PHOTO

The amount of U.S, dollar-denominated bonds and sukuk issued in the Middle East and North Africa (MENA) is likely to reach $80-$85 billion in 2019 - similar to the $84 billion of issuance recorded last year, according to a new study, but there is potential for this figure to climb higher if Saudi Aramco embarks on its anticipated journey into debt capital markets with a maiden $10 billion bond issuance.

Speaking at the launch of a white paper on the MENA fixed income market, Parth Kikani, director of fixed income at Emirates NBD Asset Management, said that the $84 billion of hard currency issuance which took place last year was a decline on the $100 billion issued a year earlier, but the market still witnessed some "jumbo" issuances, including a $12 billion, multi-tranche issuance by the State of Qatar in April and an $11 billion, multi-tranche sovereign issuance by Saudi Arabia in the same month.

“Sovereign issuance has been the dominant factor in 2018. While there was so much issuance, the deals were well-covered - on an average 2-2.5 times oversubscribed,” Kikani said.

“So we still see good demand, and roughly 50-60 percent of the deals were placed in the region,” he added. “We expect roughly about $80-$85 billion of issuance again in 2019.”

Kikani said that oil prices were expected to range between $60 and $65 per barrel, meaning “we'll still see some of the MENA countries having fiscal deficits”. This will drive further sovereign issuance this year, he said.

The report, which was jointly authored by Dubai-based Emirates NBD Asset Management, Switzerland’s Fisch Asset Management and Kuwait’s KAMCO Investment Company, also highlighted that demand from investors for MENA fixed income products is likely to remain strong this year, particularly as bonds from five out of six GCC countries will be included in JP Morgan's Emerging Markets bond indices. MENA bonds will be added to the indices gradually, starting from the end of this month, lasting through until September.

Index inclusion is likely to attract inflows of around $30 billion into GCC bonds, Kikani said, on the basis that around $300 billion of assets track the indices and that Gulf Cooperation Council (GCC) bonds are likely to have a weighting of around 10-12 percent.

Philip Good, CEO of Fisch Asset Management, said, however, that he thought “a big chunk” of these bonds will already have been bought by active managers in anticipation of passive flows into emerging market bonds.

“To estimate is there still a lot of money coming just purely because of index inclusion, I would say that's very difficult,” Good said.

Strong demand

However, he added that there is clearly a demand from investors for MENA bonds, given the issuance earlier this month of $7.5 billion worth of Saudi government bonds, for which there were $27 billion worth of investor orders.

“That was almost four times oversubscribed so that gives you a little bit of an idea on how much risk appetite for the region is out there,” Good said. In total, $9.1 billion already has been raised in January, the report said, including First Abu Dhabi Bank’s $850 million sukuk and Dubai Islamic Bank’s $750 million tier 1 sukuk.

Good argued that the MENA region still offered better credit fundamentals than other emerging markets, with lower debt-to-GDP ratios than other emerging market regions, despite total bond issuance in the GCC region jumping to around $300 billion, up from $180 billion in 2014, according to a recent Emirates NBD report.

Salman Bajwa, CEO of Emirates NBD Asset Management, said that “MENA markets held up pretty well” in 2018, which was the first year in decades where bond markets faced a slump.

“You saw a lot of turmoil in global markets. EM (emerging markets), particularly, bore the brunt of it,” he said.

“Whereas most EM portfolios were down in the negative single large digits last year (and) most developed market portfolios were down 2-3 percent, most MENA portfolios were just flat or marginally negative. In 2019… as long as oil prices remain range-bound, we see no threat to that story repeating itself.”

Faisal Hasan, head of research at KAMCO Investment Company, indicated that he believed that some of the regional demand for debt issuance would come from the need to finance both hard and soft infrastructure projects.

“We are seeing a lot of infrastructure projects and that needs to be financed,” he said. “Fixed income is a go-to place where they can finance these projects.”

Good said that MENA fixed income was an asset class that is still marginal in many global asset managers’ portfolios.

“If I look in Europe, and in the US it's actually the same, emerging market is under-represented within the portfolio, and within emerging markets I do believe MENA is under-represented against the rest of emerging markets.”

