PHOTO

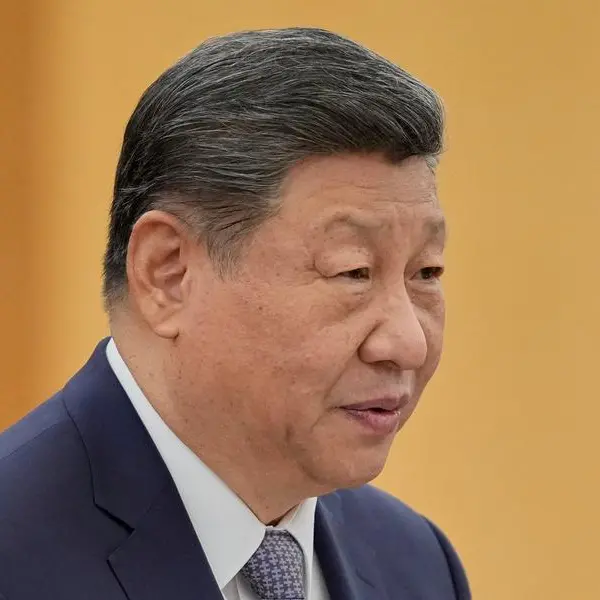

Hong Kong has entered a more “action-oriented” phase in its role as a Belt and Road Initiative (BRI) hub, as deal-making gains pace in traditional and emerging sectors, according to Hong Kong Trade Development Council (HKTDC) Deputy Executive Director Patrick Lau.

Lau told Zawya Projects that the post-pandemic recovery in international travel has transformed the city’s business forums into active platforms for transactions.

“In the last one and a half years, we have seen record high participation in our conferences. It’s not just the main forums that are packed; the spaces outside are equally lively, filled with people discussing deals and closing them,” he said.

The designated deal-making zone during the recent Belt and Road Conference remained busy throughout the two-day event.

“People are no longer just talking about opportunities; they’re acting on them,” Lau said, adding that Hong Kong is becoming a functional hub for BRI-related collaboration producing tangible results and deals.

Last month, the 10th Belt and Road Summit concluded with the signing of nine memoranda of understanding (MoUs) and 36 business-to-business (B2B) deals worth close to $1 billion.

The HKTDC executive said that deals at the annual Belt and Road summits reflect the flagship initiative’s transformation over the past 13 years, evolving from traditional connectivity infrastructure like roads and ports to smaller, socially focused ventures in sectors such as agriculture, fintech, health tech, logistics, and the digital economy.

“Society has far more needs beyond connectivity, and these are being translated into tangible business deals,” he explained. “We see them reflected at the summit, where our team facilitates meaningful matches each time the event takes place.”

Since travel restrictions were lifted in 2023, over 100 agreements have been concluded through the Belt and Road Summit and other HKTDC platforms.

“What’s most encouraging is the diversity of these deals,” said Lau. “It’s no longer just large, government-to-government projects; we’re now seeing strong participation from small and medium-sized enterprises (SMEs) and the private sector in deals that make a difference to society.”

Excerpts from the interview:

From your profile, you have been very involved in the ESG [Environmental, Social, and Governance] space. HKSAR Financial Secretary Paul Chan said during the Belt and Road Summit that Hong Kong’s 200+ SFC-approved ESG funds now manage $140 billion, up 30 percent in three years. From your perspective, what are Hong Kong’s strengths in ESG?

A key realisation has been that ESG is not only important on its own but also represents a powerful business opportunity for Hong Kong, aligning with the city’s long-standing tradition of leading in new frontier areas — whether it’s the digital economy, Web3, stablecoins, virtual assets, and even health tech and life sciences.

When it comes to ESG specifically, Hong Kong has a natural advantage as an international financial hub. The ESG journey begins with banks and investors, because they are the source of capital, and sets the tone for the broader market. Complementing this are Hong Kong’s world-class professional services - lawyers, accountants, consultants, and valuers - who play a key role in facilitating and implementing ESG strategies for businesses. The city has already achieved notable success in green finance, particularly in the issuance of green bonds, so there is a mature ecosystem and professional services to support ESG investing.

From an HKTDC perspective, we’re seeing a growing number of green and sustainability-linked deals at our summits. Interestingly, not all of these deals start as ESG-driven. Given the rising industry demand and investor preference for sustainability, we often help pivot projects in that direction.

This reflects Hong Kong’s broader role: it’s not just about providing capital; through our deal-making platforms, we also help deliver technology, ESG expertise, and talent - creating real impact beyond financing. Hong Kong has that function and HKTDC is a subset of that. Whatever noise exists elsewhere; we remain focused on advancing ESG because we believe in its long-term value.

How is HKTDC driving deeper engagement with the Gulf states and the wider Middle East region?

I would describe it as the start of a new friendship with the MENA audience. This has become increasingly evident over the past two to three years, particularly since our Chief Executive’s visit to Saudi Arabia and the UAE in 2023.

We are seeing huge interest flowing both ways. Hong Kong and mainland China businesses are very interested in the Middle East while Middle East businesses are equally interested in the opportunities here. I feel Hong Kong is the perfect hub to connect these two fast-growing regions.

I maintain close relationships with the consulates of all GCC countries here, and their feedback has been overwhelmingly positive. Hong Kong now features prominently in their global trade and investment discussions.

To give a concrete example, bilateral trade between Hong Kong and the UAE reached around USD42 billion in 2024 — a 42 percent year-on-year increase — making Hong Kong the UAE’s second-fastest-growing trade partner globally that year. In 2024, Qatar was Hong Kong’s third largest trading partner in the Middle East, accounting for 6.6 percent of the total trade with the region, while Saudi Arabia was fourth, accounting for 5.9 percent of the total trade.

Given the current geopolitical environment and emerging trends like supply chain diversification and nearshoring, how does HKTDC view these shifts? What’s your outlook?

I think the external environment is becoming very complicated. We have been facing geopolitical issues for a long time, even before the pandemic, so at HKTDC, we have always focused on turning challenges into opportunities. In times like these, diversification becomes essential and alongside that, digitalisation, ESG integration, and technology adoption. Our role is to ensure Hong Kong businesses have access to these tools and the knowledge to deploy them effectively.

In 2026, our goal would be to strengthen Hong Kong’s role as a global trade and investment hub, enabling firms — including those from the Middle East — to avail global business opportunities, while helping local businesses digitally transform, diversify, and stay competitive amid global challenges.

HKEX was the first exchange in Asia Pacific to launch a Saudi-focused ETF in November 2023 while two ETFs tracking Hong Kong-listed equities were listed on the Saudi Stock Exchange Tadawul in October last year. How is HKTDC supporting and building on this growing momentum for cross-listings between Hong Kong and the Middle East?

We are encouraging companies from other regions, including the Middle East, to dual-list in Hong Kong so that they can access a wider pool of capital. We’re already seeing momentum — most recently, a company from Kazakhstan dual-listed in Hong Kong. We believe firms from Saudi Arabia, the UAE, Kuwait, and Qatar can benefit from Hong Kong’s vibrant capital market and the growing ties between our regions.

Hong Kong has become the world’s largest IPO market, reflecting its growing financial strength in an increasingly multipolar world. Middle Eastern investors traditionally oriented towards Western markets should look at Asia and particularly China for new opportunities, with Hong Kong positioned as the ideal hub driving this two-way flow of capital and collaboration.

(Reporting by Anoop Menon; Editing by SA Kader)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.