PHOTO

Riyadh/Dubai: Rasan, a Saudi-owned Fintech and Insurtech company, participates at GITEX Global 2021, which was held from 17th to 20th October at the Dubai World Trade Center, to help drive innovation and create value in the insurance and finance industry through its innovative solutions.

Under the theme, “Shining a light on the intersection between technology and finance,” GITEX Fintech Surge 2021 will feature innovations across banking, asset and wealth management, insurance, regulation and more. The Middle East and North Africa (MENA) Fintech market is slated to reach US$ 2.5 billion by 2022 (SME10X).

Rasan, the pioneer in regional Insurtech through its market leading Tameeni platform, showcased its various innovations in the health and motor insurance as well as other solutions and multi-sided platforms. The company’s primary aim is to highlight three core points:

- Simplicity - Share its success story on making its technology intuitive for its broad user base

2. Pioneering - Offering innovative and unprecedented solutions in the insurtech and broader fintech markets in Saudi Arabia and broader MEA region

- Sustainability - Awareness about its role in promoting sustainable economic growth and improving economic productivity

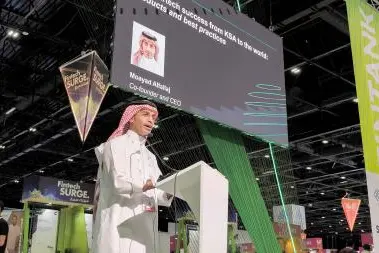

On the other hand, Mr. Moayad Alfallaj, the CEO of Rasan, participated in the sessions accompanying the exhibition, where he highlighted, through his speech, the company's experience in the areas of innovative solutions in Fintech and Insurtech fields, reviewing the products the company has created and its success story by simplifying its digital technologies.

Alfallaj stressed the extent to which Saudi Arabia's Vision 2030 contributed to the development of and support for financial and insurance technologies and its positive implications for the development of the SME sector, which would contribute effectively to the transition to the digital economy

In his speech, Alfallaj also referred to Rasan’s leading role in providing innovative and unprecedented solutions in insurance and financial technologies, as well as partnerships in which the company had achieved many successes, noting the company's launch of Tameeni platform, through its brokerage partner IHC, the first authorized and licensed online insurance aggregator in Saudi Arabia by the Saudi Central Bank (SAMA), has led to a digital boom in the regional insurance technology sector.

Alfallaj reported on the experience of the "Tameeni and Treza" technology platforms designed and developed in Saudi Arabia, which are fully integrated with all interested parties, including insurance companies, data providers as well as electronic payment portals. All that enables Tasan to offer its customers instant policy, which is consistent with Rasan's vision of offering innovative and comfortable solutions to help the community and provide a distinguished customer service at a global level.

Founded in 2016, Rasan platforms have contributed to the digital transformation of the economy as part of Vision 2030. It has also helped more than 8 million users through its Tameeni and Treza platform and gave customers the possibility to access insurance products while at their homes or offices. The platform completely eliminated the need to print insurance policies and provided a comprehensive digital experience, resulting approx. SAR 120 million in savings from printing costs.

Speaking about environmental protection, the company's products contributed to reducing atmospheric CO2 emissions by approx. 2000 tons through digitizing services and ensuring that policyholders did not need to travel between different outlets for insurance offers.

About Rasan

Founded in 2016, Rasan is the Saudi-owned technology startup behind the pioneering Insurtech platform Tameeni and other Fintech solutions. Rasan streamlines human experiences and drives operational digitalization, value-chain transformation and cross-sector collaboration across KSA and the wider region.

Since 2017, eight million users have used Rasan’s platforms, including Tameeni Motor and Tameeni SME Health, at an increasing daily traffic of 40,000 to 100,000 transactions. Instant policy, insurance comparisons and 100% digitalized transactions makeup Tameeni’s market leading value proposition.

Rasan not only connects people to opportunities, it also connects businesses to opportunities. Both alliances and partnerships form two key components of Rasan’s corporate strategy.

Sustainability is part of Rasan’s DNA. It all started in the launch of KSA’s first Insurtech infrastructure product, Tameeni. Rasan’s climate action is as remarkable. Its 100% paperless and 100% online solutions have saved the environment 30,000 to 60,000 trees and 62000 tons in CO2 emissions to date.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.