PHOTO

Business conditions in Qatar's non-oil and gas private sector are continuing to improve, according to a report commissioned by the Qatar Financial Centre (QFC).

The data, compiled by IHS Markit, showed that despite the rate of expansion slowing to a one-year low, growth of new business remained robust and job creation reached a record high. (Read the full report here).

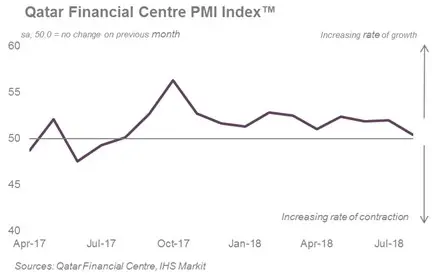

The data is based on the Purchasing Managers Index (PMI), a monthly survey in which purchasing managers answer questions on factors including levels of new orders, employment, business activity and suppliers’ delivery times.

IHS Markit reported that QFC’s PMI softened to 50.4 in August, down from 52.0 in July. QFC said in a press release that any reading above 50.0 indicates an improvement in business conditions, while anything below that level shows a deterioration.

The monthly survey began in April 2017, with historic data showing that the last time the PMI was below 50 was in the second quarter of 2017, reaching a high of 56 in October of that year.

In the press release, issued on Wednesday, QFC said respondents to the August survey indicated an improvement in new order inflows. While the rate of growth eased, it remained solid overall.

“Prices pressures faced by businesses fell in the latest survey. In fact, the drop in input prices was the fastest since the survey's inception in April 2017. Survey data suggested that easing capacity pressures at suppliers were partly linked to the fall in input prices. Meanwhile, delivery times improved at a marked rate,” the release stated.

Sheikha Alanoud bint Hamad Al-Thani, managing director of business development, QFC Authority said that while the headline PMI figure has eased since July, there was still positive news in the latest survey.

“Job creation hit a survey-record high as firms sought to increase payroll numbers to meet growth inflows of new business,” she said.

“Furthermore, overall cost burdens faced by local businesses fell as supplier performance improved to a marked degree. Finally, client demand continued to expand, signaling that the softening in the sector’s rate of growth may prove short-lived.”

Further reading:

• Growth streak in Qatar's non-oil and gas private sector continues

• Qatar banks forecast 2018 uptick in private sector credit growth

• Qatar growth expected to strengthen in 2017 - QNB

• Qatar to lead GCC non-oil growth in 2017/18

• Qatar Financial Centre new business inflow increases by 69% in H1 2018

• Commercial Bank and QFC form strategic partnership

(Writing by Imogen Lillywhite; Editing by Shane McGinley)

(shane.mcginley@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018