PHOTO

When the thorny issue of the oversupply of units in the property sector in the United Arab Emirates arises it is usually in reference to the Dubai residential market, but landlords and agents in the commercial sector are also facing similar challenges, especially those in the hospitality and retail space.

For those in the office sector the outlook may not be as bad, but it is hardly a picture of health for property owners – either in Dubai or Abu Dhabi.

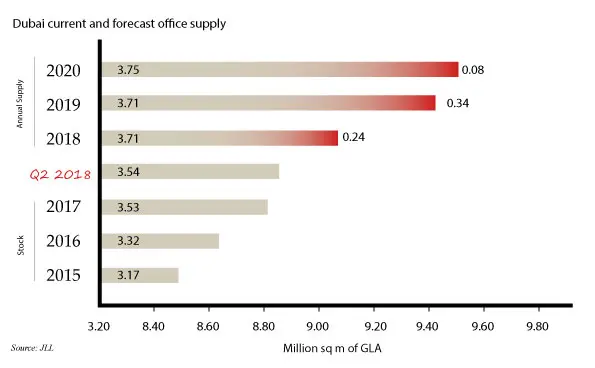

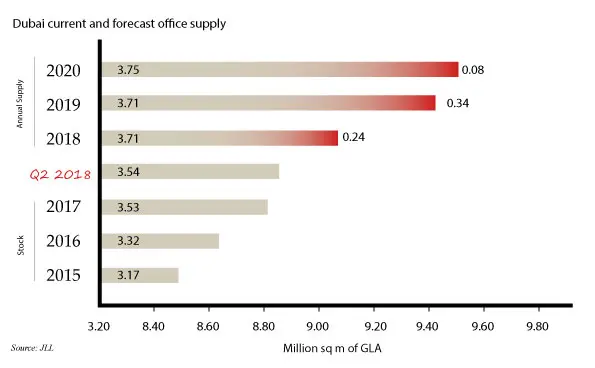

JLL's latest Real Estate Market Overview for Dubai published last week shows that the only 20,000 square metres of space has been added in the first half of this year, and there were no new completions in the second quarter.

The pipeline for new space until the end of 2020 also remains modest, with 240,000 square metres set to be added this year, 340,000 square metres next year, and just 80,000 square metres in 2020.

Despite this, take-up of office space has declined. Vacancy rates across the city increased to 14 percent during the quarter, up from 10 percent a year earlier. This had a knock-on effect on average rents, which fell by 13 percent year-on-year to 1,687 UAE dirhams ($459.30) per square metre, JLL’s report said.

Taimur Khan, research manager at Knight Frank, said that rent declines were less pronounced in prime areas, such as Dubai International Financial Centre (DIFC), where occupancy rates remain relatively high. Knight Frank’s Q2 update found prime rents in the area dropped by 0.9 percent year-on-year, compared with a 7.6 percent decline for top-quality, Grade A rents across the city.

He said that Grade A rents had come under pressure in areas such as Emaar Square, as more new buildings on the fringes of DIFC have become available at cheaper rates.

Khan added that the completion of Gate Avenue in DIFC would also open the ‘core’ DIFC to other, cheaper buildings along its 1km spine, and that the completion of the $1 billion ICD Brookfield Place tower will also have a knock-on effect.

“I think you’ll [see] vacancy rates increase as the ICD Brookfield building comes up,” Khan told Zawya in a telephone interview. “That’s quite a substantial project,” he said, adding that tenants vacating other parts of DIFC to move into the building could place pressure on rents.

ICD Brookfield Place is a 54 storey, 282 metre-high tower, which is being developed as a joint venture between the Investment Corporation of Dubai and Brookfield Asset Management. It will contain 900,000 square feet of office space and connect to a 150,000 sq ft retail centre. The building was initially due to complete at the end of this year, but is currently scheduled to open in the second half of 2019. It is 25 percent pre-let.

Although property experts agree that a series of recent changes announced by the UAE government aimed at stimulating the economy – including the promise of 10-year visas for doctors, engineers and entrepreneurs, as well as allowing for 100 percent foreign ownership of companies in onshore locations – will be of benefit to the office market in the long run, its short-term impact is likely to be muted.

“These announcements are very interesting but there has been so little detail and clarity around them that really I would say they’re not being taken seriously at the moment in the market,” Paula Walshe, Cluttons Middle East’s head of international corporate services, said in a telephone interview.

Levelling the field

JLL’s MENA head of research, Craig Plumb, told Zawya in a telephone interview that one likely impact of allowing 100 percent foreign ownership onshore is that it may bring rents down in some free zones, which are typically more expensive than in onshore locations.

“For Abu Dhabi, that’s a much bigger thing than Dubai,” he said in a telephone interview last week. “You’ve got over 30 free zones in Dubai. In Abu Dhabi, you’ve got five and dual licensing has only recently (been introduced) in certain locations.”

