PHOTO

Tokyo stocks rebounded from earlier losses to close higher on Thursday, with investors' eyes on the Middle East.

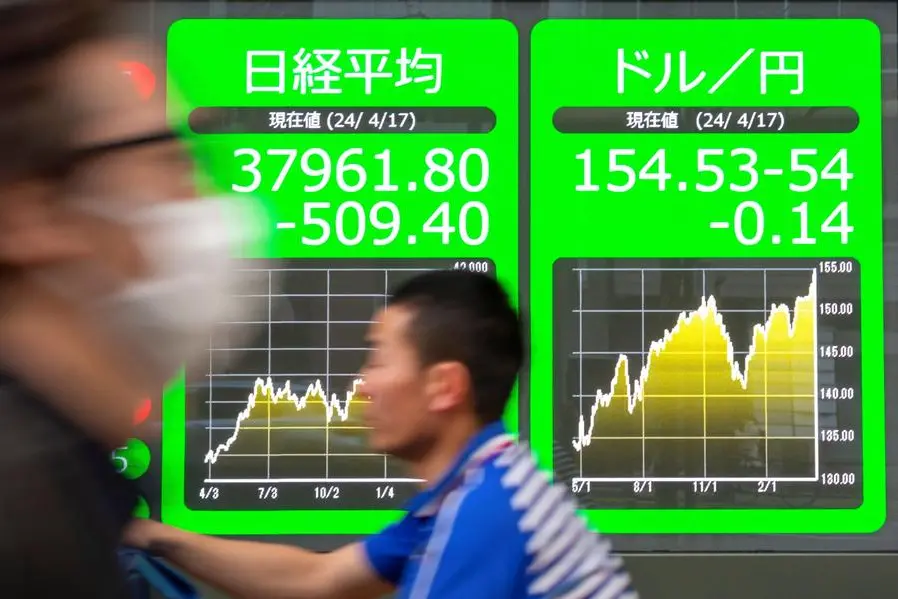

The benchmark Nikkei 225 index rose 0.31 percent, or 117.90 points, to end at 38,079.70, while the broader Topix index added 0.54 percent, or 14.30 points, to 2,677.45.

The Nikkei started in the red following drops on Wall Street but climbed back into positive territory by the break as smaller shares and financial stocks attracted buyers.

"It was a natural rebound" after falls in the last three sessions for the Nikkei prompted caution over possible overselling, Daiwa Securities said.

"There is an increasing sense that the Tokyo market may be bottoming out," it added.

Robust trade in other Asian markets also encouraged investors, who are gradually shifting their interest to upcoming corporate earnings and the Bank of Japan meeting later this month, IwaiCosmo Securities said.

Attention is also still focused on the Middle East as a diplomatic flurry aims to calm tensions after Iran's unprecedented attack on Israel over the weekend.

Meanwhile dimmed prospects for early US rate cuts continued to weigh on the market.

The dollar was 154.20 yen, little changed from 154.36 yen seen in New York overnight.

Some semiconductor shares rebounded. Advantest surged 5.06 percent to 5,735 yen and Disco rose 1.67 percent to 54,130 yen, but Tokyo Electron lost 1.47 percent to 36,740 yen.

Financial shares enjoyed solid gains. Mitsubishi UFJ Financial Group rose 1.64 percent to 1,517 yen. Brokerage house Nomura Holdings added 1.13 percent to 906 yen.

Among other major shares, Toyota added 0.14 percent to 3,602 yen and Sony Group was up 0.75 percent to 12,760 yen.