PHOTO

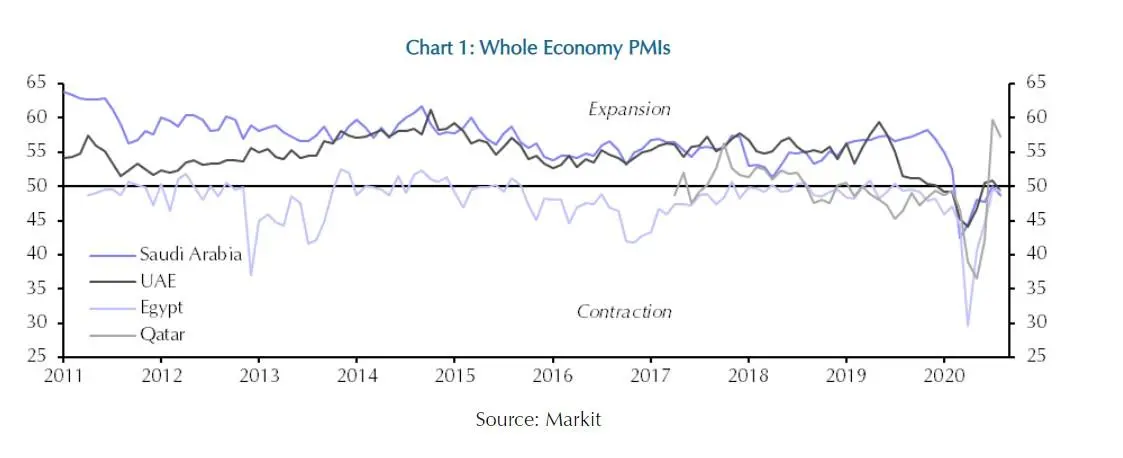

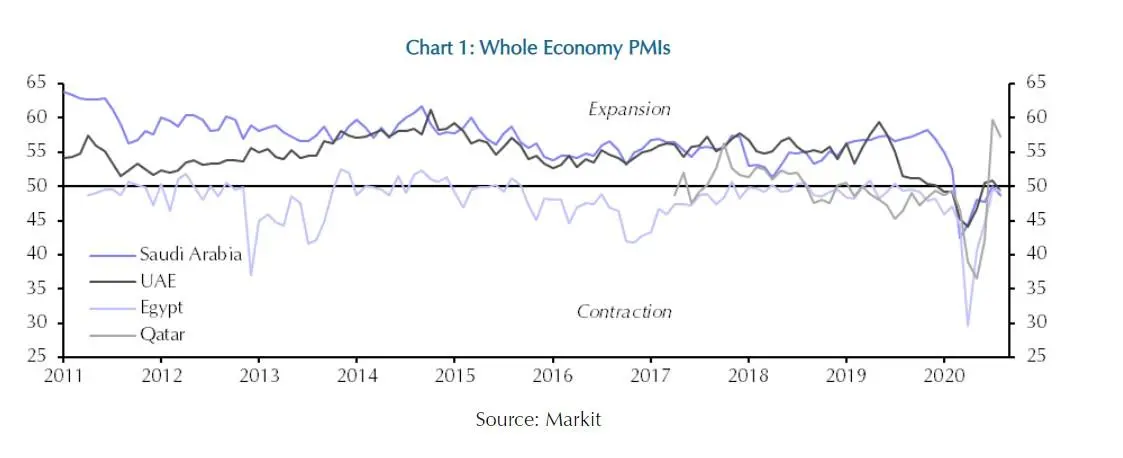

The Purchasing Managers Index (PMI) data of economies from across the Middle East and North Africa (MENA) all fell in August, indicating that activity in the region has plateaued amid fiscal austerity and continued virus containment measures. In this situation, recoveries from the current crisis will remain slow, London-based economic research consultancy Capital Economics said.

The seasonally adjusted IHS Markit Purchasing Managers Index is a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy.

Saudi Arabia's PMI dropped from 50.0 in July to 48.8 in August. The UAE’s figure fell from 50.8 to 49.4 and Qatar’s edged down from a record high of 59.8 to 57.3. In Egypt, the headline reading eased from 49.6 in July to 49.4 last month, which still leaves it below the 50-mark that, in theory, separates expansion from contraction.

"All told, August’s whole economy PMIs add to the recent evidence that activity in the region has started to level off. A combination of fiscal austerity, the continued presence of containment measures and weakness in tourism sectors will hold back recoveries," James Swanston, MENA economist at Capital Economics said.

The tripling of the VAT rate in Saudi Arabia is seen as a key factor behind the softening of activity there. The VAT hiked caused inflation to jump to 6.1 percent year-on-year in July, eroding households’ incomes and dampening consumer spending. This was reflected in an edge down in output and new orders dropped sharply.

While output continued to expand, the pace of the recovery in activity has eased in the UAE. PMI survey respondents noted that future business sentiment for the next year dropped to its lowest on record. Several firms noted the weak recovery could lead to business closures, particularly as competition remained strong.

In Egypt, the headline PMI eased slightly as activity has stagnated there. The breakdown showed that the output price component rose to a ten-month high, suggesting that price pressures are building.

"For our part, though, we expect the headline rate will stay below the mid-point of the central bank’s target range, leaving the door open for the monetary easing cycle to be resumed," Swanston said.

(Writing by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020