Doha, Qatar: Ooredoo Q.P.S.C. (“Ooredoo”) - Ticker: ORDS today announced results for the quarter ended 31 March 2019.

Financial Highlights:

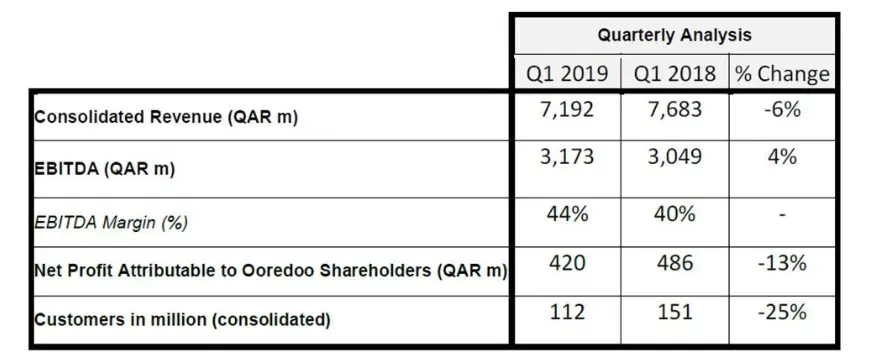

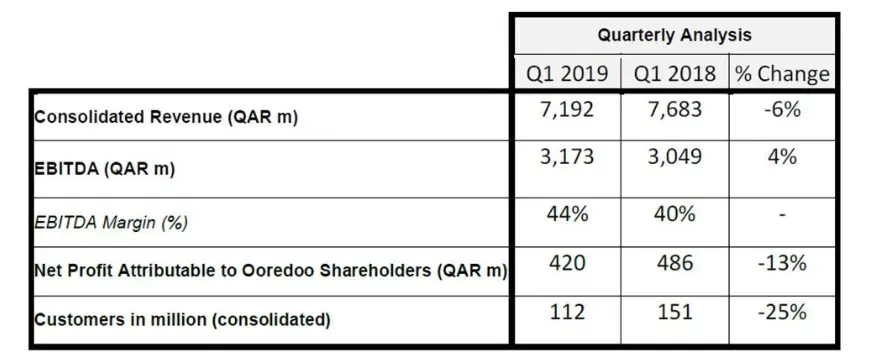

- Group EBITDA was QAR 3.2 billion with a corresponding EBITDA margin of 44%. Group EBITDA margin increased by 4 percentage points year-on-year mainly due to rigid cost management, reduced cost of sales from equipment sales and a positive impact from the new IFRS 16 accounting standards, changing the classification of operating leases.

- Q1 2019 Revenue stood at QAR 7.2 billion, a decline of 6% compared to the same period last year, largely driven by a reduction in handset sales, an industry wide shift from voice services to data services, as well as macroeconomic and currency weakness in some of our markets.

- Group Net Profit attributable to Ooredoo shareholders was QAR 420 million, down 13% compared to the same period last year. This decrease was primarily due to lower FX gains in Myanmar compared to the previous year. Excluding the FX impact, Net Profit attributable to Ooredoo shareholders increased by 8%.

- Increased monetization of data business, with significant data growth coming from consumer and enterprise customers: saw data revenue increase to 50% of Group revenue. Revenue from data contributed QAR 3.6 billion.

Operational highlights:

- Ooredoo made further progress with its digitisation strategy and conducted the world’s first international 5G call between Qatar and Kuwait; formed a partnership to provide 5G infrastructure and digitalise Qatar’s Logistics Parks and Industrial Zones (“Manateq”).

- Ooredoo Algeria achieved the highest 4G coverage in the country, reaching more than half of the population and all 48 wilayas. In Indonesia, Ooredoo’s 4G plus is available in 422 cities, now covering more than 80% of the population.

- Ooredoo Myanmar passed the 10 million customer milestone and the ‘My Ooredoo’ app reached the monthly active user base milestone of one million.

- Ooredoo Tunisia increased its customer base by 7% confirming its position as the Number 1 mobile telecom player; while Ooredoo Palestine increased its market share in Gaza, providing connectivity to an area that is currently struggling with economic hardship.

- The customer base in Kuwait, Algeria, Tunisia, Myanmar, Maldives, Iraq, Qatar and Palestine increased. The Group customer number decline of 25% was mainly due to a clean-up of the Indonesian customer base, post the new SIM regulation last year.