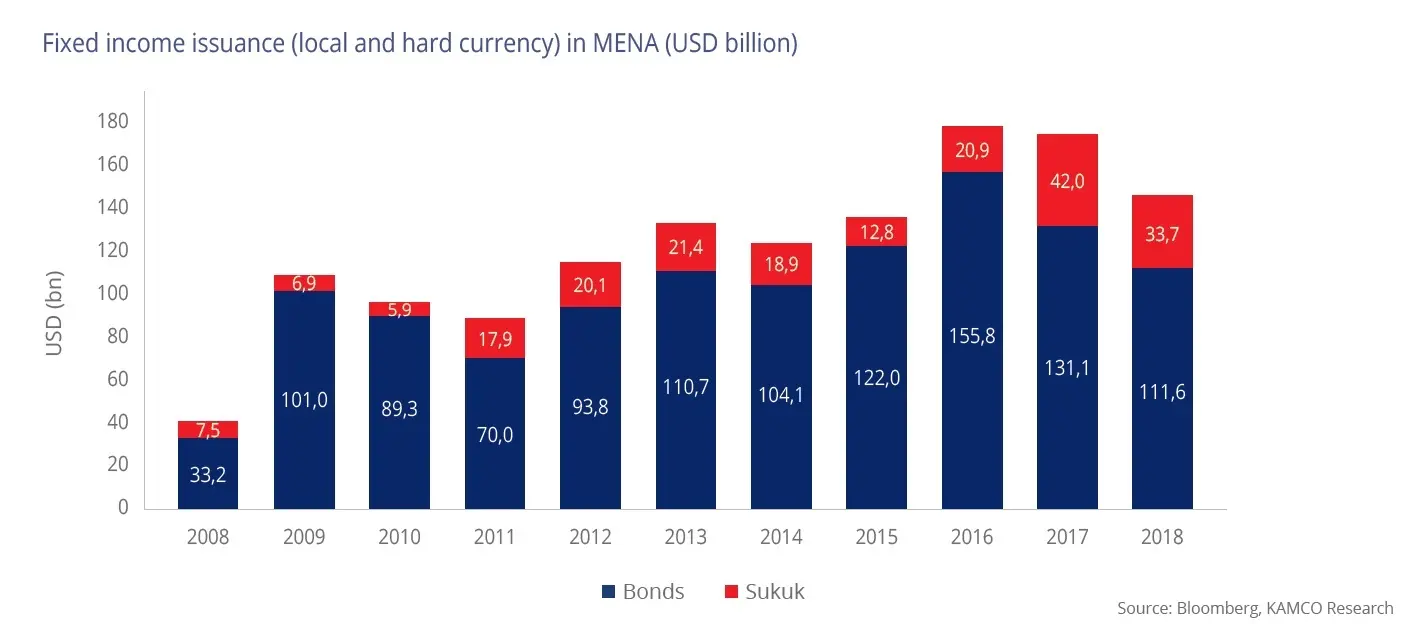

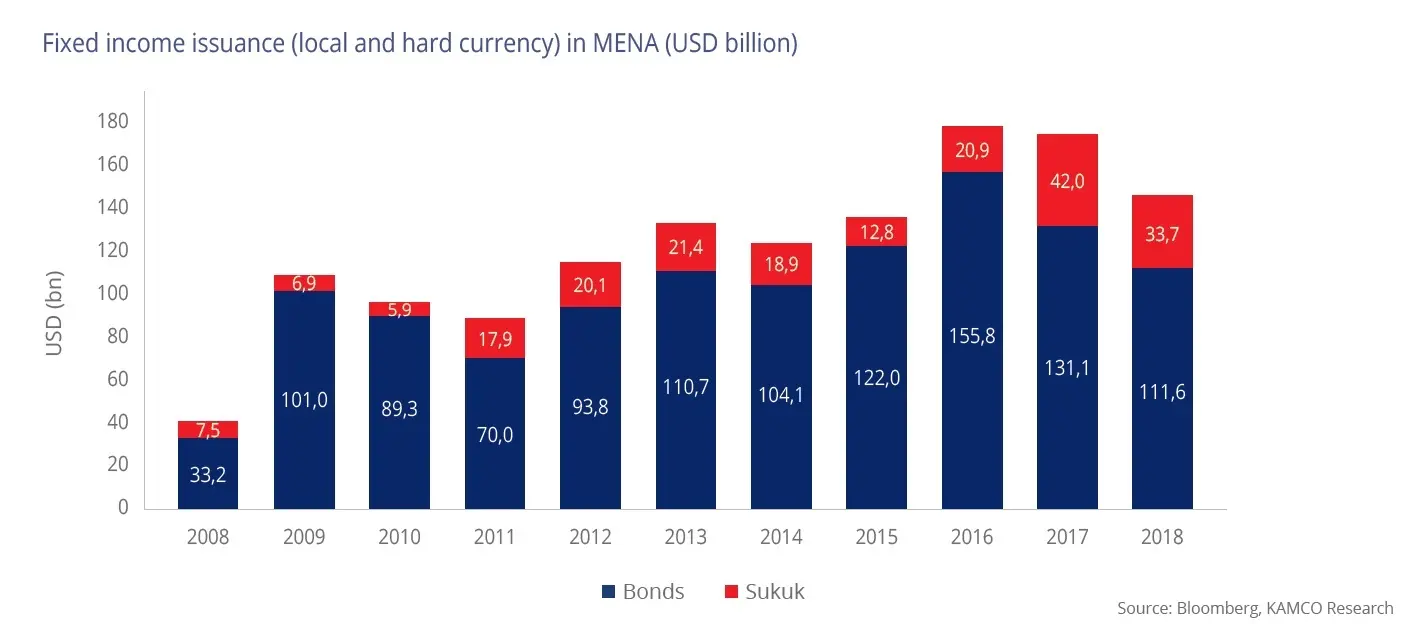

The total amount of debt capital issuance in the MENA region last year, including local currency and sukuk issuance, reached $145 billion, the report said. This was marginally below the five-year average rate of $150 billion. Total MENA sukuk issuance reached $34 billion – ahead of its five-year average of $26 billion.

(Reporting by Michael Fahy; Editing by Mily Chakrabarty)

(michael.fahy@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019