Al Sayer:

- Our diversification and digitisation strategies set NBK on the right course to maintain its leadership position

- Strong volumes across most business segments further maintain our robust balance sheet and demonstrate the high quality and diversity of our earnings

- NBK’s new headquarters is a milestone in the Bank's sustainability practices

- Our dominant market share and strong financial position enable us to navigate through various operational challenges

- We are committed to supporting economic growth and Kuwait’s national development plan as the bank of choice for financing mega public sector projects

Al Sager:

- Our financial results reflect the strength of our business model and our strategic focus on diversification

- We continued to grow our balance sheet while maintaining healthy asset quality metrics and robust levels of capitalization

- Our Tier 1 capital securities issuance was very well-received by investors globally, reflecting NBK’s well-established reputation and prominent leadership position

- Our financial and operational results confirm the soundness of our business model and our ability to achieve further growth in the future

- We are building a global banking network that supports Kuwait’s economy and its infrastructure development plan

- NBK is focused on increasing operational efficiency through its investments in technology and digital transformation to provide its customers with the best banking solutions

Al Bahar:

- We made huge progress in building our digital future and consolidating our leadership position in the region

- Our profit growth and business expansion are in line with our prudent risk mitigation policies

- The launch of our in-house Digital Factory is a milestone that marks our future leading role in digital offerings

- Our international operations is a key competitive advantage as it enables us to provide unique and exceptional banking services

- We are about to launch an unconventional banking model that will represent a fundamental pillar in supporting our expansion strategy in the Saudi market

- We are establishing digital platforms to maintain our technological lead and expand our share of the growing retail banking segment in Egypt

- We established a unique banking framework to promote cross-selling culture across the Bank’s locations and units through our international operations across 4 continents.

- NBK is expanding in the EU markets and supports international trade through NBK France.

Al Fulaij

- We continued to achieve outstanding robust results across our main business segments thanks to the bank’s continuously evolving business model in the Kuwaiti market

- Our dominant share and close relationship with our clients supported our Corporate Banking Services

- We managed to successfully maintain our leadership position through offering Private Banking Services and wealth management

- We continuously develop our digital channels and have the best mobile banking applications in Kuwait

- Our CSR initiatives grew by 11% in 2019, covering all key sectors

- NBK human capital remain our most valuable asset as our employees are the driving force of our success and leadership, we are very proud of the diversity of our team

National Bank of Kuwait (NBK) held today (Saturday, 7 March 2020), its 2019 Annual General Meeting (AGM) and Extraordinary General Meeting (EGM), at which there was a quorum of 77.86 %. The AGM and EGM approved the Board of Directors’ recommendation to distribute 35% cash dividends to shareholders (equivalent to 35 fils per share) and the distribution of 5% bonus shares (5 shares for every 100 shares owned).

Sustained growth

NBK’s Chairman Mr. Nasser Al-Sayer delivered his speech at the 2019 AGM and EGM affirming that NBK had another year of stellar performance in 2019 across all business units and markets. That performance was clearly reflected in the continued profitable growth and the solid financial results, a testament that NBK is on the right track to consolidate its leadership in the local market and solidifies its prominent position in expanding its geographical footprint across regional markets in line with its diversification and digital transformation strategies; the cornerstones of NBK’s future growth.

Al-Sayer added that in 2019 NBK reported over KWD 401 million in net profits which was mainly driven by core banking activities and strong volumes across most business segments. Customer loans and advances grew by 7% y-o-y, maintaining the Group’s robust balance sheet and demonstrating the quality and diversity of both operations and earnings. “That confirms that the Group’s diversification strategy is an important factor in our strong and consistent financial performance, as we continually seek to maintain diversity in both the markets we operate in and services we provide in such a way that guarantees operational excellence in the ever-changing banking environment”, Al-Sayer commented.

