PHOTO

Australian shares snapped three consecutive sessions of gains on Friday, as a contraction in U.S. manufacturing activity deepened concerns about a global economic slowdown and heavyweight local banks dropped on fears of a slowing housing market.

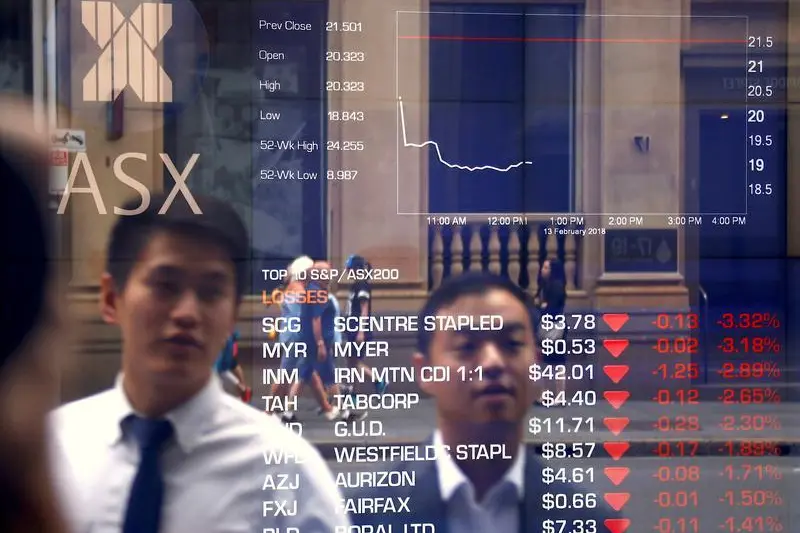

The S&P/ASX 200 index closed 0.7%, or 52.9 points, lower at 7,301.5. The benchmark rose 0.6% for the week in its second straight weekly gain.

"There are concerns getting louder about the deepening economic slowdown," said Jessica Amir, a market strategist at Saxo Markets Australia.

U.S. data released overnight showed manufacturing activity contracted for the first time in 2-1/2 years last month, evidence that the Federal Reserve's rate hikes have cooled the economy.

A key U.S. jobs report due later in the day is expected to offer further cues on the economy and pace of rate tightening.

Banks weighed the most on the Australian benchmark stock index on Friday, with the sectoral index down 1%. The country's "big four" banks fell between 0.7% and 1.4%.

Data showed total home loan commitments fell in October amid rising interest rates. Amir said the drop was steeper than expected.

Heavyweight miners fell 0.6%, with BHP Group down 1.6%.

Energy stocks were down 2.5% after oil prices dropped overnight. Santos closed 3.8% lower as a court rejected its appeal to resume drilling at a gas project following objections from a local indigenous group.

However, gold stocks were 2.4% higher after bullion prices jumped overnight on the back of a pullback in the dollar.

In corporate news, software firm Bigtincan Holdings got a A$441.9 million buyout bid from a private equity firm, and said it was in preliminary talks with other interested parties. Its shares closed 11% higher.

New Zealand's benchmark S&P/NZX 50 index fell 0.1%, or 12.71 points, to 11,641.85. (Reporting by Harshita Swaminathan; Editing by Subhranshu Sahu)