PHOTO

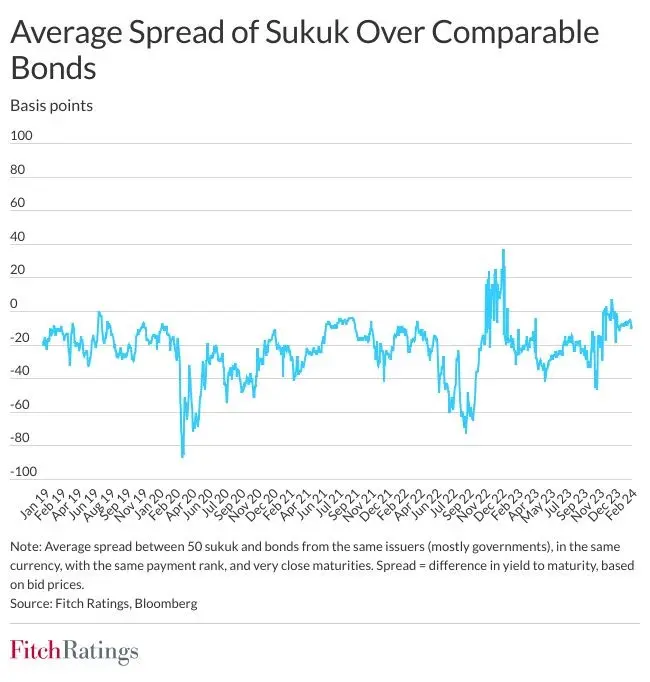

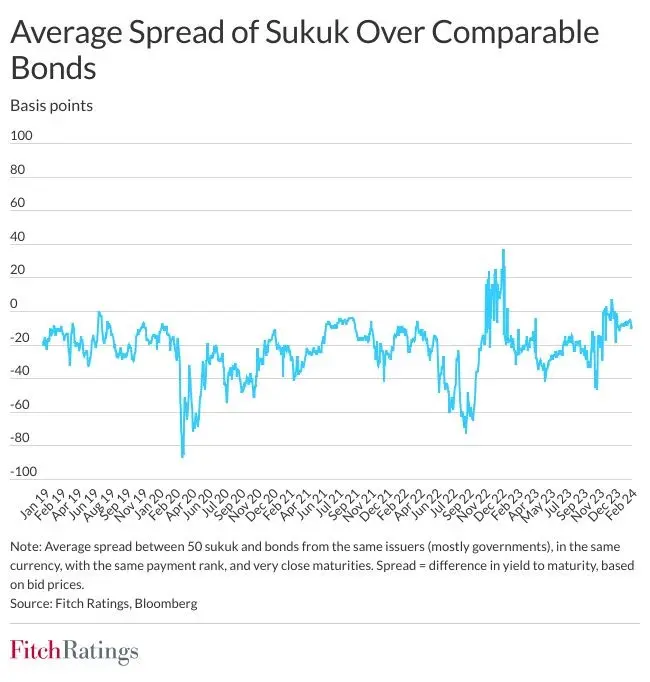

Fitch Ratings-Dubai/London: Sukuk and comparable bonds were priced at similar levels and price moves were highly correlated throughout 2023, with this trend likely to continue in 2024, Fitch Ratings says. Periods of volatility related to interest rate expectations, oil prices and geopolitics, in addition to sharia-compliance complexities for sukuk, have sometimes seen pricing correlation fall abruptly before reverting to the mean. Any developments that could alter the credit risk profile of sukuk, including sharia matters, could also affect future correlation.

Most Fitch-rated sukuk are senior unsecured obligations of the issuer and rank pari passu with other senior unsecured obligations, including bonds. We have analysed the pricing of 50 sukuk and bonds issued by the same obligors from the Gulf Cooperation Council (GCC), Indonesia and Turkiye. More than 70% of the sukuk issuance was from sovereigns. Between 2019 and until mid-Feb 2024, sukuk and bonds on average had a high pricing correlation based on yield-to-maturity of around 0.9 (out of one).

We believe these measures partly reflect investors’ perceptions of credit risk for sukuk and bonds. However, there remains a shortage of directly comparable sukuk and bonds in terms of their payment rank, issuance dates, maturity periods and currency denomination from the same issuer.

The credit profile of Fitch-rated sukuk issuers was stable in 2023, with around 80% of issuers investment grade. The share of sukuk issuers with Stable Outlooks grew to 93.6% (2022: 69.9%) while Positive Outlooks fell to 3.6% (2022: 20.6%) mainly due to the sovereign upgrades of Saudi Arabia and Oman, and resulting changes in sukuk ratings and Outlooks. Defaulted sukuk only represent 0.2% of all issued sukuk.

There have been periods when global market volatility or sukuk-specific developments have weakened the correlation between sukuk and bond yields, and temporarily widened average spreads between the two instruments. In October 2023, pricing correlation was affected due to the heightened geopolitical tension in the Middle East. Similar trends were also evident when the 2020 pandemic reduced liquidity of Islamic banks for a few months and in the aftermath of Russia’s invasion of Ukraine in 2022.