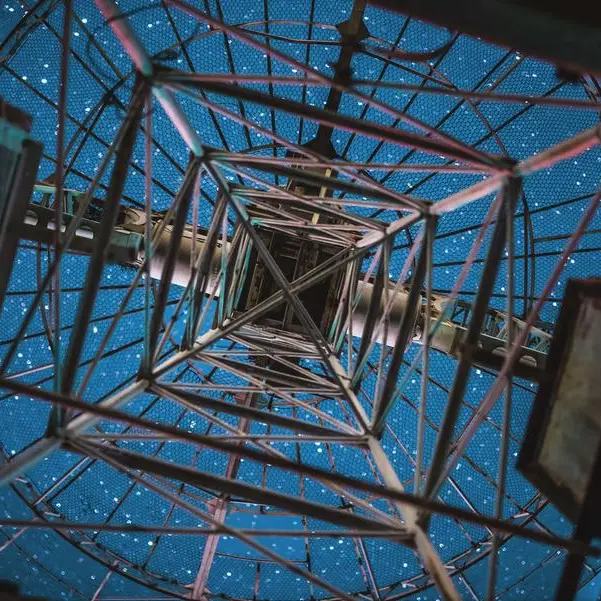

Al-Sayer said that he was pleased to host the AGM and EGM at NBK’s new headquarters which is considered a milestone in the Bank's sustainability practices, resulting in NBK’s selection to be a constituent of the prestigious sustainability FTSE4Good Index Series. NBK Tower is a new landmark green-building built in line with LEED Gold requirements, being one of the first with such high certification in Kuwait and the region based on its energy saving and environment preservation designs. “We are very optimistic regarding conserving energy and water consumption, as well as reducing greenhouse gas emissions.” Al-Sayer stressed.

Al-Sayer confirmed that in the backdrop of a challenging global economic environment Kuwait has been a beacon of stability thanks to its solid economic foundations that supported the stability of the operating environment despite global trade uncertainties and regional geopolitical tensions.

NBK showed a great deal of resilience in facing such challenges, thanks to its leadership position, its dominant market share and its strong financial position, thus positioning NBK to be the trusted bank of choice for financing public and private projects, as it maintains its leading role in supporting economic growth and the agenda of ‘New Kuwait 2035’”, Al-Sayer concluded.

Strong Balance Sheet

Isam J. Al-Sager, NBK’s Group Chief Executive Officer, said: “We are extremely proud of our solid financial performance over the past year. NBK fared well and delivered strong results despite the challenging operating environment which was negatively impacted by volatile oil prices. NBK’s performance in 2019 highlighted the strength of our business model and strategic focus driven from our diversification strategies as clearly reflected in the strong growth of our balance sheet. Total assets grew by 6.7% y-o-y, reaching KWD 29.3 billion and equity attributable to shareholders stood at KWD 3.21 billion. Meanwhile, customer loans and advances increased to KWD 15.9 billion, up by 10.7%.

Al-Sager confirmed that NBK maintained healthy levels of capitalization, with a capital adequacy ratio of 17.8% at year-end, exceeding the Central Bank of Kuwait’s guidelines and Basil III requirements. NBK’s asset quality metrics remained strong with the ratio of non-performing loans to gross loans at 1.10% and an NPL coverage ratio of 272.2%. Return on average equity was 12.3% while return on average assets was 1.42%.

Al-Sager highlighted that towards the end of 2019, NBK issued USD 750 million RegS/144A perpetual Non-Call 6-Year Tier 1 capital securities. The issuance was well received by fixed income investors and financial institutions around the world, reflecting NBK’s well-established reputation, solid investor confidence and its highest credit ratings among Kuwaiti and regional banks.

Diversification Strategy

Al-Sager indicated that NBK’s financial and operational performance is a testament to its solid foundations and confirms its ability to grow in the medium and long terms, as the Group’s strategies continues to focus on its forward-looking development and sustainable growth.

“The diversification of our income sources by focusing on Islamic Banking through our subsidiary, Boubyan Bank, and the diversity of our customer base in the MENA region were key drivers for consistently reporting strong profits. Our international operations accounted for 28% of the Group’s profit. This is a huge step in building a global banking network that fulfills the Kuwaiti economy’s need in supporting “New Kuwait 2035” though playing our role as a deeply rooted bank with a vastly expanded international network and the prestigious reputation of NBK’s name”. Al-Sager added.

