PHOTO

China is poised to prioritise transition finance to drive investments in emission-reducing technologies and address climate change, following the dissuasion of its green financing system from funding carbon-intensive sectors.

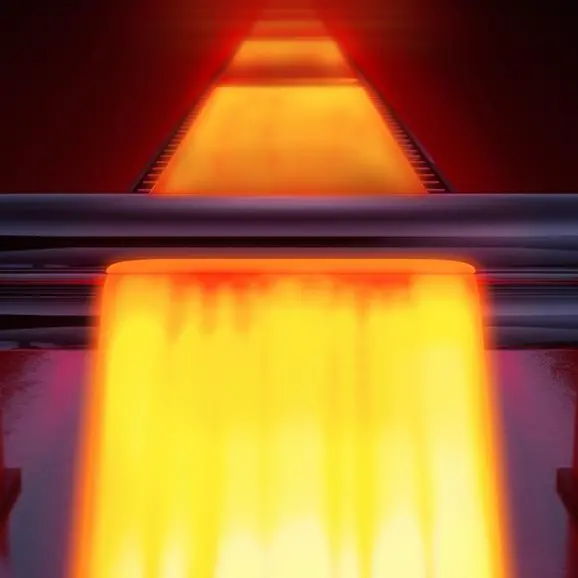

With the world’s second largest economy responsible for 27 per cent of global carbon dioxide emissions and a third of the world's greenhouse gases, the reduction of emissions in sectors such as cement, steel, and chemicals becomes crucial for China’s net-zero goals and global climate targets, according to a November 2022 World Economic Forum report. These industries are powered by coal-based electricity, which accounts for 58 per cent of China's total power generation.

A World Bank report issued in October 2022 had emphasised the indispensability of China successfully transitioning to a low-carbon economy, stating that achieving global climate goals would be impossible without it.

However, the current financial system in China discourages investments in 'difficult-to-abate' sectors, even if they are designed to bring about emission reductions. Here, transition finance could complement green financing for emission reduction in these 'brown' sectors.

Speaking at the Fifth Hongqiao International Economic Forum, Xuan Changneng, Deputy Governor of the People's Bank of China, outlined plans to enhance the connection between green finance and transition finance, applying successful practices and experiences from green finance to support transition activities, setting the stage for transition financing's future development in China.

Shifting resources

The report titled 'China Green Finance Status and Trends 2023,' authored by Dr. Christoph Nedopil and Ziying Song of the Green Finance and Development Centre at FISF Fudan University, sheds light on China's establishment of a robust green finance system while expanding support to coal-fired power.

This 'Dragon-Panda' approach, the report noted, contributed towards the increase in the share of renewable electricity from 26.3 per cent in 2015 to 31.9 per cent in 2022, but it also resulted in an increase in total CO2 emissions by 15 per cent from 2015 to 2021.

While China has removed coal-fired power plants from its 2021 Green Bond catalogue, it still includes coal-burning industrial boilers in the 'energy efficiency' category, thereby extending their lifespan, according to the report.

Additionally, China has partially increased financial support to 'brown' assets, such as a $31 billion re-lending program for clean oil.

The report stressed the importance of transition financing as an essential tool in achieving China's net-zero objectives.

Transition bonds could fund companies' green transition projects, including cleaner coal production, natural gas usage, and implementing green technologies. Similar to green bonds, transition bonds too require disclosures on the use of proceeds, third-party assessment, and certification, among others.

Companies in electricity, construction materials, steel making, non-ferrous metals, petrochemicals, chemicals, papermaking and civil aviation can issue transition bonds under rules issued by China's National Association of Financial Market Institutional Investors (NAFMII).

The report highlights that the first half of 2022 witnessed the issuance of 23 transition bonds worth $2.1 billion globally, dominated by high-emission sectors like steel, chemicals, and electricity, with China and Japan leading the way.

Of the 17 issuers, barring one, the rest are first-time issuers under the transition label.

Giving a further boost to transition bonds, the Shanghai Stock Exchange revised its guidelines for corporate bonds to include a new variety of low-carbon transition-linked bonds, the 'Belt and Road' corporate bonds.

International cooperation has further boosted transition bonds, with China and the US jointly issuing the ‘G20 Transformational Finance Framework.’ This framework guides G20 countries in formulating policies specific to transition finance, establishing transitional finance standards, disclosure requirements, and incentive mechanisms.

Furthermore, the Bank of China (HK) and S&P Dow Jones have introduced the first climate transition index, targeting the Greater Bay Area to direct capital flows towards low-carbon companies.

Despite the flurry of activities in the transition financing field, the report acknowledges its limitations. Uncertainty surrounds the transition path and its level of ambition, raising questions about whether transition financing can effectively reduce emissions in a timely manner. Moreover, there is concern about potential greenwashing disguised as transition financing.

To address these challenges, the report suggests the implementation of taxonomies based on compulsory transition timelines for specific activities. China has been working on establishing a transition taxonomy in alignment with the G20 Climate and Sustainability Working Group's (which is co-led by China) sustainable finance roadmap.

Layering markets

Transition finance operates within a multi-layered capital market and various financing channels. While green credit and green bonds dominate the field, other financial instruments such as the Green Fund, ESG fund, Sustainability Linked Bonds (SLBs), green index funds, green insurance, biodiversity finance, carbon finance, and emission trading contribute to China's mobilisation of capital for its net-zero goals.

The report noted that Green Credit, the most mature of the green instruments, had scaled to $3 trillion by the end of the third quarter of 2022, an increase of about 31 per cent compared to the previous year.

Green Fund, providing equity finance for select green industries, was established in 2020 with a capitalisation of $14 billion.

By June 2022, public and private equity funds with ESG orientation climbed to $126 billion. Sustainability Linked Bond (SLB) had its first set of seven issuers in May 2021, garnering RMB 7.3 billion.

Future trends

The report said China would prioritise economic growth while investing in high-technology products and technologies, including those in the green economy space.

Simultaneously, the country's economic policies may lead to further investments in fossil fuels for energy security reasons. Collaboration with aligned countries in the Belt Road Initiative (BRI) and non-aligned countries will shape China's policies. Green financing will gain significant prominence, with transition finance receiving priority with comprehensive disclosure requirements and supervision.

Also, there will be support for the wider application of Common Taxonomy, both domestically and internationally, while expanding the influence of the Green Investment Principles (GIP) over the Belt and Road BRI area.

(Writing by SA Kader; Editing by Anoop Menon)