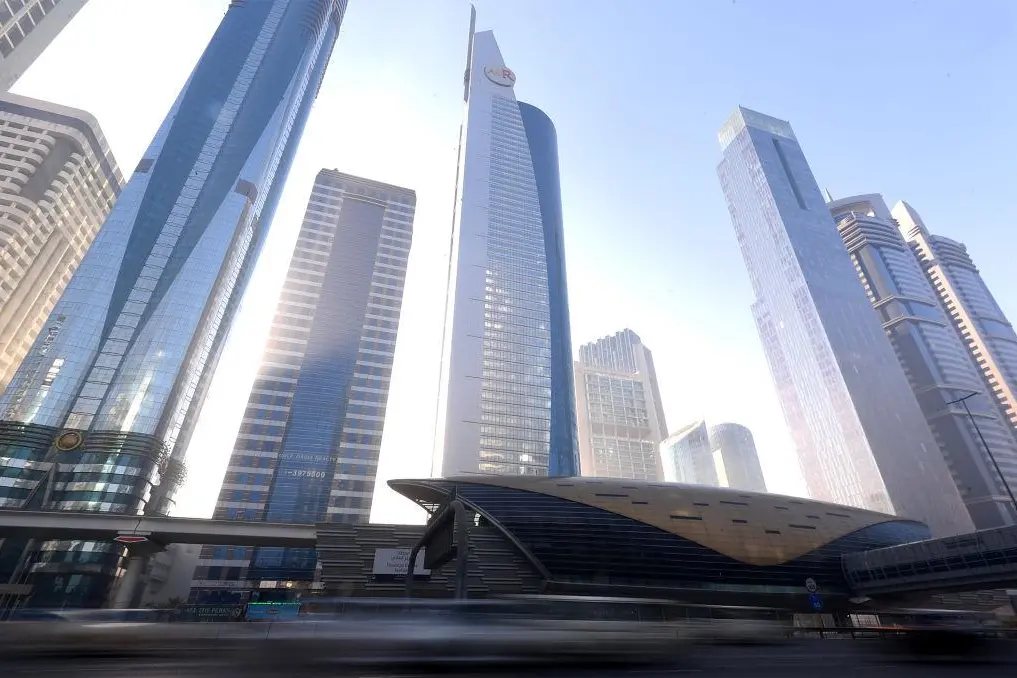

PHOTO

UAE - Lower prices and the completion of ongoing infrastructure projects along with various supportive measures launched by the government in 2020 to revive the economy will have a positive impact on the UAE real estate market going forward, according to real estate analysts.

The introduction of a stimulus package by the Central Bank of the UAE was a shot-in-the-arm to the property market once lockdown restrictions were eased. “We witnessed a gradual increase in demand, especially across the residential sector in H2 2020,” Richard Paul, head of Professional Services & Consultancy Middle East, Savills, wrote.

According to Savills “Property Report,” a relaxation in LTV (loan to value) laws encouraged more investment appetite into the sector.

Hussain Sajwani, chairman of Damac, said in an interview on CNBC that lower prices may be a good time for investors looking to buy. Now is a great time for people to buy real estate in Dubai, Sajwani said, estimating that resale units could cost 10 per cent less than a new development at this point. The market is likely to remain subdued for the next two years as the city recovers from the pandemic, he added.

The Savills report said banks also increased their exposure to real estate and the construction sector, and a spike in re-mortgage activity was witnessed due to attractive borrowing rates and other promotional discounts. “The upfront deposits required to buy a residential property was reduced as individuals now have an additional 5.0 per cent borrowing ability as part of the relaxed LTV laws. The Abu Dhabi government also waived off (for the entire year) real estate registration fee of 2.0 per cent,” said the report.

Swapnil Pillai, associate director, Research Savills Middle East, said as a result of these measures, transaction activity increased. “Individuals who were renting found it more affordable and lucrative to purchase their own property. A continued softening in asset pricing and completion of new projects in the last few months have offered a value proposition to end-users to upgrade their current real estate to better quality stock. However, the residential market witnessed a slowdown in demand from international investors due to restrictions in travel.”

In Dubai, a large number of project completions over the last few years and the handover of an additional 39,000 units in 2020 were among the primary reasons for the general drop in prices on an annual basis.

Close to 32,900 units were transacted across the city – a drop of 15 per cent year on year compared to 2019. It is however, important to note that demand for residential units was on an upward trajectory before the pandemic.

Project handovers during the year were active across Jumeirah Village Circle (5,200 units), Business Bay (2,700 units), Town Square (2,700 units), Akoya Oxygen (2,400 units), Dubai Hills Estate (2,200 units) and Al Furjan (1,900 units).

In 2020, transactions for ready townhouses and villas across Dubai increased by 32 per cent year-on-year. Demand for ready units across villa/townhouse developments was strong across Dubai Hills Estate, Mudon, Arabian Ranches, The Springs, Al Furjan and Damac Hills while ready apartments were preferred across Dubai Marina, Business Bay, Jumeirah Village Circle, Serena – Dubai Properties, Downtown Dubai and Town Square.

On the other hand, off plan sales for apartments were buoyant across Jumeirah Village Circle, Business Bay, Downtown Dubai, Dubai Creek Harbour and Sobha Hartland. Amongst villa / townhouse projects, activity was upbeat across the recently relaunched Tilal Al Ghaf, Emaar South, Arabian Ranches Phase 3 and Villanova. Demand for high-end and luxury units was particularly upbeat over the last 12 months.

In 2021, companies from the non-oil sector are likely to drive demand for office space in Dubai, while Abu Dhabi may witness steady demand from government related entities and also tech related companies. The market may also benefit from any projected improvement in oil prices, said the report.

Copyright © 2021 Khaleej Times. All Rights Reserved. Provided by SyndiGate Media Inc. (Syndigate.info).