PHOTO

Dubai:

- Emirates Islamic a leading Islamic financial institution in the UAE, today announced its results for the period ending 31 March, 2021.

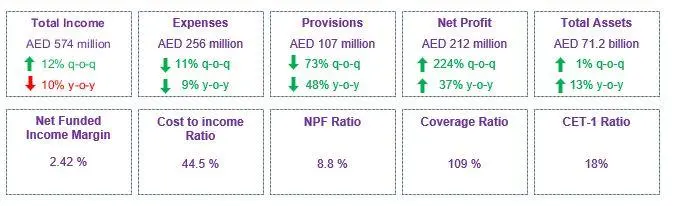

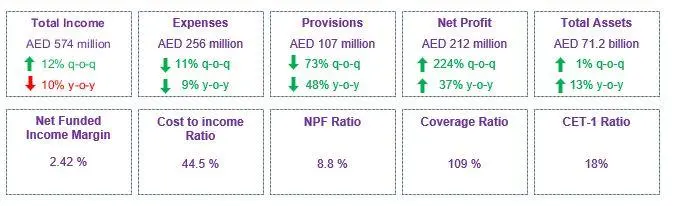

Key Highlights – First Quarter 2021

- Strong operating performance on higher non-funded income with proactive cost management

- Total income up 12% q-o-q on the back of recovery in non-funded income

- Expenses declined 9% y-o-y and 11% q-o-q due to effective cost management

- Impairment Allowances reduced 48% y-o-y and 73% q-o-q with a substantially lower net cost of risk at 108 bps following proactive provisioning in previous quarters

- Operating profit of AED 319 million lower by 12% y-o-y and improved 39% q-o-q

- Net profit increased 37% y-o-y on the back of lower cost and lower impairment allowances

- Net profit margin at 2.42% following stable profit rates in the first quarter of 2021

- Strong capital and liquidity combined with a healthy deposit mix enable the EI to provide continued support to customers

- Total assets at AED 71.2 billion, increased 1% from 2020

- Customer financing at AED 41.2 billion, increased 1% from 2020

- Customer deposits at AED 46.6 billion, declined 1% from 2020 with an improved CASA to total deposit ratio at 79%

- Credit Quality: Non-performing financing ratio reduced marginally to 8.8%. Coverage ratio remained strong at 109%

- Headline Financing to Deposit ratio at 88% and within the management’s target range

- Capital: Tier 1 ratio at 18% and Capital adequacy ratio at 19.1% reflect the strong capital position of the Bank

Hesham Abdulla Al Qassim, Chairman said:

- “We are pleased to report a strong performance by Emirates Islamic in Q1 2021, as the Bank focused on enhancing its operations and the UAE economy continued to respond favourably to the positive measures and vaccination programme undertaken by the Government in handling the Covid-19 pandemic.

- We are confident that consumer confidence and business activity will continue improving.

- As the Official Islamic Banking Partner to Expo 2020 Dubai, we are optimistic of the growth opportunities this milestone event will brings to individuals and business in the UAE.”

Salah Mohammed Amin, Chief Executive Officer said:

- “Emirates Islamic has delivered profitable growth in Q1 2021 with net profit improving 37% year on year, driven by proactive cost management and lower provisions.

- As a leading Islamic Bank, our focus has always been on improving the customer experience which differentiates us from our competition. Our customer-centric and innovative approach is appreciated by customers and we aim to build upon our existing strengths in digital innovation to meet the increasing demand for customer-friendly, secure and convenient solutions.

- We remain committed to advancing the adoption of Islamic banking among business and individuals in the UAE and be a key driving force in fulfilling the vision of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of UAE and Ruler of Dubai in making Dubai the global capital of Islamic economy.”

Business Performance

- 22% increase in digital transactions across the Bank’s online banking platforms.

- The Bank has transformed nine of its branches to provide people of determination with convenient user experiences. The initiative is part of the bank’s commitment to create a financially inclusive community for people of determination in the UAE.

- The Bank has expanded its Business Banking centre network to support small and medium enterprises (SMEs) by launching two new facilities in the heart of Dubai, on Sheikh Zayed Road and in Al Twar.

About Emirates Islamic:

Emirates Islamic (DFM: EIB), part of Emirates NBD Group, is one of the fastest growing banks in the UAE. Established in 2004 as Emirates Islamic Bank, the bank has established itself as a major player in the highly competitive financial services sector in the UAE.

Emirates Islamic offers a comprehensive range of Shari’a-compliant products and services across the Personal, Business and Corporate banking spectrum with a network of 41 branches and 177 ATMs/CDMs across the UAE. In the fast-growing area of online and mobile banking, the bank is an innovator, being the first Islamic bank in the UAE to launch a mobile banking app and offer Apple Pay, as well as being the first Islamic bank in the world to launch Chat Banking services for customers via WhatsApp.

Emirates Islamic has consistently received local and international awards, in recognition of its strong record of performance and innovation in banking. The Bank won international acclaim as the ‘Most Innovative Islamic Bank’ at the Islamic Finance Awards 2020 by World Finance, in addition to being named the ‘Best Islamic Bank, UAE’. The Bank was also awarded the title of ‘Most Innovative Islamic Bank’ by Islamic Finance News and ‘Islamic Bank of the Year – UAE 2020’ by The Banker. Additionally, New York-based Global Finance magazine recognised Emirates Islamic as the ‘Best Islamic Financial Institution, UAE’ for a second year in a row on its list of the ‘World’s Best Islamic Financial Institutions’.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions.

For further information please visit www.emiratesislamic.ae

Or please contact:

Amina Al Zarooni

Media Relations Manager, Emirates Islamic

Tel: +971 4 4397430;

Email: AminaAlZarooni@emiratesislamic.ae

Ibrahim Sowaidan

SVP - Head - Group Corporate Affairs

Emirates NBD

Tel: +971 4 609 4113

Email: ibrahims@emiratesnbd.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.