PHOTO

- Saudi Arabia received same rating as USA, Hong Kong and Austria.

- Retirement system received high scores on adequacy and integrity sub-indices

Mercer, a global consulting leader in advancing health, wealth and careers, and a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC) today released the results of their Global Pension Index survey in Saudi Arabia. The index compares the retirement income systems of 34 countries covering a diversity of pension policies and practices.

The index, currently in its tenth year, included Saudi Arabia in its research for the first time. According to the results, Saudi offers C-Grade world class retirement income systems – scoring the same rating as countries like USA, Austria and Hong Kong.

The Index uses three sub-indices – adequacy, sustainability and integrity – to measure each retirement income system against more than 40 indicators. Saudi Arabia scored high on both adequacy and integrity, indicating generous retirement pension plans underpinned by strong government regulations.

The index highlighted some of the strengths of the retirement pension system around the three sub-indices. The Saudi Arabian pension system shows high net household saving rates, significant investments in growth assets and the provision of regular monthly income to its retirees rather than lump-sums. The pension system also scored well on governance and integrity with the establishment of policies and governance models around risk management and investments.

Mazen Abukhater, Head of Retirement, Mercer, Middle East, said: “We are pleased to include Saudi Arabia in the Global Pension Index for the first time this year. The country has fared considerably well and is on par with some of the countries in the western world, such as the US. With the demographic shifts in the country where population above the age of 60 are expected to rise considerably in the next decade, it is important to understand the current retirement income system and how sustainable it is for the future generations. The Index serves as an important reference for policymakers and governments to learn from the world’s most adequate and sustainable systems.”

While Saudi Arabia’s system has a variety of good features, the results also indicated shortcomings that should be addressed. Some of these include: improvement in the minimum level of support for the poorest aged individuals, increasing the labour force participation rate at older ages as life expectancy rise, and improving the required level of communication and engagement with its membership. Encouraging older workers to remain longer in the labour force is often cited as the most viable solution to fiscal pressures and macroeconomic challenges related to population aging.

Mazen added: “The changing dynamics of the region, lower oil prices, rapidly growing and ageing population will pose challenges to the country’s fiscal and macroeconomic stability, thereby impacting the pension systems. The launch of the new PPA strategy 2022, for example and its alignment with Vision 2030, indicates that the government of Saudi Arabia recognizes these emerging trends and is taking active and concrete steps to address them. The government is taking practical measures towards reforming the pension schemes, enhancing investments and diversifying to raise the revenues within an effective and flexible framework of risk management and transparency. This will make future pension systems more sustainable over the longer term. We are confident that the index for the Kingdom will improve as these initiatives and strategies get implemented.”

The MMPGI is the world’s most comprehensive comparison of pension systems covering 60% of the world’s population. The report measures 34 retirement income systems against more than 40 indicators. To download the full report, visit www.me.mercer.com/

Melbourne Mercer Global Pension Index

The Melbourne Mercer Global Pension Index is published by the Australian Centre for Financial Studies (ACFS), in collaboration with Mercer and the State Government of Victoria who provides most of the funding. Financial support has also been provided by The Finnish Centre for Pensions.

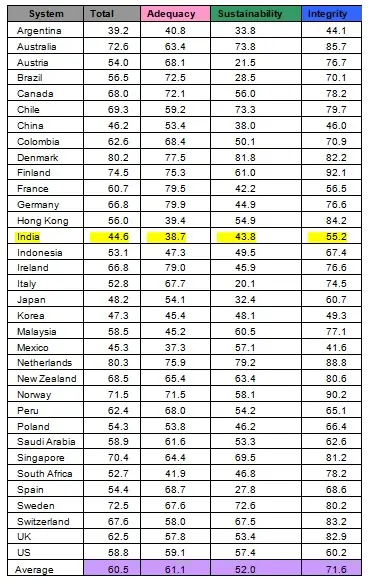

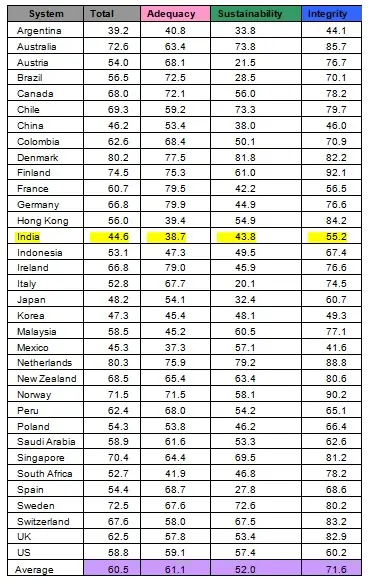

Melbourne Mercer Global Pension Index – Overall index value results

The Index uses three sub-indices – adequacy, sustainability and integrity – to measure each retirement income system against more than 40 indicators. The following table shows the overall index value for each country, together with the index value for each of the three sub-indices: adequacy, sustainability, and integrity. Each index value represents a score between zero and 100.

2018 Results

-Ends-

About Mercer

Mercer delivers advice and technology-driven solutions that help organizations meet the health, wealth and career needs of a changing workforce. Mercer’s more than 23,000 employees are based in 44 countries and the firm operates in over 130 countries. Mercer is a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC), the leading global professional services firm in the areas of risk, strategy and people. With nearly 65,000 colleagues and annual revenue over $14 billion, through its market-leading companies including Marsh, Guy Carpenter and Oliver Wyman, Marsh & McLennan helps clients navigate an increasingly dynamic and complex environment. For more information, visit www.me.mercer.com . Follow Mercer on Twitter @Mercer.

About the Australian Centre for Financial Studies

The Australian Centre for Financial Studies (ACFS) is a research centre within the Monash Business School. The Centre was established in 2005 with seed funding from the Victorian Government and became part of Monash University in 2016. The asset management and pension industries are an area of particular focus for the Centre. For more information, visit www.australiancentre.com.au .

Trade and Investment Victoria

Trade and Investment Victoria leads the Victorian Government's strategy to increase the state's export opportunities as well as attract international business investment to Victoria to create Victorian jobs and grow the economy.

Through its global network of 23 offices, Trade and Investment Victoria provides free professional investment advice and services to potential and existing overseas partners, helping facilitate investment and access to export markets.

Businesses looking to invest, explore commercial opportunities or create research linkages in Victoria should contact Trade and Investment Victoria for more information.

www.trade.vic.gov.au

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.