PHOTO

(Updated to include key source markets)

Many of the tourists coming to Dubai this year will prefer to stay in midscale hotels due to economic slowdowns in source markets, according to predictions made by Deloitte in a new report that included data from other tourism indices and sources.

“In the context of economic uncertainty from key source markets, leisure travelers to Dubai are becoming increasingly price sensitive. The midscale segment in Dubai has seen significant growth in supply in both international and local brands such as the Rove by Emaar and Zabeel House by Jumeriah,” consultancy firm Deloitte said in a Real Estate Predictions 2019 report.

The key source markers are: India, Saudi Arabia, the United Kingdom, China, Oman, Russia, the United States of America, Germany, Pakistan and Philippines, Dunia Joulani, Deloitte’s assistant director for travel, hospitality and leisure for Europe, Middle East and Africa, told Zawya on Thursday in response to queries sent by email.

“In a period of two years, the Rove portfolio has expanded to five hotels across Dubai, with a further four hotels in the pipeline. Jumeirah has also forayed into the mid-market segment with the introduction of their Zabeel House and Zabeel House Mini brands, which currently includes two properties in Al Seef and a property in The Greens. The midscale shift is also evident amongst international operators. Marriott has accelerated the development of its Midscale brands with the opening of three Aloft Hotels and Dubai’s first Element Hotel in Me’aisam (area),” Deloitte report added.

Rove, which is managed by Dubai-based Emaar Properties, announced plans last year to expand into Saudi Arabia.

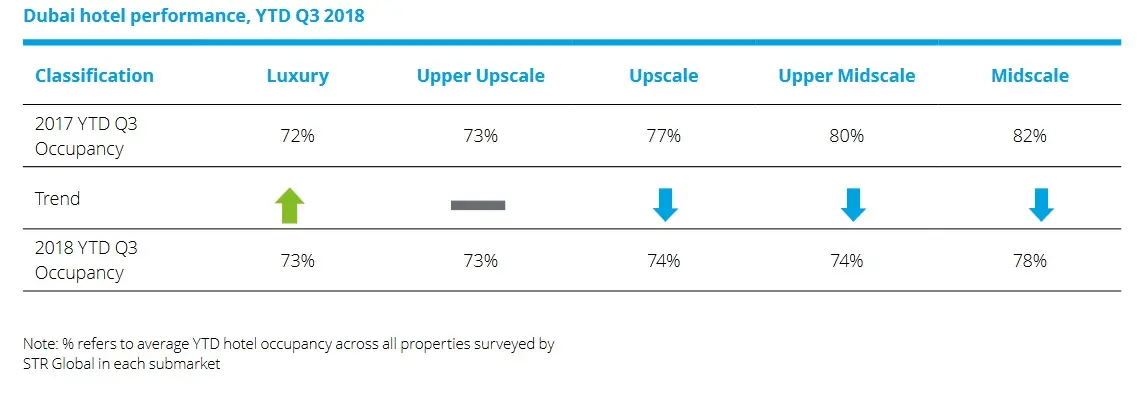

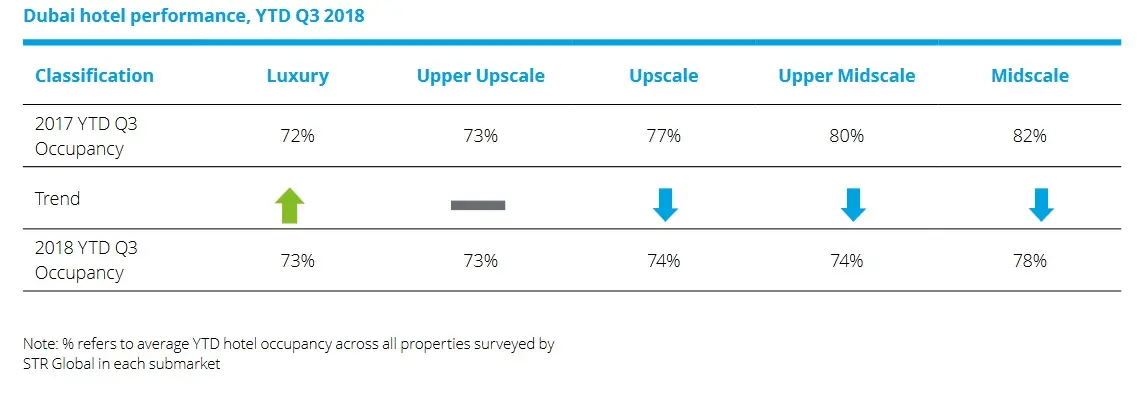

The Deloitte report predicted that new, midscale hotels will put more pressure on other hotel segments. Many of these, including the midscale segment, have suffered declines in occupancy levels in the first three quarters of 2018.

Click image to enlarge

(Source: STR Global, Deloitte)

A report released by real estate consultancy JLL last month showed that overall hotel occupancy rates in Dubai dropped by 2 percent year-on-year until the end of November 2018 to 75 percent, down from 77 percent in November 2017. The average daily room rate declined by 7 percent in the same period, falling to $169, from $181 in November 2017.

“2019 will likely see continued growth in tourist arrivals with a shift in visitor preferences to more affordable offerings as key source markets continue to face economic headwinds,” Deloitte said as a prediction for the tourism market in Dubai this year.

The number of foreign visitors to Dubai stalled in the first nine months of last year, Reuters reported last December, quoting data from Dubai's government media office.

Deloitte said that the emirates held the fourth position in terms of the number of overnight visitors among 162 international cities surveyed by Mastercard Global Destination Cities Index. The top three cities were Bangkok, London and Paris respectively.

The number of overnight visitors who came to Dubai in 2017 stood at 15.79 million, a figure that is forecast to have grown by 5.5 percent last year, according to a press release issued by Mastercard Global Destination Cities Index last September.

Dubai held the first position in the amount of money the visitors spent in 2017, which stood at $537 per day on average, while Istanbul recorded the lowest daily spend of the cities surveyed for the same year, with an amount of $108 per day on average, according to Mastercard’s press release. It added that, overall, international overnight tourists spent $29.70 billion in Dubai in 2017, a figure that it predicted would rise by 7.8 percent last year.

Further reading:

- Dubai Tourism releases bank guarantees of tourism companies to boost investment in ecosystem

- New initiatives, entertainment offerings keep Dubai's tourism appeal high

- Dubai maintains steady tourism volumes with 11.58mln visitors in first three quarters of 2018

- Dubai hotels record upswing in supply and demand

(Writing by Yasmine Saleh; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019