PHOTO

The expansion of Saudi Arabia’s Real Estate Investment Trust (REIT) sector is expected to accelerate as more of the Kingdom’s ongoing construction projects turn into investable assets, Sapna Jagtiani, Director & Lead Analyst, Middle East at S&P Global Ratings told Zawya Projects.

“This could include some assets/sub-projects from the giga-projects portfolio,” she said.

However, Jagtiani said that the long construction timelines mean these developments may only contribute meaningfully once they are leased and established, probably around or after 2030 for most projects.

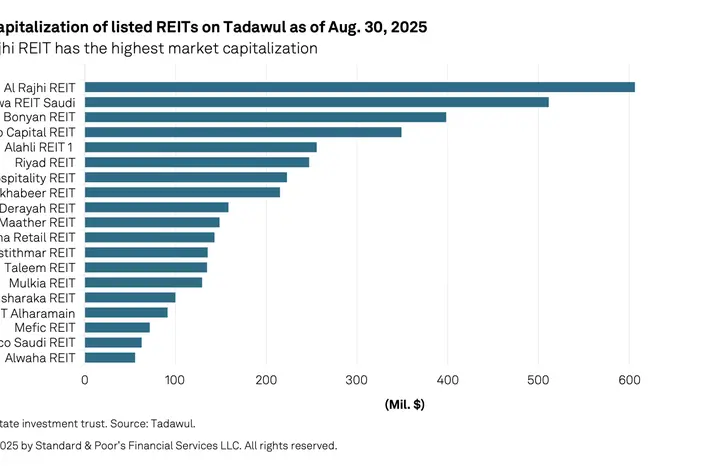

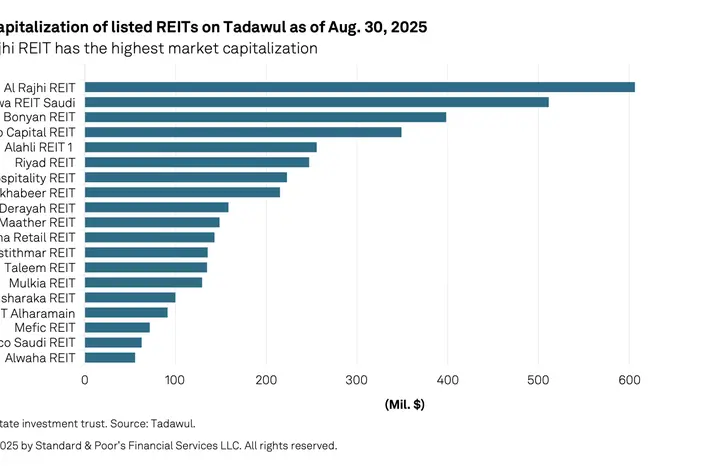

After an initial surge, new REIT listings in the Kingdom have slowed over the past five years. Currently, 19 REITs are listed on the Saudi stock exchange Tadawul.

S&P’s report, ‘Saudi REITs: A Market in the Making,’ co-authored by Jagtiani, had observed that the Kingdom’s REIT sector is relatively small, with a total market capitalisation of about $4 billion as of 30 August, 2025 and total asset base of over $7.5 billion at the end of 2024. It said the sector mainly comprises smaller operators with a median balance sheet size of nearly $368 million.

In comparison, the US, the world’s largest REIT market, had a total market capitalisation of listed REITs of about $1.2 trillion by the end of 2024. Other developed countries with well-established REIT sectors include Japan, the UK, Australia, Canada, France, and Spain.

Regulatory evolution

Jagtiani said that the regulatory framework for REITs in the Kingdom is comparable to that in developed markets.

“While companies need time to mature and adopt this framework to raise capital, the availability of strong income-generating assets will be crucial for market growth,” she stated.

In July, the Capital Market Authority (CMA), Saudi Arabia’s market regulator, approved various changes to investment fund regulations, including amendments to REIT regulations. As a result, REITs listed on Nomu-Parallel Market can now invest in real estate development projects, subject to certain limitations.

Under existing rules, Saudi REITs must invest at least 75 percent of their portfolios in income-generating assets. Investment funds, including REITs that meet the CMA’s regulatory requirements, are currently exempt from corporate tax. And, if they are profitable, REITs must distribute at least 90 percent of their net profits annually to unitholders.

Growing real estate pipeline

Opportunities remain abundant for local developers, particularly in the residential and commercial sectors, Jagtiani said.

Real estate consultancy Knight Frank expects the housing supply in the Kingdom to increase by 26 percent by 2030. The S&P report noted that the National Housing Company (NHC) intends to deliver 600,000 units by that year, with half of that expected by the end of 2025.

New commercial real estate supply in Riyadh is expected to increase by 70-80 percent by 2027, spurred by the government’s regional headquarters (RHQ) programme and a shortage of Grade A office space.

Although diversification through international assets could strengthen REIT portfolios, most Saudi REITs remain heavily domestic-focused, with roughly 90 percent of their assets based locally.

Long-term outlook

According to the S&P report, the long-term growth prospects for Saudi Arabia’s real estate market remain strong, despite significant funding needs.

“The government is investing heavily in real estate, for example, through the Public Investment Fund (PIF), and views the sector as a critical component of its diversification strategy,” the report said.

However, this growth comes with risks, including execution challenges, cost inflation, interest rate pressures, regulatory changes, and capital structure issues that could impair credit quality.

REITs can secure perpetual capital from local and international investors, attract foreign capital, and increase diversification, S&P Global Ratings credit analyst and co-author Timucin Engin wrote in the aforementioned report.

“Additionally, they can provide investors with a consistent income yield. Consequently, developing this asset class is an important priority for Saudi authorities,” he said.

(Editing by Anoop Menon) (anoop.menon@lseg.com)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.