- Ooredoo continues to be a data leader in its markets with 4G networks now available in 8 of Ooredoo’s 10 markets.

Commenting on the results, H.E. Sheikh Abdulla Bin Mohammed Bin Saud Al-Thani, Chairman of Ooredoo, said:

“Traditional telecom services remain under pressure, in line with regional and global trends for our industry. The Ooredoo Group reported a solid set of results for the first quarter of the year.

Consolidated Group Revenue was QAR 7.2 billion down from QAR 7.7 billion in 2018, due to a reduction in handset sales, currency depreciation and economic weakness in some of our emerging markets that have adversely affected our reported revenue in Qatari Riyals.

Group EBITDA was QAR 3.2 billion, up 4% compared to the same period last year. Our EBITDA margin improved from 40% to 44%, driven by comprehensive cost management programs and the positive impact of the new IFRS 16 accounting standards. Driven by these improvements Group Net Profit excluding Foreign Exchange impact increased by 8% during the first quarter of 2019.

We remain focused on providing reliable connectivity and innovative products to our customers and are proud to be at the forefront of the global 5G revolution.”

Also commenting on the results, Sheikh Saud bin Nasser Al Thani, Group Chief Executive Officer of Ooredoo said:

“A major highlight for the quarter is the recovery in Indonesia, our second biggest market in terms of contribution to revenues, from the negative impact of the SIM card registration regulation in 2018. In Q1 2019, Indosat Ooredoo saw the return of both top and bottom line growth, with revenues up 2% and EBITDA up 10%, a clear indication that our refreshed strategy and our new leadership team are able to navigate the changing market landscape in the country.

In Kuwait, we were able to increase our EBITDA margin to 31%, supported by a healthy 13% increase in our customer base, further improved efficiencies and increased service revenue. In Myanmar, our customer base increased by 20% despite the entrance of a new player in the market. In Tunisia, we strengthened our position as the Number 1 customer market share telecom player and in Algeria, we remain on track with our 4G strategy with increasing data usage.

Looking forward towards the remainder of the year, we will push ahead with our digital strategy, whilst effectively managing our costs and overheads to support the growth of our business and long-term shareholder value generation.”

Operational Review

Middle East

Ooredoo Qatar

Ooredoo Qatar reported Revenue of QAR 1,834 million (Q1 2018: QAR 1,979) , with stable service revenue compensating for a drop in the sale of devices. EBITDA stood at QAR 1,037 million (Q1 2018: QAR 955), supported by on-going digitization of internal processes and other cost optimization initiatives. Customer numbers remained stable at 3.3 million.

The company continued to drive network innovation, conducting the world’s first international 5G call in January from Qatar to Kuwait. With more than 90 5G sites now live in Qatar, 5G services were extended to Shahaniya municipality as well as to a number of corporate customers during the quarter. Innovation also extended to business services, with the launch of a new Internet of Things (IoT) platform, IoT Builder, and to Ooredoo’s retail presence, with the launch of a new paperless price tag system called ePaper labels at Ooredoo Shops – a first within Qatar.

Ooredoo Qatar’s content and entertainment services saw strong growth, with the customer base for Ooredoo tv services growing 9% year-on-year. Ooredoo Qatar launched new Android-powered set top boxes during the period. The Ooredoo Fibre rollout programme continued, with 413,000 homes now connected across the country.

Ooredoo Oman

Ooredoo Oman reported a robust set of financial results, with growth across the board. Revenues increased 1% to QAR 650 million in the first quarter of 2019, driven by growth in fixed line and a strong performance in post-paid mobile revenues. EBITDA increased 5% to QAR 367 million, and EBITDA margin was strong at 57%, up from 55% in Q1 2018. Ooredoo Oman’s customer base remained stable at 3.0 million in Q1 2019.

Ooredoo Oman expanded its digital offering to meet the increasingly sophisticated needs of its customers. During the quarter, “Digital Shahry” was launched alongside a new app for businesses, giving customers increased flexibility along with new channels to interact with Ooredoo Oman.

Ooredoo Kuwait

Ooredoo Kuwait reported significant EBITDA growth of 46% to QAR 210 million and margin improvement from 18% to 31% in the first quarter of 2019, compared to the same period last year. EBITDA margin growth was driven by a favourable mix between service revenue and handset sales, a positive IFRS 16 impact as well as improved efficiencies and cost optimisations across the business.

