PHOTO

MENA debt issuance reached $92.4 billion during the first nine months of 2020, up 8 percent from the value recorded during the same period in 2019 and an all-time year-to-date high, global data provider Refinitiv revealed.

After a strong start, with over $9 billion raised in both January and February, March issuance slowed to just $572.0 million. $52.4 billion was recorded during the second quarter of 2020, an all-time quarterly high in the region, followed by $20.5 billion during the third quarter.

According to Refinitiv, the UAE and Saudi Arabia were the most active issuer nations during the first nine months of 2020 with $34.7 billion and $21.9 billion in bond proceeds, respectively. This was followed by Qatar, Bahrain and Egypt, issueing $19.4 billion, $6.1 billion and $5.8 billion respectively.

Standard Chartered took the top spot in the MENA bond underwriter ranking during the first nine months of 2020 with US$16.5 billion of related proceeds, or an 18 percent market share.

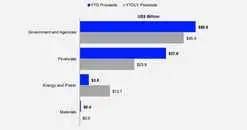

The top issuing sectors included government and agencies, financials, energy and power and materials.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020