PHOTO

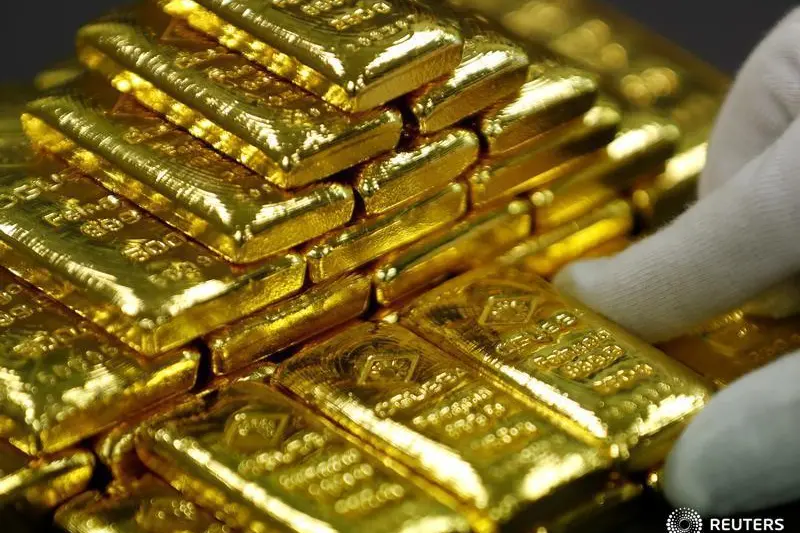

Gold prices rose on Thursday as fears of a pandemic heightened after coronavirus infections surged in Italy and Iran, triggering a move away from riskier assets.

FUNDAMENTALS

Spot gold gained 0.3% to $1,644.11 per ounce as of 0044 GMT.

U.S. gold futures was up 0.2% at $1,646.

The number of new infections inside China - the source of the outbreak - was for the first time overtaken by fresh cases elsewhere on Wednesday, with Italy and Iran emerging as epicentres of the rapidly spreading illness.

Italy has reported more than 400 cases and Iran has reported only 139 cases, but epidemiologist say the true number of cases must be many times higher.

Financial markets have been reacting to news of the virus' spread because of its potential impact on the global economy.

The benchmark U.S. 10-year Treasury yields were holding close to a record low touched in the previous session, while S&P 500 e-mini futures also fell.

Public health officials on Wednesday warned Americans to prepare for more virus cases and New York City announced plans to provide up to 1,200 hospital beds if needed.

Germany is also at the beginning of an epidemic after new cases sprung up which can no longer be traced to the virus's original source in China, Health Minister Jens Spahn said on Wednesday.

Sales of new U.S. single-family homes raced to a 12-1/2-year high in January, pointing to housing market strength that could help to blunt any hit on the economy from the epidemic and keep the longest economic expansion in history on track.

South Korea's central bank kept its key interest rate unchanged on Thursday, defying expectations for a cut amid growing pressure to ease policy as the outbreak hits demand in the export-reliant economy.

SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, said its holdings fell 0.5% to 935.70 tonnes on Wednesday.

* Palladium rose 1.4% to $2,829.12 per ounce, while platinum inched up 0.2% to $912.44, having touched its lowest level since December earlier this session.

* Silver edged up 0.3% to $17.93 an ounce, after having touched a one-week low in the previous session.

DATA/EVENTS (GMT)

1000 EU Consumer Confidence Final (Feb)

1330 U.S. Durable Goods (Jan)

1330 U.S. GDP 2nd Estimate (Q4)

1330 U.S. Initial Jobless Claims (Weekly)

(Reporting by K. Sathya Narayanan in Bengaluru; Editing by Amy Caren Daniel)

© Reuters News 2020