Going forward, Al-Sager stressed that NBK is focused on increasing operational efficiency through its investments in technology and digital transformation in order to reach a more efficient operational performance and provide the best solutions to the Bank's retail and corporate clients as it strives to maintain its leadership position in providing the best digital banking solutions.

Digital Future

Commenting on NBK’s solid performance throughout 2019, NBK’s Deputy GCEO Ms. Shaikha Al Bahar said: “2019 was an outstanding year, not only in terms of the Bank’s solid financial performance but it was a great year for NBK all around. NBK successfully managed to achieve huge strides in establishing its digital footprint and consolidating its leadership position in advanced banking technologies across the region. We continue to reap the benefits of building digital disruptive businesses to diversify income sources and mitigate risks by expanding our international operations, which is considered one of the Group’s unique competitive advantages.”

Al-Bahar added that these achievements were reflected in NBK’s financial results, as profits continued to grow despite operational challenges and as the Bank accelerated its drive towards establishing its digital age through the implementation of its digitization roadmap in order to maintain its strategic competitive advantage over its peers. In the meantime, NBK’s balance sheet continued to expand while keeping strong asset quality metrics, demonstrating our deep commitment towards sustainable growth within the guidelines of the Bank’s prudent risk mitigation policies.

“We are proud of launching our in-house Digital Factory, which is playing a vital role in driving the Group’s progress towards a digital future and supporting our digital offering in the region. With its client-centric approach, the Digital Factory is staffed by the market’s sharpest and most capable FinTech minds”. Al Bahar added.

Global Expansion

Al Bahar emphasized that the continued expansion of the Group’s footprint represents its most significant competitive advantage, thanks to the unique offerings that sets NBK apart from its competitors. Therefore, international operations is an essential pillar in maintaining the Bank’s leadership and its continued growth as its contribution to the group’s net profit reached 28% despite the lower cost of risks in the Kuwaiti market, and its contribution also increased to 25% of the total operating revenue.

“We maintain our focus on expanding our operations and continue to heavily invest in the deployment of our digital offerings across our main markets, especially Egypt and Saudi Arabia”, Al Bahar confirmed.

Speaking of the Egyptian market, Al Bahar pointed out that NBK is focused on building digital platforms to complement the traditional branch-based sales and service model. NBK Egypt is also focused on expanding its footprint in the Egyptian market as the country’s economy gathers further momentum in the rollout of the wide-reaching economic reform programme, as we maintain our focus on increasing our share of the burgeoning retail banking segment and continue to expand our presence throughout various Egyptian governorates.

As for the Saudi market, NBK is working on launching an unconventional banking model that will represent a fundamental pillar in supporting its expansion strategy in the Saudi market. Moreover, NBK successfully inaugurated two new branches as it maintains a permanent presence in three of the Kingdom’s major cities: Jeddah, Riyadh and Khobar. NBK Saudi is also targeting to capitalize on growing its Assets Under Management (AUM) through Watani Wealth Management Company.

As for the remaining international markets, Al Bahar indicated that NBK has established a unique banking framework which mainly maintains a strong emphasis on promoting cross-selling culture across the Bank’s locations and units through its international operations in 15 countries across 4 continents. NBK also continues to expand its presence in EU markets as it strives to support international trade between Europe and the regional countries through NBK France.

Operational Excellence

Meanwhile, NBK-Kuwait CEO, Mr. Salah Al Fulaij said: “NBK had unique operational performance in 2019 as it successfully managed to achieve outstanding growth rates across our main business segments despite adverse headwinds that negatively impacted the non-oil sector and the delay in project award and execution, thanks to the continued development of the bank’s business model in the Kuwaiti market, our primary market, which constitutes 44% of total assets and 63% of net profits”.

Al-Fulaij pointed out that last year, NBK mainly focused on corporate banking services to maintain its dominant share in the local market through skillfully maintaining close relations with former and current clients thanks to its exceptional customer service and specialized professional advice, in addition to its international presences. Moreover, NBK Capital provides further support through the comprehensive and wide range of financing solutions and investment offerings, which are key elements in maintaining the Group’s leading position in financing mega deals.

