PHOTO

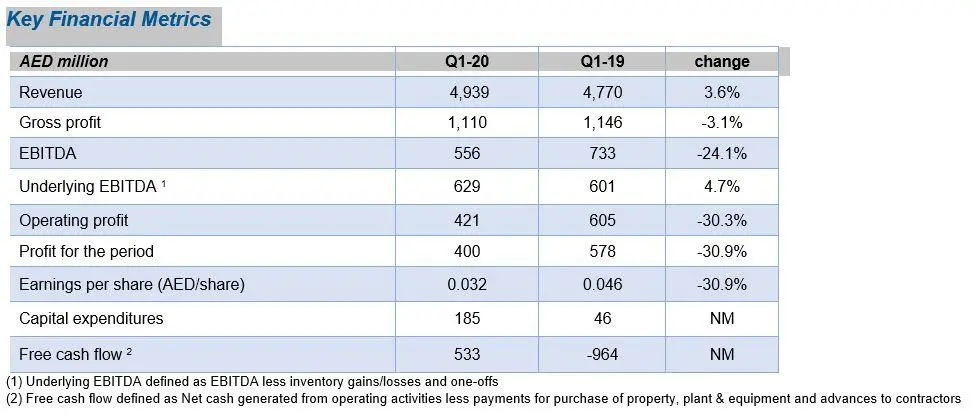

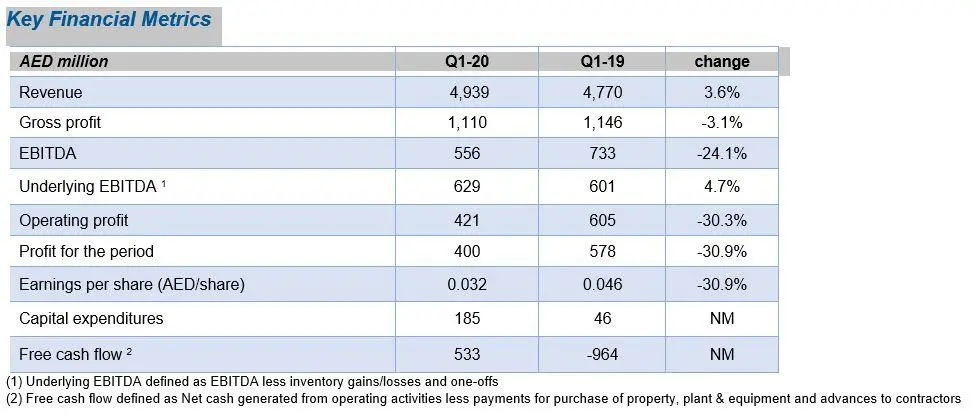

Abu Dhabi, UAE: ADNOC Distribution (ISIN: AEA006101017) (Symbol: ADNOCDIST), the UAE’s largest fuel and convenience retailer, announced its first quarter 2020 financial results, recording an underlying EBITDA of AED 629 million, a growth of 4.7%, while net profit was AED 400 million for the quarter and cash flow generation remained strong with free cash flow of AED 533 million. The company continues to focus on ensuring the safety of its employees, customers and local communities as it responds to COVID-19 and, despite the challenging operating environment, remains resilient with a strong balance sheet, delivering on its smart growth strategy with seven new stations opened in Q1 2020.

During the first quarter, ADNOC Distribution responded swiftly to the evolving needs of its employees, customers and local communities, by introducing a number of health and safety measures, including new services to enhance customer experience and protect staff and customers during the current COVID-19 pandemic, including the daily cleaning of its sites and free car interior sanitization with every auto wash. To further protect customers and staff, the company has accelerated its digital transformation strategy in response to the current pandemic, providing customers with a seamless digital experience and enhancing the company’s position as a best in class fuel retailer. A key element has included enhancing its advanced Mobile Pay technology, which allows totally contactless refueling and payment. As a result, customer uptake of the ADNOC Distribution Wallet, which includes Mobile Pay as well as the ADNOC Rewards program, increased by more than 100,000 users in the first quarter of the year to over 730,000 users.

