customers first, we listen and respond to the needs of our customers. We continue to enhance our customer centric culture by continuing to invest in technology and simplifying our businesses. In 2015, we have digitised many systems and processes to provide a better and more comprehensive banking experience by making it simpler for customers to bank with us, whilst delivering best in class service. Today, more than 90% of retail financial transactions are done electronically, enabling us to better serve our customers whilst moderating costs. In 2015, our cost to income ratio was 34%, remaining stable over 2014. This was achieved while simultaneously improving our Net Promoter Score (NPS) throughout 2015. We use NPS as a way of measuring and managing customer experience.

The ADCB Difference is also reflected in the power of our brand, which was recognised as one of the top 10 brands in the UAE according to MBLM Brand Intimacy 2015 Report, an independent study by an international branding authority. ADCB was the only local brand in the Top 10, alongside a collection of global names. Also, ADCB was the UAE's number one "Most Googled" local brand in 2015. This strong brand engagement is a tribute to our customer centric culture and the passion of our team members who bring our culture to life every day."

Looking forward

"We are confident that ADCB is well positioned and going forward we will continue to strengthen the elements of the 'ADCB Difference', by building on our proven strategy, doing more to serve our customers and growing our business profitably to continue delivering value for our stakeholders."

About ADCB (31 December 2015):

ADCB was formed in 1985 and as at 31 December 2015 employed over 5,000 people from 70 nationalities, serving over 650,000 retail customers and over 52,000 corporate and SME clients in 49 branches, 3 pay offices and 2 branches in India, 1 branch in Jersey and representative offices in London and Singapore. As at 31 December 2015, ADCB's total assets were AED 228 bn.

ADCB is a full-service commercial bank which offers a wide range of products and services such as retail banking, wealth management, private banking, corporate banking, commercial banking, cash management, investment banking, corporate finance, foreign exchange, interest rate and currency derivatives and Islamic products, project finance and property management services.

ADCB is owned 58.08% by the Government of Abu Dhabi (Abu Dhabi Investment Council). Its shares are traded on the Abu Dhabi Securities Exchange. As at 31 December 2015, excluding treasury shares, ADCB's market capitalisation was AED 34 bn.

This document has been prepared by Abu Dhabi Commercial Bank PJSC ("ADCB") for information purposes only. The information, statements and opinions contained in this presentation do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. This document is not intended for distribution in any jurisdiction in which such distribution would be contrary to local law or reputation.

The material contained in this press release is intended to be general background information on ADCB and its activities and does not purport to be complete. It may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. It is not intended that this document be relied upon as advice to investors or potential investors, who should consider seeking independent professional advice depending on their specific investment objectives, financial situation or particular needs.

This document may contain certain forward-looking statements with respect to certain of ADCB's plans and its current goals and expectations relating to future financial conditions, performance and results. These statements relate to ADCB's current view with respect to future events and are subject to change, certain risks, uncertainties and assumptions which are, in many instances, beyond ADCB's control and have been made based upon management's expectations and beliefs concerning future developments and their potential effect upon ADCB.

By their nature, these forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond ADCB's control, including, among others, the UAE domestic and global economic and business conditions, market related risks such as fluctuations in interest rates and exchange rates, the policies and actions of regulatory and Governmental authorities, the impact of competition, the timing impact and other uncertainties of future acquisition or combinations within relevant industries.

As a result, ADCB's actual future condition, performance and results may differ materially from the plans, goals and expectations set out in ADCB's forward-looking statements and persons reading this document should not place reliance on forward-looking statements. Such forward-looking statements are made only as at the date on which such statements are made and ADCB does not undertake to update forward-looking statements contained in this document or any other forward-looking statement it may make.

CASA: Current and Savings account*

For further details please contact:

Investor Relations

Denise Caouki

E: adcb_investor_relations@adcb.com

Corporate Communications

Majdi Abd El Muhdi

E: majdi.a@adcb.com

Press Release 2016