PHOTO

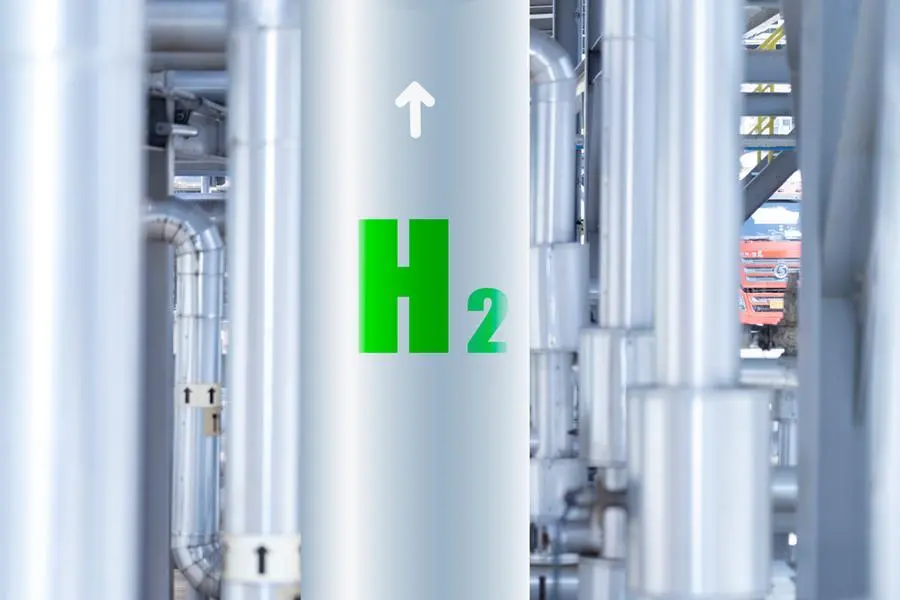

With the Sultanate of Oman moving stridently towards a green hydrogen-based low carbon energy future, the owner and operator of the country’s massive gas pipeline system, OQ Gas Networks (OQGN), is gearing up to suitably upgrade the gas grid to transport hydrogen as well.

According to top officials of OQ Gas Networks, a subsidiary of Oman’s global integrated energy group OQ, significant business and growth opportunities will be unlocked for the company when mega green hydrogen projects begin to materialise in the Sultanate of Oman in the coming years.

As the monopoly operator of the country’s roughly 4,000 km-long gas pipeline system, OQ Gas Networks is expected to play a frontline role in the delivery of hydrogen – Blue or Green – to customers distributed around the country. To this end, it has begun “testing the network for its readiness to transport hydrogen”, said Mansoor bin Ali al Abdali, Managing Director.

Speaking at an investor forum hosted by Muscat Stock Exchange (MSX) recently, he said a feasibility study for blending hydrogen into existing natural gas networks is now in its final stages. Hydrogen transportation costs would be significantly lower for repurposed pipelines compared to investments in new networks, he noted.

Initial blending efforts involving the use of hydrogen at low percentages have been “promising”, said Al Abdali, adding that the study is being expanded to pinpoint any impacts for OQ Gas Networks customers further afield. The growth of this network to support hydrogen transportation also supports the goals of Oman’s Vision 2040, he stated.

“We see big potential for business growth when it comes to hydrogen,” added Khalid al Qassabi, Vice-President Finance, OQGN. “So we are already evaluating our network to check its capabilities to accommodate hydrogen.”

Oman has ambitions to boost hydrogen production exponentially from the equivalent of 1 gigawatt (GW) of capacity in 2025 to 10 GW by 2030, rising sharply to 30 GW by 2040.

OQ Gas Networks is among a number of public sector entities that are targeted for full or partial privatisation via Initial Public Offerings (IPO) on the Omani bourse over the next several years. The company’s regulated asset base is valued at around $2.5 billion.

2022 © All right reserved for Oman Establishment for Press, Publication and Advertising (OEPPA) Provided by SyndiGate Media Inc. (Syndigate.info).