PHOTO

Global markets

Investors are awaiting the outcome of a summit that started today between the President of the United States, Donald Trump, and North Korean leader Kim Jong Un in Singapore.

Wall Street was mixed overnight, with the Dow barely changed, the S&P 500 up 0.1 percent and the Nasdaq adding 0.2 percent.

Trading was volatile in Asia, as MSCI's broadest index of Asia-Pacific shares outside Japan seesawed between positive and negative territory.

“So today, we have the opportunity for a historic meeting, a possible end to the Korean war, and a possible move to denuclearise, and maybe even demilitarise the Korean peninsula,” Robert Carnell, chief economist Asia-Pacific at ING told Reuters.

“All of that’s great, but how can you make money from it? Well, the short answer is you probably shouldn’t even try.”

Middle East markets

Stock markets in the Middle East were mixed on Monday, as trading volumes were lower ahead of the Eid Al Fitr holiday.

Dubai’s index jumped 1.4 percent as property developer Emaar Properties jumped 4.1 percent and as Dubai Islamic Bank rose 1.2 percent. It rallied for the second session in a row after its 5.1 billion dirham rights issue was nearly three times oversubscribed.

The Abu Dhabi index added 0.9 percent, backed by First Abu Dhabi Bank, which rose 1.6 percent and property developer Aldar, gaining 1.4 percent.

The Saudi index lost 0.4 percent with 114 declining stocks out of 176 being traded during the session.

Property developer Jabal Omar and telecoms firm Mobily fell by 2 percent and 5.9 percent respectively.

Qatar’s index closed 0.2 percent down, weighed down by losses among financial stocks.

Qatar National Bank and Qatar Islamic Bank lost 1.4 percent and 0.5 percent respectively, while Industries Qatar rose 1.4 percent.

Egypt’s index fell 1.4 percent, Oman’s index was flat, while Kuwait’s index lost 0.6 percent and Bahrain’s index added 0.5 percent.

Oil prices

Oil prices were stable early on Tuesday as investors awaited the outcome of the summit in Singapore.

Brent crude futures were trading at $76.45 per barrel at 0355 GMT, little changed from their last close.

U.S. West Texas Intermediate (WTI) crude futures were at $66.16 a barrel, up 6 cents from their last settlement.

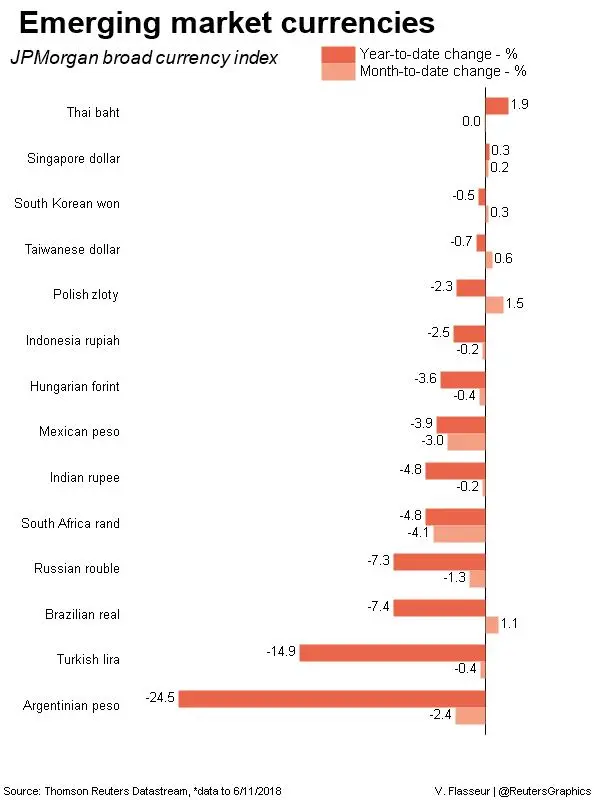

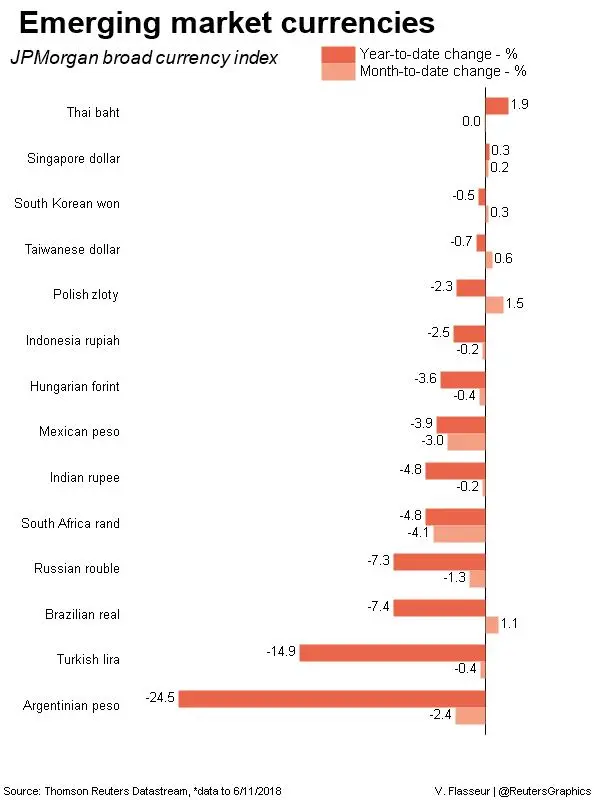

Currencies

The dollar index was up 0.2 percent against a basket of major currencies.

Against the safe haven yen, the dollar jumped to a three-week top of 110.49 in early deals. It was last at 110.18.

Most Asian currencies gained early in the week before the summit between the U.S. President Trump and the North Korean leader Kim Jong Un.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Precious metals

Gold prices edged lower on Tuesday, weighed down by a stronger dollar.

Spot gold was down 0.2 percent at $1,297.68 per ounce at 0046 GMT.

U.S. gold futures for August delivery were 0.1 percent lower at $1,301.60 per ounce.

(Writing Gerard Aoun; Editing by Mily Chakrabarty)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018