These periods of weaker correlation may be partly due to the limited secondary-market liquidity of sukuk, attributable to the buy-and-hold nature of most Islamic investors, particularly Islamic banks. Sukuk pricing could incorporate market developments more slowly than bonds, which are generally traded more actively. Moreover, sukuk supply remains much lower than demand and Fitch expects this imbalance to persist in the medium term.

Funding cost advantages of issuing sukuk or bonds for issuers varies as relative pricing can fluctuate in either direction. However, sukuk typically help issuers broaden their investor base to include Islamic banks in the GCC and other key Islamic finance markets.

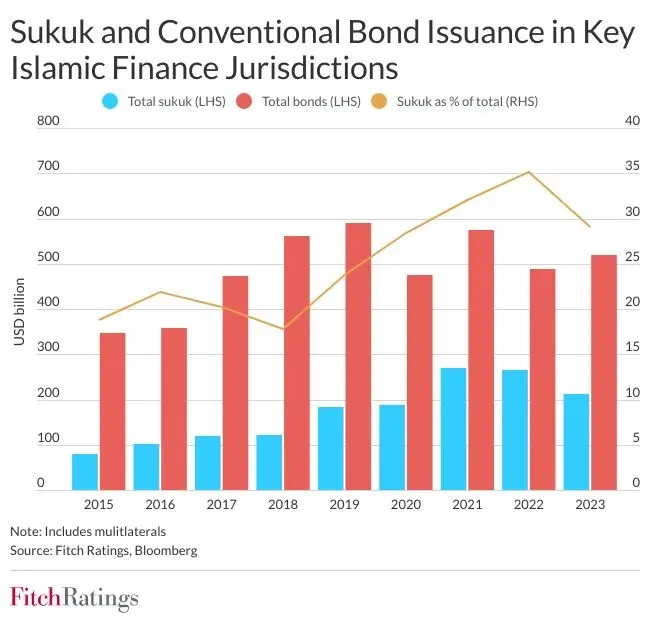

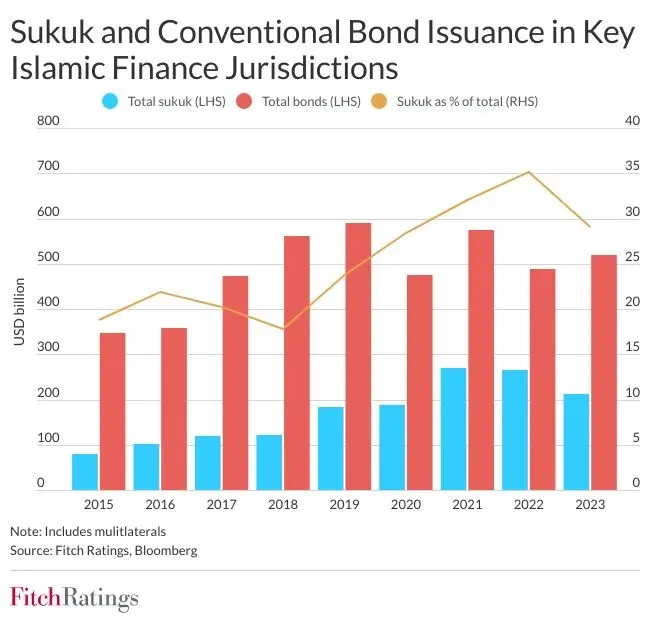

The global sukuk market maintained its growth last year, with total outstanding sukuk up 10.3% to about USD850 billion at end-2023. Sukuk are a key funding tool in the core markets of the GCC, Malaysia, Indonesia, Turkiye and Pakistan, with a 29% share of debt capital market issuance in all currencies (2022: 35%) and a 40% share in US dollars (2022: 41.6%). Fitch rates more than 70% of outstanding US dollar sukuk globally.

In 2023, a US Dollar Sukuk Market Index analysed by Fitch rose by 6.5% yoy, while a broad Emerging Markets Bond Index went up by 9.5%, and the two indexes were highly correlated at 0.92 in the same period. A MENA Sukuk Index analysed by Fitch rose 5.3%, with a MENA Bond Index being 4.9% higher.

-Ends-

The above article originally appeared as a post on the Fitch Wire credit market commentary page. The original article can be accessed at www.fitchratings.com. All opinions expressed are those of Fitch Ratings.

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating scale and rating categories, including definitions relating to default. Published ratings, criteria, and methodologies are available from this site at all times. Fitch's code of conduct, confidentiality, conflicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the Code of Conduct section of this site. Directors and shareholders’ relevant interests are available at https://www.fitchratings.com/site/regulatory. Fitch may have provided another permissible or ancillary service to the rated entity or its related third parties. Details of permissible or ancillary service(s) for which the lead analyst is based in an ESMA- or FCA-registered Fitch Ratings company (or branch of such a company) can be found on the entity summary page for this issuer on the Fitch Ratings website.