PHOTO

Inflation in Saudi Arabia was at 5.2 percent in February, the lowest since the kingdom increased VAT in July to 15 percent to tide over the coronavirus crises and low oil prices. However, inflation in the kingdom is likely to rise again in the next few months, according to London-based Capital Economics.

“While, it is likely to rise again over the next few months, we expect it to fall sharply to 1.5-2.0 percent from July as the effects of last year’s VAT hike drop out of the annual price comparison,” Jason Tuvey, Senior Emerging Markets Economist at Capital Economics said in a report.

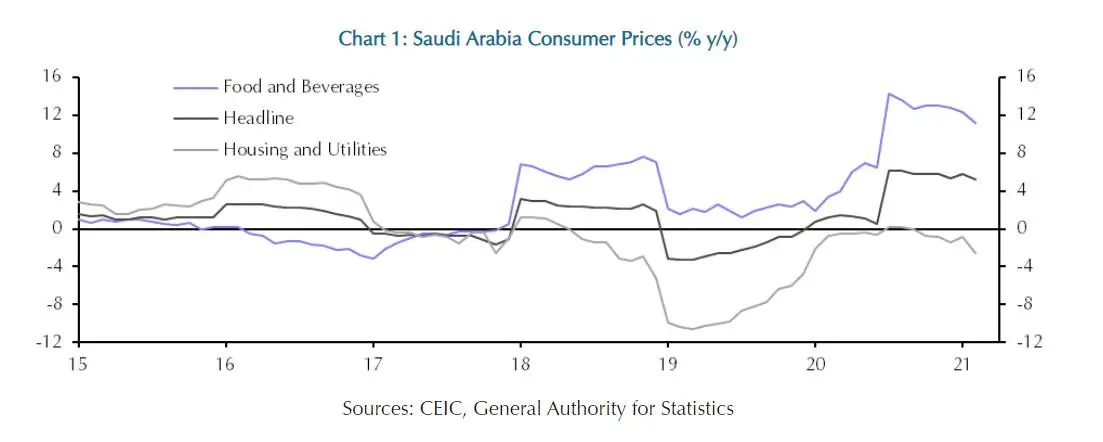

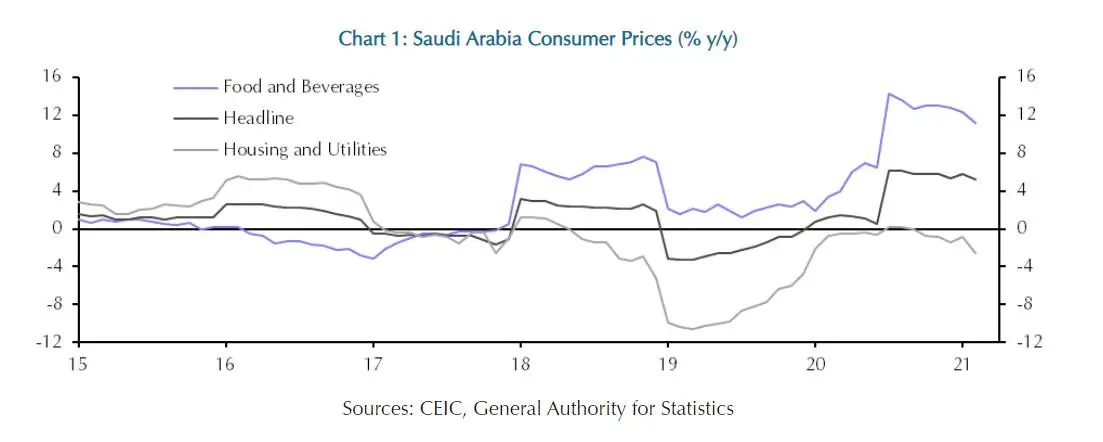

The breakdown of the data showed that food inflation continued to ease.

After peaking at 14.3 percent year-on-year (y-o-y) in July, food inflation has steadily dropped back and stood at 11.2 percent (y-o-y) in February. There was also a sharp decline in housing and utilities inflation last month as rents declined at an even faster pace.

However, transport inflation went up as Aramco raised local fuel prices due to higher oil prices. There were also increases in recreation and culture inflation and restaurant and hotels inflation.

“We expect the headline rate to rise over the next few months largely due to the unfavourable base effects created by last year’s collapse in oil prices. But the headline rate will drop sharply from July as the effects of last year’s VAT hike drop out of the annual price comparison,” Tuvey said.

As the kingdom slashed its oil output and COVID-19 took a toll on businesses, Saudi's economy contracted by 3.9 percent in Q4 2020 compared to the same period in 2019. Since January 2017, the world's largest oil exporter has been curbing output to support oil prices.

According to data from Saudi's General Authority for Statistics, the oil sector contracted by 8.5 percent and the non-oil sector declined by 0.8 percent from the same period of 2019.

(Writing by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021