PHOTO

While the financial disaster triggered by COVID-19 is still being fathomed out, experts doubt whether the world will see a widespread trend of austerity (spending cuts and tax increases) to reduce public sector debt ratios and budget deficits going forward.

Nonetheless, austerity will still be undertaken in a few isolated cases, primarily in emerging markets. And in other countries, there will be a redistributive tax hike on the rich to fund higher health spending and support for the less well-off, according to the UK think tank Capital Economics.

"Of the countries worldwide, the Gulf economies are among the most likely to implement fiscal austerity as they rely on this (rather than currency devaluations) to help address large twin deficits and make the adjustment to low oil prices," Jason Tuvey, Senior Emerging Markets Economist at Capital Economics told Zawya.

"We've already seen the Saudi government outline fairly large austerity measures, including the tripling of the VAT rate and the suspension of the Cost of Living Allowance. One key difference between now and the austerity implemented after the oil price crash in 2014-16 is that it appears households will share more of the burden this time around," he added.

According to Capital Economics, another widespread round of austerity is not required in most countries. The coronavirus will result in a sharp one-off rise in government debt but, given the low level of interest rates, governments can generally tolerate this.

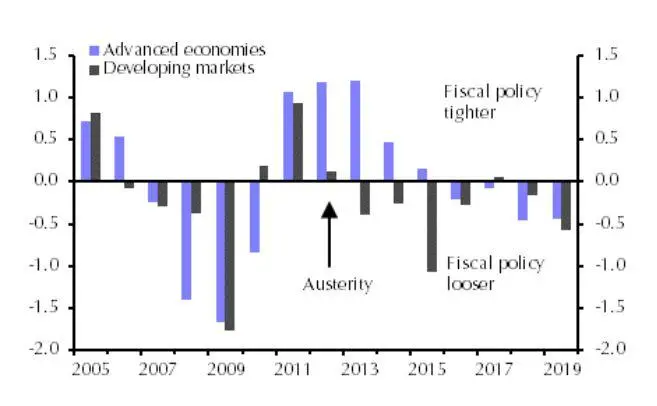

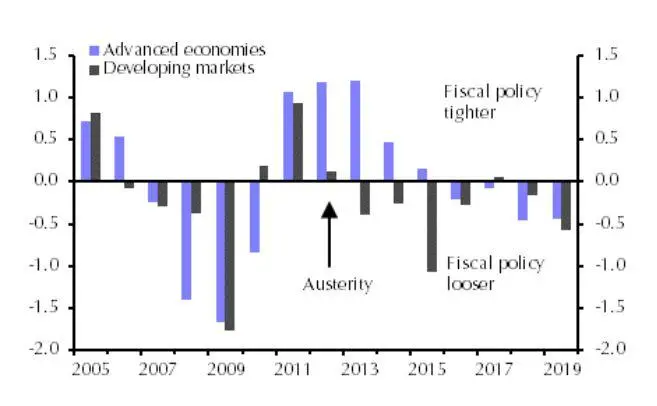

Annual Change in Structural Budget Balance (% of GDP). Sources: IMF, Refinitiv, Capital Economics

"Admittedly, there is a risk that the crisis also results in permanently bigger deficits and a deterioration in the trajectory of the debt ratio. Indeed, the austerity after the financial crisis was designed to fill the black hole left in the public finances by a permanently lower level of tax revenues. But this might be avoided now if the virus does not inflict too much long-term damage on the economy's supply potential," Vicky Redwood Senior economic advisor at Capital Economics said in a report.

The second reason why austerity is unlikely is that governments now have more confidence than in the past that financial markets will tolerate higher debt burdens.

The justification for past episodes of austerity, including the one after the financial crisis, was that the near-term pain is worth it to avoid a sharp rise in government bond yields and higher borrowing costs that would inflict even bigger damage to the economy further ahead, Redwood noted.

But the past few years have shown that bond markets are unperturbed by high levels of government debt and in some cases (including the US) even by rising trajectories of debt.

Also, the austerity that was seen after the financial crisis hardly went well.

Research indicated that fiscal multipliers (the impact a change in government policy has on the economy) are high, especially if options for loosening monetary policy are limited. So, although some countries, like the US, seemed to weather austerity well, others did not.

(Writing by Seban Scaria, editing by Anoop Menon)

#ECONOMY #RECESSION #FISCAL #GULF #UAE

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020