Revenue was down 15% to QAR 673 million during the quarter mainly due to the reduction in handset sales. Ooredoo Kuwait’s customer base increased to 2.5 million in Q1 2019, up by 13% compared to Q1 2018.

Asiacell - Iraq

Asiacell’s revenue for the first quarter of 2019 was stable at QAR 1.1 billion. EBITDA was down 12% to QAR 471 million during the quarter, as a result of increased sales and marketing activities to expand its customer base. Asiacell’s customer base increased 10% to 14.2 million at the end of the first quarter of 2019. Asiacell is continuing the network expansion and increasing capacity in order to meet the data demand of its customers.

North Africa

Ooredoo Algeria

The telecommunications market in Algeria continues to be marred by weak economic conditions, political uncertainty and intense price competition. Ooredoo Algeria’s results were further impacted by the depreciation of the Algerian Dinar by 4% year on year, leading to a decrease in revenue to QAR 644 million in the first quarter of 2019, compared to QAR 733 million in the same period last year. EBITDA was QAR 261 million in Q1 2019, down from QAR 306 million in Q1 2018. EBITDA margin improved sequentially to 40% compared to 34% in the previous Quarter.

Ooredoo Algeria is on track with its 4G strategy with increasing data usage quarter on quarter, supported by a new portfolio of offers.

Ooredoo Tunisia

Ooredoo Tunisia reported a strong set of results, despite the challenging market environment characterised by currency depreciation and high inflation. In local currency terms revenues were up by 7% supported by an equivalent increase in its subscriber base to 9.1 million customers, resulting in gains in data, international and fixed revenues. EBITDA grew 23% (local currency) mainly as a result of increased revenue.

Performance in Qatari Riyals was impacted by currency depreciation of 20% year on year, with revenue for the first quarter of 2019 at QAR 329 million (Q1 2018: QAR 387 million) and EBITDA at QAR 142 million, down 1% compared to the same period last year.

Ooredoo Tunisia confirmed its position as the Number 1 customer market share telecom player by providing high quality services and innovative digital solutions including the revamp of its “Mobicash” app during the quarter.

Asia

Indosat Ooredoo

Indosat Ooredoo showed further signs of growth, leaving the negative impact of the SIM card registration regulation implemented in 2018 behind. In response to the new market dynamics in Indonesia, Indosat Ooredoo shifted from a push to a pull go-to-market strategy, leading to improved customer loyalty and lower churn rates. Consequently, despite a reduction in customer numbers by 45% to 53.3 million, revenues grew to QAR 1,557 million in the first quarter of 2019 up 2% compared to the same period last year. EBITDA grew faster than revenues reaching QAR 642 million, an increase of 10% compared to the same period last year, reflecting the success of cost optimisation initiatives and efficiency programmes.

Ooredoo Myanmar

Despite increased competition following the fourth player entry into the market in 2018, Ooredoo Myanmar grew its customer base to 10.9 million customers during the first quarter of 2019, an increase of 20% compared to the same

quarter last year. Ooredoo Myanmar generated revenues of QAR 260 million during Q1 2019, compared to QAR 355 million for the same period last year, impacted by the depreciation of the Myanmar Kyat, which declined 12% year on year, and aggressive data pricing in the market. Market improved starting from mid-Feb’19 as the regulator asked operators to stop top-up bonus promotions. In local currency terms, EBITDA increased 2% supported by company’s cost efficiency programme and IFRS 16 impact. In Qatari Riyals, EBITDA was QAR 59 million compared with QAR 65 million in Q1 2018.

Ooredoo Myanmar’s ‘get digital’ initiative continues to build momentum with ‘My Ooredoo’ app reaching a million monthly active users during the period.

Ooredoo’s Q1 2019 financial statements will be available on its website, accessible at: http://www.ooredoo.com

-Ends-

For further information:

Email: IR@ooredoo.com

About Ooredoo

Ooredoo is an international communications company operating across the Middle East, North Africa and Southeast Asia. Serving consumers and businesses in 10 countries, Ooredoo delivers the leading data experience through a broad range of content and services via its advanced, data-centric mobile and fixed networks.

Ooredoo generated revenues of QAR 30 billion as of 31 December 2018. Its shares are listed on the Qatar Stock Exchange and the Abu Dhabi Securities Exchange.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.