PHOTO

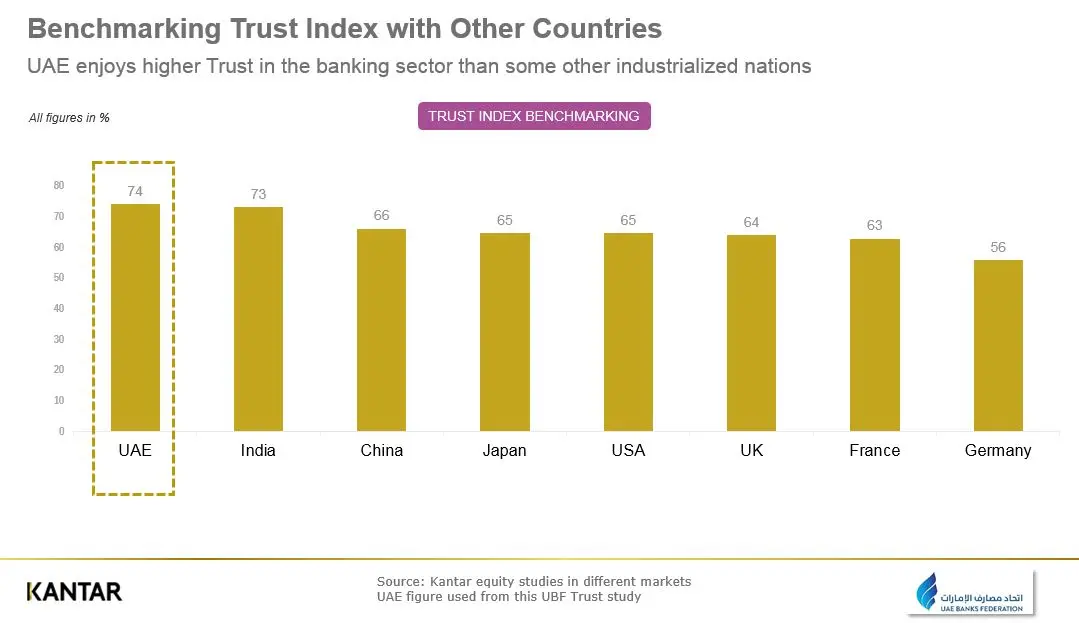

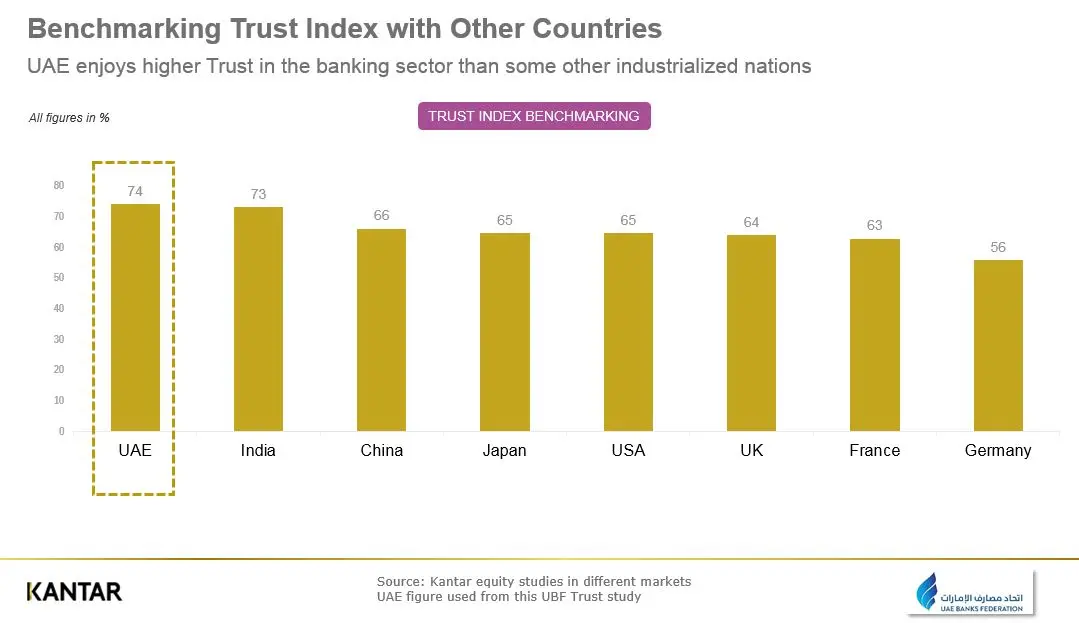

UAE enjoys the highest trust in the banking sector compared to other developed countries such as the US, UK and China, if the Trust Index Survey 2018 is anything to go by.

Seventy four percent of the respondents had high trust in the sector, compared to 68 percent in 2017, according to the Trust Index Survey conducted by the UAE banks federation (UBF).

The ‘trust’ factor for Chinese banks stood at 66 percent. For the US and the UK it was as 65 percent and 64 percent respectively.

The survey shows “phenomenal improvement in the trust in the banking sentiment,” Abdul Aziz Al Ghurair, Chairman of the UAE Banks Federation said at a meeting.

In 2018, 95 percent of retail banking customers were satisfied with the performance of their main bank, compared to 93 percent in 2017.

Out of the 1,515 individuals surveyed, 83 percent of participants recorded a very positive perception towards UAE banks, compared with 76 percent in 2017 and 72 percent in 2016.

Al Ghurair said that “banks have shown highest improvement” among other sectors. Trust in banks added 6 percentage points, trust in other sectors like food and beverages added 3 points while trust in the retail sector and the financial sector rose by 4 points.

“Despite global geopolitical and economic headwinds, this 4th edition of the Trust Index Survey shows marked improvements, demonstrating the UAE banking sector’s ongoing commitment to enhance services and products, provide convenience and outstanding customer experience, and address key issues and challenges,” he added.

Regarding challenges in the banking sector, 61 percent of banks said that UAE banks faced high interest rates for loans and credit cards.

According to the survey, 78 percent of respondents stated that UAE banks are excellent or very good at providing convenience, while 77 percent responded that their experience with ATMs was excellent or very good.

(Writing by Gerard Aoun, editing by Seban Scaria)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here

© ZAWYA 2019