- 49% reduction in operating costs through implementation of the cost efficiency program and contingency plans to mitigate the impact of the pandemic

- Adjusted EBITDA loss increased by 8%, driven by the impact of lower revenues and partially offset by the implementation of prudent cost control measures

- Relaunch of Bollywood Parks™ Dubai on 21 January 2021, with a significantly improved and repositioned offering including nine new thrill rides and attractions, as well as the themed shopping experience at the Bollywood Souq Bazaar and authentic F&B offerings

- Strategic operational priorities for 2021 include the enhancement program at MOTIONGATE™ Dubai with the installation of two new thrill rides, the completion of the world record wooden coaster at Bollywood Parks™, as well as the completion and opening of the region’s first ever Legoland Hotel

- The Company is in need of new sources of funds, without which the current available liquidity is likely to be exhausted during Q2 2021

- On 20 December 2020, the Board of Directors (“Board”) of DXBE received a conditional cash offer (the “Offer”) from Meraas Leisure and Entertainment LLC (“Meraas”) to acquire 100% of the issued and paid-up ordinary shares of DXBE

- The Board having evaluated the inputs received from its independent financial and legal advisors as to the terms of the Offer, in conjunction with the DXBE’s current cash position and liabilities, and near term general economic conditions, considers the terms of the Offer to be fair and reasonable. Therefore, the Board has unanimously recommended to DXBE’s shareholders to accept the Offer from Meraas, attend the general assembly meeting on 9 March 2021 and vote in favour of the resolutions required to implement the Offer

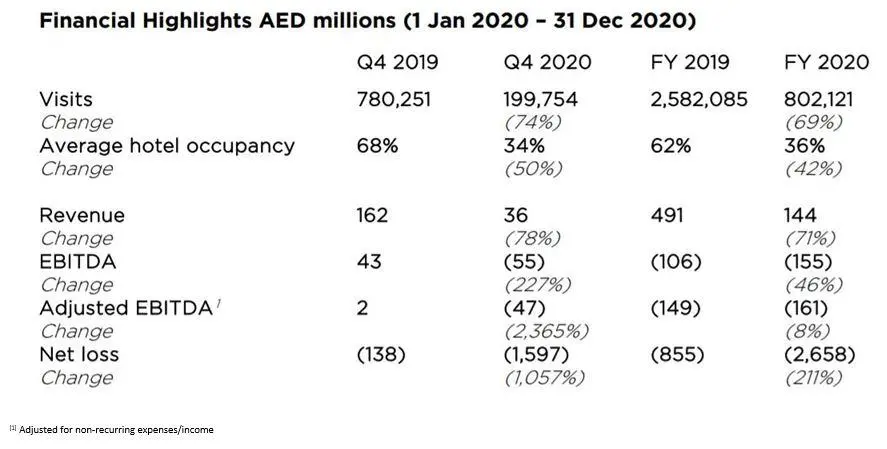

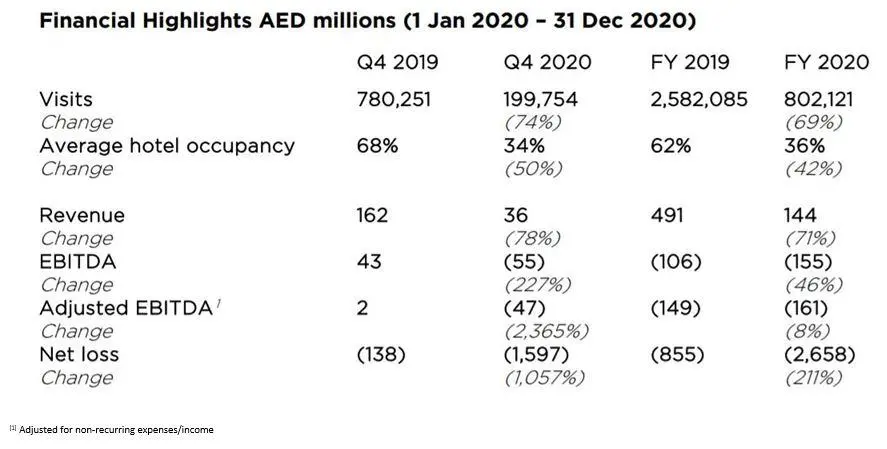

2020 Financial Highlights

The Company’s 2020 operational and financial performance was significantly impacted by the adverse conditions of the Covid-19 pandemic, resulting in the closure of the destination for a period of approximately six months during March to September 2020, as well as a depressed tourism and travel market for the remainder of the year. These disruptions resulted in:

- 802,121 visits during the year, a reduction of 69% compared to prior year and 36% occupancy at Lapita™ Hotel for FY 2020, compared to 62% in 2019;

- FY 2020 revenue of AED 144 million, compared to AED 491 million in 2019, 71% lower;

- FY 2020 operating costs of AED 285 million, compared to AED 556 million in 2019, 49% lower;

- FY 2020 adjusted EBITDA loss of AED 161 million, compared to AED 149 million in 2019, 8% higher;

- FY 2020 net loss of AED 2.7 billion, including an impairment AED 1.7 billion on property and equipment and AED 346 million of depreciation;

- As at FY 2020 the Company had AED 651 million of cash and cash equivalents and AED 117 million of other financial assets;

- As at FY 2020 the Company had AED 6.2 billion in property and equipment assets, after AED 1.7 billion in impairment;

- As at FY 2020 the Company had AED 6.0 billion in liabilities from financing activities and net debt of AED 5.2 billion;

- As at FY 2020 the Company had AED 7.8 billion of accumulated losses (currently at 98% of the issued share capital); and

- As at FY 2020, the Company’s net asset value per share is AED 0.0277.