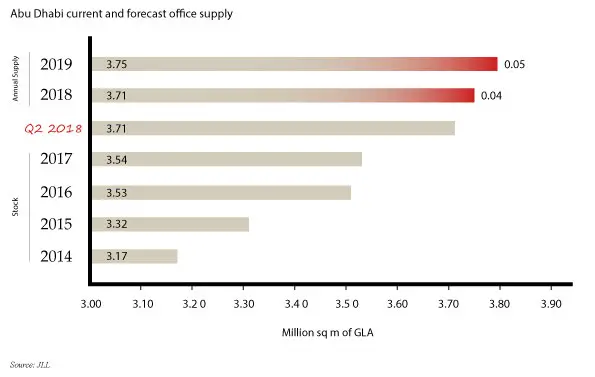

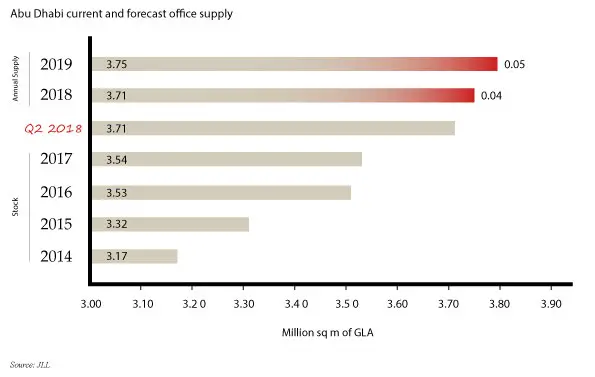

The Abu Dhabi office market continues to be impacted by sluggish demand, despite the fact that improving oil prices appear to be supporting a growth in employee numbers. Knight Frank’s Q2 report states that employment growth is set to increase to 3.7 percent this year and 4.1 percent next year.

Yet vacancy rates for office space in the city currently stand at 27 percent, according to the report, and Khan said the market is being impacted by both government and corporate entities consolidating space in their own, purpose-built headquarters, leaving other buildings vacant.

“In Abu Dhabi, most of the stock coming on is owner-occupied,” he said. “The bigger players are building for themselves. The overall square footage goes down (and) it makes a lot of sense for them in terms of lower costs.”

For other parts of the commercial property market, sluggish demand is compounded by (sometimes substantial) increases in supply.

Plumb believes that this is most acute in the retail market. JLL’s Q2 Dubai report showed that within the next two and-a-half years, the total amount of mall space in Dubai is set to increase by 40 percent – from 3.65 million square metres currently to 5.11 million square metres by the end of 2020.

Yet rents in the biggest, super-regional malls have already declined by 10 percent over the past 12 months, while regional malls have witnessed a 13 percent decline. Vacancy rates have also climbed from 10 percent to 14 percent.

Plumb said that whereas in the past, it was the smaller, secondary malls that suffered the most from slowing demand, “now you’re finding higher vacancies even in the primary malls”.

Shopping around

“It’s taking them longer to find tenants for any space that does become vacant, and even in the good malls now they are having to offer lower rents,” he said.

“The retail developers, the Majid Al Futtaims, Emaar , Dubai Properties, Nakheel and Meraas – all of the big developers - are still positive about retail and they’re all launching new retail malls. Personally, we think that is causing an oversupply,” Plumb said.

Anthony Spary, associate director of advisory and transaction services at CBRE Middle East, said in an emailed response to questions that “retail rents are under considerable pressure with landlords offering significant reductions to secure new and international brands to their schemes”.

“Leasing incentives such as extended rent-free periods, capex contributions, flexible payment terms and turnover rental structures are now being offered by landlords to continue to attract these retailers,” Spary added.

The hotels market is facing similar pressures. Figures released on Wednesday last week by Dubai’s Department of Tourism and Commerce Marketing showed that tourism numbers for the first half of the year had increased only marginally – up 0.49 percent year-on-year, to 8.1 million, compared to a 10 percent-plus increase in the same period a year ago.

DTCM said that in the same period, the number of hotel rooms in the emirate increased by 7 percent year-on-year to stand at 111,317. Some 24 new mid-market hotels were added, bringing the total number to 138 – or 25 percent of the total.

Figures from industry consultant STR for the first half of 2018 show that revenues per available room (RevPAR) fell by 12 percent year-on-year to 399 UAE dirhams per night during the second quarter of 2018 as average daily room rates (ADR) dropped by 9 percent to 591 dirhams per night.

In Abu Dhabi, despite the number of hotel guests increasing by 5 percent during the first half of the year to more than 2.4 million, increased hotel room supplies meant both average daily rates and RevPAR fell by 3 percent, to 374 dirhams and 244 dirhams respectively.

STR said that about 17,000 new hotel rooms will be added to the 153,000 rooms currently operational across the UAE by the end of the year, as 60 new hotels are due to open during the second half.

Finally, the logistics market is also witnessing a softening of demand, which is also due to oversupply, according to Clutonns Middle East’s associate director of commercial agency, James Lynch.

He said that although there were some requirements for big-ticket logistics and warehouse space from e-commerce retailers like noon, Amazon, Jollychic and others, there is “a mismatch” between the huge, modern sheds required by these firms and the type of stock available in the market.

“There’s an oversupply generally in the industrial market at the moment, but that oversupply is in the 50-100,000 sq ft market,” Lynch said.

“Like offices, there’s been a softening in the market over the last 12-18 months. With that, there’s been a flight to quality. The modern, well-built, globally-specified units are still in demand and can still command a strong rent, but the unit next door might be a 10-15 year-old property that’s not quite of the same calibre.”

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018