PHOTO

Debt Capital Markets (DCM) in the MENA region totaled $90.9 billion during the first nine months of 2021, down 8 percent compared to the same period last year, according to Refinitiv.

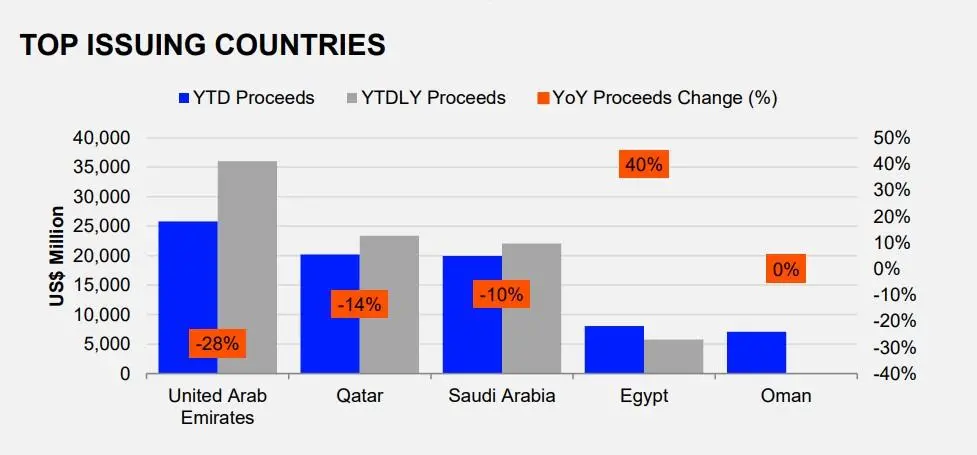

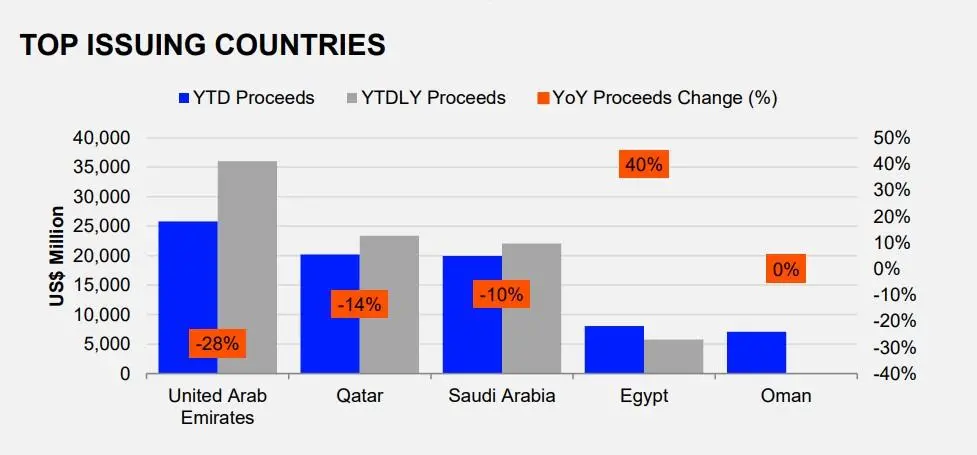

The UAE was the top nation in DCM activity, with $25.8 billion in related proceeds. Qatar came in second, with $20.1 billion in related proceeds followed, by Saudi Arabia, Egypt and Oman.

Investment-grade corporate debt recorded a total of $62.3 billion, equivalent to 68 percent of total DCM proceeds and the highest year-to-date total since records began in 1980, the global data provider said.

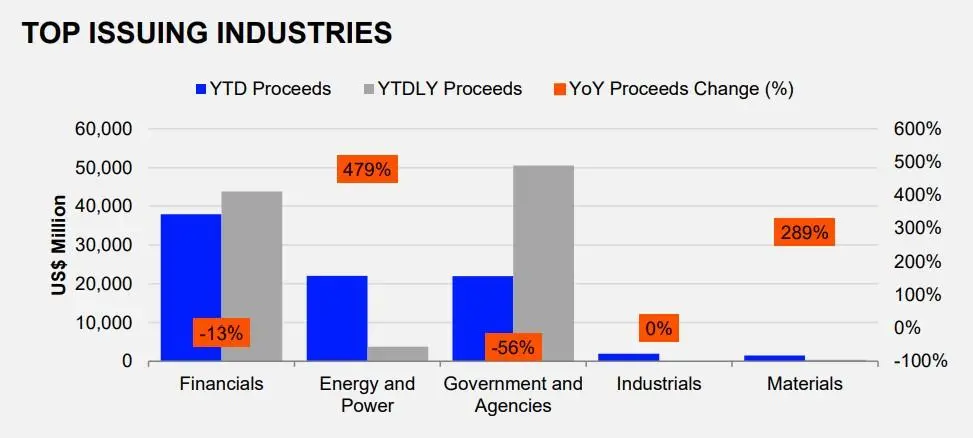

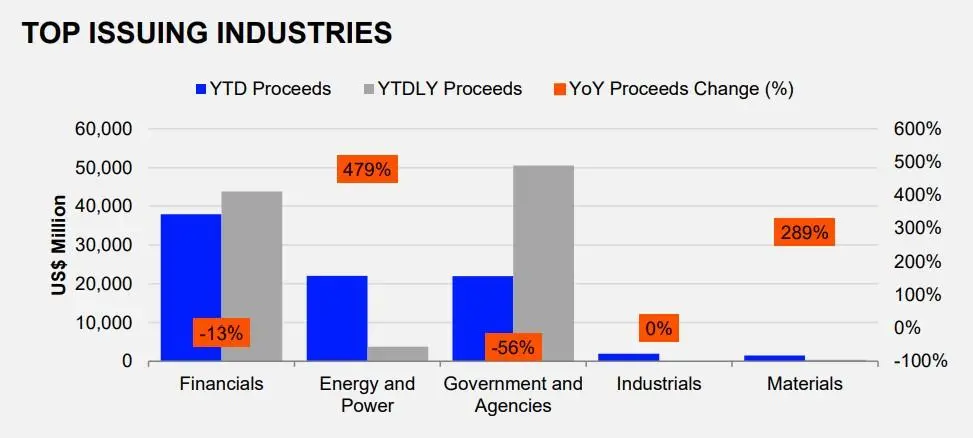

The financials industry remained the top-performing industry from last quarter with $37.9 billion in proceeds so far in 2021.

The largest deal of the year so far is the $12.4 billion bond sale from state energy company Qatar Petroleum Corp back in June this year. This was followed by Saudi Aramco's $6 billion sukuk for funding its dividend.

The oil giant's debut $12 billion bond deal in 2019 was followed by an $8 billion, five-part transaction in November last year, both used to fund its dividend.

Refinitiv data revealed that Standard Chartered took the top spot in the MENA Debt capital markets league table for the first nine months of 2021, with $10.6 billion in related activity, accounting for a market share of 12 percent.

HSBC came second, with a 11 percent share of the market ($10.2 billion), followed by JP Morgan, with a 10 percent market share ($9.04 billion).

According to UBS’s latest Chief Investment Office report on emerging market bonds, the outlook for Middle Eastern sovereign bonds significantly improved in 2021 thanks to the rise in crude oil prices (37 percent year-to-date), increasing vaccination rates, and reform measures in key countries in the region.

While UBS sees much positive in the region, risks include slower global growth, monetary policy tightening by major central banks, lower commodity prices, regional tensions, stringent Chinese regulatory actions, and US dollar strength. Reform fatigue or an unsustainable policy mix are dangers for selected countries.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021