PHOTO

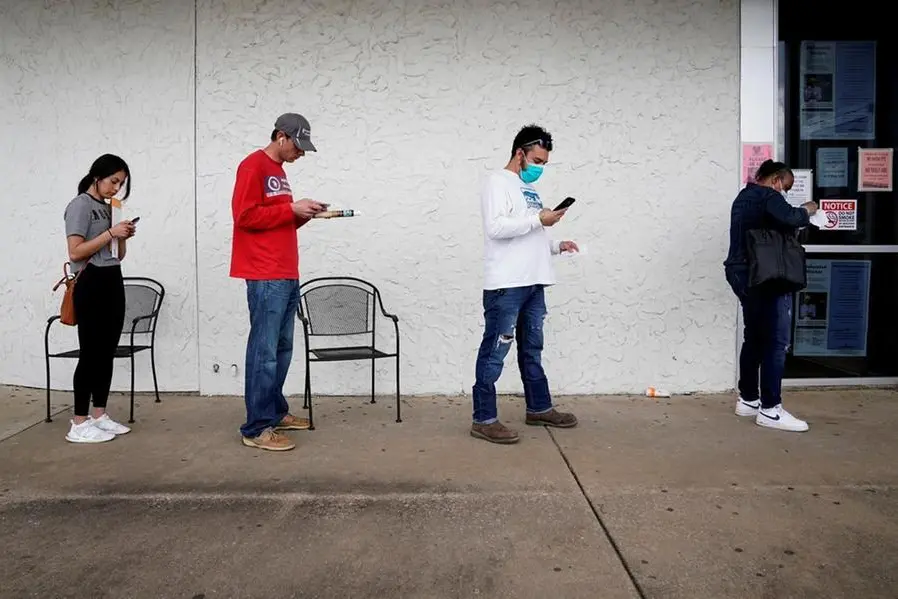

WASHINGTON- The number of Americans filing new claims for unemployment benefits fell last week, indicating a further tightening of labor market conditions heading into the second quarter, which could contribute to keeping inflation elevated.

Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 166,000 for the week ended April 2, the Labor Department said on Thursday. Economists polled by Reuters had forecast 200,000 applications for the latest week.

The government revised claims data from 2017 through 2021, and published new seasonal factors, the model that it uses to strip out seasonal fluctuations from the data. It said the methodology used to seasonally adjust the data reflected a change in the estimation of the models.

A severe shortage of workers is keeping layoffs low and boosting hiring. Worker demand is being driven by a sharp decline in COVID-19 infections, which has resulted in restrictions being lifted across the country.

There is no sign yet that the Russia-Ukraine war, which has pushed gasoline prices above $4 per gallon, has impacted the labor market. Nonfarm payrolls increased by 431,000 jobs in March, the government reported last Friday.

March marked the 11th straight month of job gains in excess of 400,000, which pushed the unemployment rate to a fresh two-year low of 3.6%. The jobless rate is just one tenth of a percentage point above its pre-pandemic level.

With a near record 11.3 million job openings on the last day of February, the scarcity of workers is forcing companies to boost wages, which is contributing to high inflation.

Minutes of the Federal Reserve's March 15-16 meeting published on Wednesday showed policymakers observed that "demand for labor continued to substantially exceed available supply across many parts of the economy," and "that various indicators pointed to a very tight labor market."

The U.S. central bank last month raised its policy interest rate by 25 basis points, the first hike in more than three years. Wednesday's minutes appeared to set the stage for hefty rate increases down the road.

(Reporting by Lucia Mutikani; Editing by Chizu Nomiyama)