The company was also quick to launch a new ‘essential products’ range in its ADNOC Oasis stores, including fresh food, household and healthcare products, at low cost to help customers across the UAE. In addition, retail fuel customers across Abu Dhabi Island have had the added convenience of having their vehicles refueled on their doorstep through ADNOC Distribution’s My Station, a new mobile fueling service that provides services at a location and time of customers’ choosing.

The company has also introduced new complimentary deep cleaning and sanitization of cars at select stations as part of its auto wash service. More recently, ADNOC Distribution launched an online home delivery service with select leading providers, of more than 1,000 of its Oasis products, including groceries and hot beverages for the convenience and safety of its customers. The service is already proving popular and has resulted in an increase in basket size for participating stations.

The company’s retail fuel business posted strong operational performance, with retail fuel gross profit growing by 13.1% year-on-year in the first quarter, led by higher margins and volume growth in the first two months of the year. Although retail fuel volumes declined by 1.9% in the quarter, due mainly to the business impact of COVID-19 in March, commercial fuel volumes remained stable year-on-year.

The company has shown resilience in Q1 2020, with underlying EBITDA (EBITDA excluding inventory losses and one-offs) of AED 629 million, an increase of 4.7% compared to the same period last year. While revaluation of current inventory stock in the commercial business, following lower oil prices, and prudent provisioning in the current environment negatively impacted reported EBITDA and Net Profit for the first quarter by AED 73 million, most of the year on year decline comes from an unfavorable base period which benefitted from one-off reversals and recoveries of AED 132 million.

Despite the unprecedented market conditions and the uncertainties ahead, ADNOC Distribution remains in a strong financial position and is well placed to navigate the challenges posed by the COVID-19 pandemic. It has ample liquidity to weather the immediate impacts of COVID-19 and is exploring new growth opportunities presented by the current environment. As of 31 March 2020, the company’s liquidity was at AED 8.0 billion in the form of AED 5.2 billion in cash and cash equivalents and AED 2.8 billion in unutilized credit facility.

Ahmed Al Shamsi, Acting Chief Executive Officer of ADNOC Distribution said: “In Q1 2020 we have shown strength and agility as a business. We are especially thankful to our dedicated frontline colleagues who have played a vital role in this effort by providing a lifeline to communities around the country that rely on our services 24 hours a day to meet their essential fuel, food and grocery needs. In turn, we have taken and will continue to take, every step to ensure their health, safety and wellbeing.”

“By understanding our customers’ needs and adapting our products and services, while they adhere to social distancing, we have built a stronger relationship with our communities, one that we hope will last long into the future after this pandemic is over,” added Al Shamsi. “We also remain committed to our shareholders by protecting our business through the application of robust business continuity measures and the strengthening of our business resilience, in readiness to return in a position of strength and continue our growth trajectory when the effects of the pandemic subside.”

The company successfully opened seven new stations in Q1 and construction is well advanced on a number of additional stations that will be opened in the coming quarter. Since announcing its new ‘On-the-Go’ community station concept in November 2019, five ‘On-the-Go’ stations have already been brought into operation by April 2020, with more coming soon.

During its recent General Assembly meeting, held virtually due to social distancing measures, ADNOC Distribution announced that its 2020 dividend policy is set to continue with an increase of 7.5% to AED 2.57 billion, after a 62% increase in the 2019 dividend to AED 2.39 billion. Looking further ahead, the company’s shareholders approved amendments to the dividend policy for 2021 onwards, setting an AED 2.57 billion dividend for 2021 and a dividend equal to at least 75% of distributable profits from 2022 onwards. The changes to the dividend policy approved by shareholders demonstrates its confidence in the Company’s future prospects and ability to deliver sustainable growth, providing investors with longer term visibility on the company’s dividend strategy.

The full first quarter earnings announcement can be found at https://www.adnocdistribution.ae/en/investor-relations/investor-relations/

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.