PHOTO

Harshita Swaminathan- Malaysia's ringgit and equities were little changed on Thursday after its central bank held lending rates steady, while the Thai baht advanced after U.S. Fed Chair Jerome Powell's testimony revived some risk appetite. The Malaysian central bank held its overnight policy rate at 1.75%.

The ringgit was up 0.2%, while the stock market rose 0.9%. Analysts at Maybank and Barclays said the latest decision was not affecting the ringgit as it was already priced in. Brian Tan, a regional economist at Barclays Bank, however, expects a rise in interest rates in May.

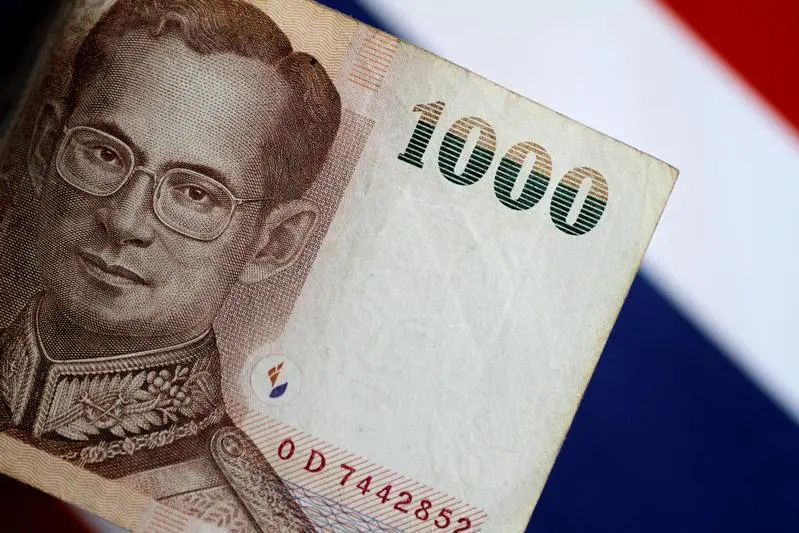

"We feel that the central bank is essentially watching COVID infection rates right now," Tan said, adding that this would be the main driver for future rate hikes as the central bank's tone on inflation too was relatively unchanged. Meanwhile, the Thai baht jumped 0.5%, boosted by a renewed mood for risky assets after the Fed's Jerome Powell said the Russia-Ukraine crisis would not likely derail their rate hiking cycle. Powell also backed a 25-basis point hike in March, effectively ruling out the prospect of the feared 50 basis points hike. As such, markets took Powell's comments as a vote of confidence in the economy, even as the prospect of higher rates supported the dollar. Mitul Kotecha, a senior EM Strategist at TD Securities, also attributed improving tourism prospects as a potential bright spot for the baht.

"Tourism is a big source of revenue for Thailand and clearly if there's talk of China starting to open the door to outbound tourism, is becomes reality in the months ahead. That bodes very well for the Thai baht," he said.

Singapore's bond yields, perceived as the region's safe-haven bonds, also rose 66 basis points to 1.878% The yuan also rose marginally as focus turned to the annual parliamentary gathering for cues on the country's economic agenda. Emerging Asian stocks in the region also resumed their upward climb after the previous day's slump, with South Korean shares at a three-week high, as its big tech names gained on the Powell testimony. Stocks in Singapore, Thailand and the Philippines also rose between 0.3% and 1.2%.

Markets in Indonesia were closed for a public holiday.

(Reporting by Harshita Swaminathan; Editing by Sam Holmes and Anil D'Silva)