The impact of the Covid-19 pandemic and resulting adverse conditions, as well as the extent of these on our financial and operating results, will be dictated by the length of time that such adverse conditions continue.

DXB Entertainments PJSC (DFM: DXBE) announced today its financial results for the twelve months ended 31 December 2020, reporting 802,121 visits, 36% occupancy at the Lapita™ Hotel and AED 144 million in revenues.

As part of the UAE’s Government efforts to curb the spread of the COVID-19 pandemic, the Company temporarily ceased operations for a period of approximately six months, from 15th March to 23rd September 2020, when the operations partially reopened under the new social distancing and health and safety guidelines. Severe disruptions in global trade and tourism, and the city-wide lockdowns globally and locally, significantly impacted the Company’s operations and financial performance for the year 2020.

Total theme park visitation during the year was 802,121, lower by 69% compared to the previous year, while international visitation - which accounted for 36% of the total visitation - declined 7% year on year. The occupancy rate of Lapita Hotel was 36% with an ADR of AED 409 for the year 2020, compared to an occupancy rate of 62% and an ADR of AED 535 in 2019.

The Company reported revenue of AED 144 million for the year ended 31 December 2020, 71% lower than AED 491 million in 2019. Theme parks remained the highest contributor to total revenues, with AED 97 million reported in 2020, followed by Lapita and Riverland revenues of AED 38 million and AED 7 million respectively.

Operating costs declined 49% to AED 285 million in 2020 compared to the previous year, driven by temporary cost mitigation measures while the destination was closed, as well as from the impact of the cost efficiency plan implemented in 2019. Management will continue to focus on identifying and implementing further operating cost savings progressing into 2021 while keeping guest experience a priority.

Adjusted EBITDA loss widened to AED 161 million, up by 8% compared to previous year.

Net loss for the year ended 31 December 2020 was AED 2.7 billion, compared with AED 855 million in 2019. Loss for the year includes AED 1.7 billion of impairment losses on property and equipment and AED 346 million of non-cash depreciation. Net finance costs for the year were AED 410 million of which AED 117 million is noncash interest on the Company’s convertible instrument.

Liquidity position

As at 31 December 2020, the Company had cash balances, including other financial assets of AED 0.8 billion, of which AED 0.1 billion is restricted or ringfenced cash, mainly related to the debt service reserve account and AED 0.3 billion is related to the settlement of construction related costs associated with the Six Flags project and the ongoing enhancement program. As a result, the Company had AED 0.4 billion of available cash balances as at 31 December 2020.

In 2020, as part of the further debt amendment discussions amid the pandemic and efforts to maintain adequate liquidity, the Company reached an agreement with its financing partners in relation to its AED 4.2 billion syndicated loan facility, where cash settled interest was reduced to 1% for the 15 month period ended 30 June 2021 with the differential interest continued to be accrued on a non-compounded basis and to be settled on 30 June 2021. Estimated interest repayments of AED 250 million are due over the course of the full year 2021.

Further, the Company’s moratorium period on principal repayments and covenant testing ends in Q1 2021, with AED 213 million of principal repayments due over the course of the full year 2021.

Should the total debt service payments be required, the Group’s current available liquidity is likely to be exhausted by June 2021.

Commenting on the 2020 financial results, Remi Ishak, Acting CEO and CFO, DXB Entertainments PJSC, said:

“2020 was a tremendously challenging year with major disruptions in travel and tourism as a consequence of the Covid-19 pandemic. The closure of the destination for a period of approximately six months had a significant impact on our operational and financial performance. We implemented our contingency plans and realised further cost savings during the year which partially mitigated the decline in revenues.”

“In 2021, while material uncertainty around near term general economic conditions remains, we continue to focus on identifying and implementing further operating efficiencies, completing the enhancement program and hotel strategy, and preparing for a potential recovery in visitation.”

“On behalf of my fellow management team members, I would like to extend my sincere appreciation to our Board for their leadership and guidance to DXBE, and to the Government of Dubai and the UAE Federal Authorities for their continued support. My gratitude goes to all the employees across the DXBE team and our operating partners for their dedication and perseverance during an extraordinary year, as well as to our shareholders and financing partners for their support in the development of the company. “

“Finally, a big thank you to our guests for their contributions in 2020 and for being a part of Dubai Parks and Resorts’ journey as a leading integrated leisure and entertainment destination.”

On 9 February 2021, the Board recommended to shareholders to accept the Offer from Meraas and vote in favour of the general assembly resolutions required to implement the Offer. Further details on the Board’s recommendation and the Offer have been disclosed to the market and published on the Dubai Financial Market website and on https://www.dxbentertainments.com/investor-relations/meraasoffer/.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.