Masraf Al Rayan and Qatar International Islamic Bank lead global Cost-to-Income Ratio rankings

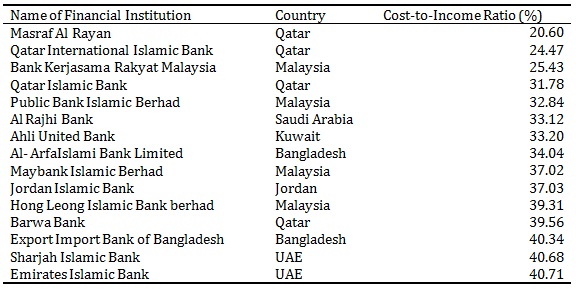

Manama, Bahrain: The WIBC Leaderboard announced today the global rankings of Islamic banks in terms of Cost-to-Income ratio, one of the financial performance sub-indicators of the Leaderboard. No less than four Qatar-based banks figured in the top 15. As per the rankings, Qatar-based Masraf Al Rayan leads the global cost-to-income ratio rankings with a ratio of 20.6%. Next on the ranking charts is Qatar International Islamic Bank and Malaysia-based Bank Kerjasama Rakyat Malaysia with a ratio of 24.4% and 25.4% respectively.

The WIBC Leaderboard is an innovative performance assessment framework designed by, Middle East Global Advisors, the conveners of the much-acclaimed World Islamic Banking Conference (WIBC), as part of its efforts to improve the quality and performance of the Islamic banking industry.

The Cost-to-Income ratio is a key financial measure used to gauge the efficiency of a bank. It is calculated based on non-interest operating cost divided by the sum of net interest income and non-interest operating income. The ratio gives a clear view of how efficiently a bank is operating at and what portion of costs can be covered by income.

In short, the lower the ratio, the higher the ranking of the bank. The Chart below shows the global rankings of banks along with their scores.

Top 15 Global Islamic Banks ranked according to the Cost-to-Income Ratio

Source: Bankscope and ICD Thomson Reuters Islamic Finance Development Indicator

Highlighting the importance of Cost-to-Income ratio as a measure to gauge performance, Jordan Islamic Bank's Chief Executive Officer Mr. Musa Shihadeh said:

"This ratio is an important indicator of how efficient a bank is in keeping its cost low. In this age of digital transformation and intense competition from both big banks and small lenders, it is imperative that banks cut down their costs as well as focus on areas to increase income as this ratio is equally affected by how banks generate income. "

Reiterating the views of Mr. Shihadeh, Dr Sayd Farook, Vice Chairman and CEO of Middle East Global Advisors, stated:

"By virtue of its business model, Islamic banks are able to keep their costs low as they do not participate in volatile market based activities. However, this decreases Islamic banks' income generating avenues. In light of such issues, Cost-to-Income ratio helps banks in keeping track of their financial performance by readjusting costs and focus on revenue generating streams in case they fall below the industry benchmark."

Cost-to-Income ratio is an important indicator for bank managers regarding the financial strength of their banks. It has never been more important than now for banks to achieve operational excellence given the range of headwinds they face, ranging from the challenge of regulatory requirements to the imperative of managing volatility in global financial markets.

WIBC 2015 will take place on the 1st, 2nd and 3rd of December at the Gulf Hotel in Manama, Kingdom of Bahrain. For more information, visit www.wibc2015.com.

About Middle East Global Advisors

Connecting markets with intelligent insights & strategic execution since 1993.

Middle East Global Advisors (MEGA) is the gateway connectivity and intelligence platform to opportunities in the rapidly developing economic region that stretches all the way from Morocco in the West to Indonesia in the East - The Middle East North Africa Southeast Asia (MENASEA) connection. We pride ourselves for being at the heart of these diverse markets for over 22 years.

Visit us at meglobaladvisors.com

About WIBC

The World Islamic Banking Conference (WIBC) has established its reputation as the world's largest and most influential gathering of international Islamic banking and finance leaders for over two decades. With the strategic support of the Central Bank of Bahrain, the next generation WIBC will focus on transforming Islamic finance into a global proposition by facilitating strategic opportunities, addressing systematic challenges and connecting international market players and institutional investors to the industry's catalysts, thought leaders, partners and institutions.

For over two decades, WIBC has served as a key platform for bankers, institutional investors, asset managers, policymakers, academics and other stakeholders within Islamic finance and banking from key markets such as Luxembourg, the United Kingdom, the Middle East, Sudan, Nigeria, Singapore, Malaysia, Indonesia, and other Asian growth markets. Over the years it hosted globally renowned leaders such as Sir Howard Davies, Former Chairman of the European Central Bank, Professor Robert Kaplan of Harvard Business School, Nicholas Naseem Taleb, the author of "The Black Swan," and Dr. Mark Mobius, Emerging Markets Guru and Executive Chairman of Templeton Emerging Markets. With its strong focus on cutting edge content, WIBC remains the strategic event for staying ahead of the innovation and technology forces that will shape the Islamic financial services industry in the near future.

About WIBC Leaderboard

The WIBC Leaderboard, a first of its kind performance assessment, a truly groundbreaking and innovative tool providing high visibility rankings of Islamic banks based on an aggregate performance index. This aggregate index holistically ranks the entities on the basis of stability, performance and governance measures. The WIBC Leaderboard and particularly the aggregate performance index, is the basis for the WIBC Performance Awards, to be announced at the Gala Dinner of the conference.

To find out more, visit www.wibc2015.com

Join the global conversation on Twitter via @wibc_2015 #wibc2015

Contact:

Nikita Kandath

Marketing & Media Manager

ME Global Advisors

Tel: +971 4 441 4946

Email: nikita@meglobaladvisors.com

© Press Release 2015