JLL's Global Real Estate Transparency Index ties transparency to real estate investment, business activity and living standards

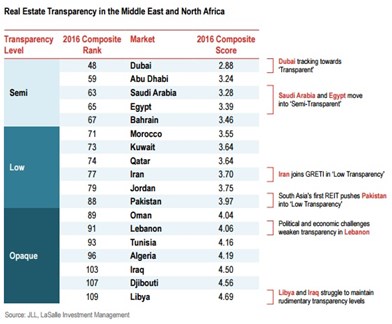

Jeddah - The Kingdom of Saudi Arabia (KSA) has moved up the rankings to finish in the 'Semi-Transparent' category for the first time in the JLL and LaSalle Investment Management's 2016 Global Real Estate Transparency Index (GRETI).

Strong advances over the past two years have seen Saudi Arabia (63rd) and Egypt (65th) move into the dynamic 'Semi-Transparent' group, which is largely dominated by large emerging markets, including the BRIC countries (Brazil, Russia, India and China) and all four of the fast-growing MIST economies (Mexico, Indonesia, South Korea and Turkey).

Dubai (48th) has retained its position as the most transparent real estate market in the Middle East and North Africa (MENA) region, with Abu Dhabi (59th) following closely behind, according to the report.

"This is very good news for Saudi Arabia," said Mr Jamil Ghaznawi, National Director and Country Head of JLL Saudi Arabia.

"Moving into this category for the first time shows the advances the Kingdom is making and is an indication of the focus the country has on strengthening corporate governance, transparency and market data."

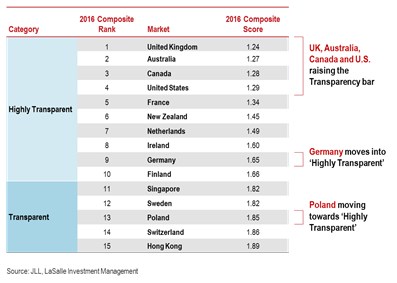

The 10 countries identified as 'Highly Transparent' by GRETI account for 75 percent of global investment into commercial real estate, highlighting the extent to which transparency drives real estate investment decisions.

A number of key factors are driving progress and frame the broader issues raised by both high and low transparency:

The World's Most Transparent Countries 2016

'Highly Transparent' group account for 75% of global direct real estate investment

· Capital allocations to real estate are growing. JLL forecasts that within the next decade in excess of US$1 trillion will be targeting the sector, compared to US$700 billion now. This growth means investors are demanding further improvements in real estate transparency, expecting standards in real estate to be on a par with other asset classes.

· There is a growing recognition that transparent real estate practices play a significant role in capital formation, municipal finance, and as a foundation to improve the quality of life in many communities. This foundation includes security of property ownership, safe housing and workplaces and the ability to trust agents to act honestly and professionally.

· Technology is both a driver of the digitisation of all kinds of real estate data and also an enabler in disseminating and analysing this data; improvements in data capture techniques are allowing a more granular and timely assessment of real estate markets.

The formation of real estate committees in the Kingdom's Chambers of Commerce has highlighted the issue of low transparency in the market and encouraged more action towards addressing the issue. As a result, there has been some mild improvement in 'open data' platforms such as registering property transactions with the Ministry of Justice which is then shared publicly on its website.

"Saudi Arabia is now positioned in a very dynamic tier, which is considered the most improved transparency group, and a category which is seeing growing middle classes mobilising against corrupt practices," added Mr. Ghaznawi.

The JLL report highlights a number of factors which will influence real estate transparency in the next several years:

· Revelations of the Panama Papers in early 2016 have led to mounting pressures for greater real estate transparency and put the fight against corruption decisively on the international political agenda.

· As new data capture techniques get adopted, the pressure mounts for real estate to raise the bar and achieve even higher levels of transparency.

· The mounting intolerance of corruption within the world's growing middle classes will force the pace of change, especially amongst the Semi-Transparent countries, and social media will help people mobilise around this issue.

· Technology will continue to advance and will allow some countries to leapfrog the traditional route to transparency; we are already seeing this happen in places like Kenya, Ghana and Ecuador.

· There will be greater emphasis on regulatory reform, but also on enforcement, particularly in semi-transparent markets where the greatest disconnect currently exists.

JLL is committed to working with Government agencies and other stakeholders to further improve the level of market data available in the real estate sector. To this end JLL has recently signed MOU's with the Chamber of Commerce & Industry in Jeddah, the Eastern Province, and Makkah to improve transparency in the real estate market.

As an independent consultant, JLL will assist the Chambers of Commerce to improve the quality and accuracy of data being collected and shared in the market by collaborating directly with major retailers and developers in both the residential and hospitality sectors, along with Government body representatives and other professionals in the market.

The JLL Global Real Estate Transparency Index is based on a combination of quantitative market data and information gathered through a survey of the global business network of JLL and LaSalle Investment Management across 109 markets in 2016, up from 102 in 2014. For more details, please visit the GRETI website

-Ends-

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. A Fortune 500 company with annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $55.3 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.

About JLL MENA

Across the Middle East, North and Sub-Saharan Africa, JLL is a leading player in the real estate market and hospitality services market. The firm has worked in 35 Middle Eastern and African countries and has advised clients on real estate, hospitality and infrastructure projects worth over US$ 1 trillion in gross development value. JLL MENA employs over 220 internationally qualified professionals embracing 30 different nationalities across its offices in Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo. Combined with the neighbouring offices in Casablanca, Istanbul, Johannesburg, Lagos and Nairobi, the firm employs more than 600 professionals and provides comprehensive services in the wider Middle East and African (MEA) region. For information, please visit our website: www.jll-mena.com

Tahliya and Andalus Streets | PO Box 2091 | Jeddah 8909 - 23326, Kingdom of Saudi Arabia tel +966 12 660 2555 www.jll-mena.com

Contact:

Lina Outri

Phone:+971 (0) 55 941 6415

Email:JLL@fourcommunications.com

© Press Release 2016