“NBK continued to consolidate its position at the forefront of Kuwait’s oil & gas, as it remains the ‘house’ bank for lending to KPC and its subsidiaries as demonstrated by the KWD 350 million revolving facility it arranged in 2019”, Al-Fulaij added.

Al-Fulaij highlighted that Private Banking Group successfully maintained its leadership position as a leading provider of wealth management services in the Kuwaiti market with improved liquidity and significant increase in its AUM which enabled the Group to record strong growth in its revenues.

Technological Excellence

Speaking on digital banking products and services, Al-Fulaij confirmed that NBK has the best mobile banking applications across local and regional markets thanks to the continuous development and improvements efforts. In 2019, 17 new and updated services were launched, as Mobile app users can now book term deposits in various currencies and may also benefit from NBK Geo Alerts, the first of its kind service that allow customers to receive notifications about discounts, offers and NBK Rewards Points on their phone while shopping, in addition to further developing NBK Quick Pay. That was reflected in a significant increase of 55% in NBK Mobile users y-o-y, and Mobile users satisfaction rate jumped to 95%.

As for Social Corporate Responsibility (CSR), Al-Fulaij said: “We are very pleased that NBK has become the biggest contributor to CSR, and we are proud to be at forefront of all local and regional institutions that have introduced environmental, social and economic sustainability initiatives. Our CSR initiatives grew by approximately 11% in 2019, including our contributions to NBK Children’s Hospital, in addition to numerous initiatives covering various sectors, including: health, education, youth, environment, sports, and culture”.

Team Spirit

Al-Fulaij concluded his message by stressing on NBK’s role in achieving these accomplishments and maintaining its leadership position as a leading franchise in the private sector that attract talented and experiences employees as it continues to heavily invest in its human capital with over KWD 1.5 million spent last year towards training programs in cooperation with the most prestigious universities and institutes around the world including Harvard Business School and INSEAD.

Al-Fulaij also stressed that NBK’s strength stems from employing national manpower, as NBK brought its Kuwaitization ratio to 70.6%, exceeding regulatory requirements. Moreover, 45% of the workforce consists of female employees, which is an unprecedented achievement across the local and regional banking sector.

Gratitude and Appreciation

On behalf of NBK Group’s board of directors and executive management, Al-Sayer expressed his deep thanks and sincere appreciation to His Highness the Amir Sheikh Sabah Al-Ahmad Al-Jaber Al- Sabah and His Highness the Crown Prince Sheikh Nawaf Al-Ahmad Al-Jaber Al-Sabah for their ongoing support of Kuwait’s economy and prosperity. Appreciation was also extended to the Central Bank of Kuwait (CBK) and the Capital Markets Authority (CMA) for making Kuwait increasingly attractive to international investors.

Al-Sayer also thanked NBK’s shareholders for their confidence and expressed his deep appreciation to NBK’s customers in Kuwait and across all markets for their continuous loyalty and support.

Furthermore, Al-Sayer extended his gratitude to the board of directors for their leadership and guidance, expressing his appreciation to NBK’s Executive Management, who have endeavored to maintain the Bank’s strategic path while exploring new avenues for growth, and the bank employees who made customers’ confidence and trust possible.

NBK Mourns the Loss of Al-Hamad

NBK’s Chairman Mr. Nasser Al-Sayer concluded his message by extending his deepest condolences on behalf of NBK board of directors, management team and employees on the demise of Mr. Yaqoub Youssef Al-Hammad, former member and Chairman of NBK. Al-Sayer said that Kuwait mourns the loss of a great patriot, outstanding leader and a visionary who had immense contribution in pushing forward the country’s development through his comprehensive redefinition of advancing its economy, education and society.

Al-Sayer also prayed that Mr. Al-Hammad be shrouded in the mercy of Allah the Almighty, and to live in his spacious gardens, and to inspire his family patience and solace.

Distributions Date

Cash dividends and bonus shares will be distributed starting Monday, 30 /03 /2020. The distribution will be made to the shareholders on the bank’s records as of the record date Thursday, 26 /03 /2020.

© Press Release 2020Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.