KSA: GapMaps, a cloud-based data intelligence platform used by brands to determine optimal locations for its physical stores, has released its first Fast Food and Quick Service Restaurant (QSR) Retail Network Report in Saudi Arabia for 2023. The report tracks store counts and market penetration of 15 leading QSR and Fast Food brands.

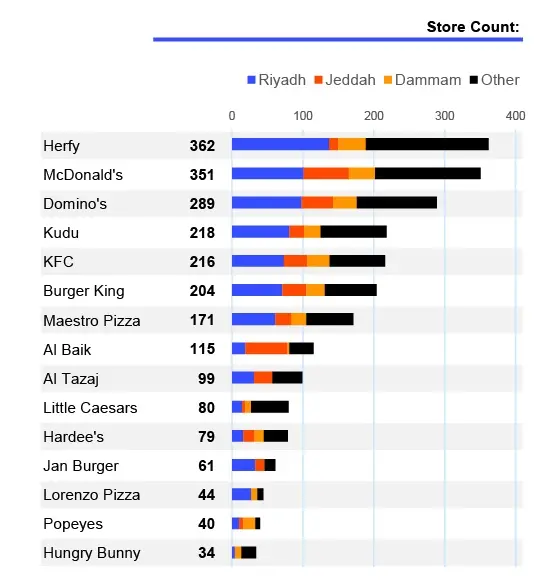

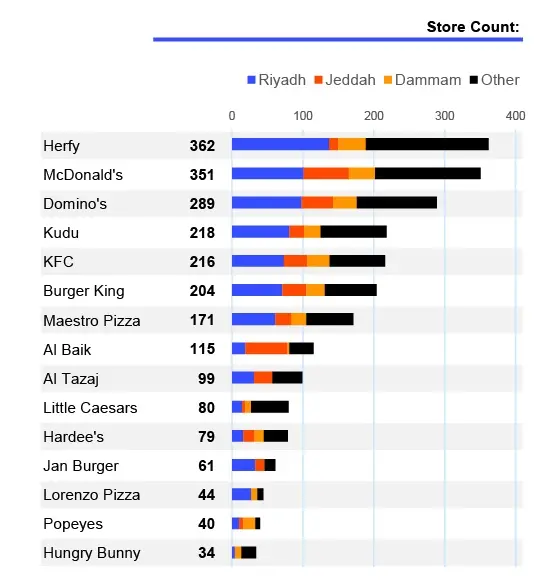

The bi-annual report monitored 15 brands in nearly 2,300 locations across Saudi Arabia, revealing that Herfy holds the most prominent store network with over 362 locations. Herfy also has at least one store in most of the cities with a population exceeding 100,000 residents. Additionally, they claim a substantial presence in the 34 cities with a population of over 500,000 residents.

“Our report offers valuable insights into the competitive landscape of the Fast-Food and QSR sector in Saudi Arabia, as brands continue to grow their networks across the country. We believe continued urban development in major cities presents ongoing opportunities for growth across the assessed brands. In addition, a number of brands are yet to fully build out their networks across major and smaller cities," said Andrew Smith, Director of Economics and Research at GapMaps.

“In order to pinpoint emerging growth opportunities, more brands in Saudi Arabia Fast Food, Fitness, Café, and Supermarket/Grocery sectors are using GapMaps Live to access the latest insights on competitor locations, resident and worker populations, household income, and other expenditure and demographic data. This provides them with the necessary information to confidently make location-based decisions,” he added.

With 351 locations throughout Saudi Arabia, McDonald's has the second-largest store network in the country, closely trailing Herfy. Other tracked brands, including Domino’s, Kudu, and Burger King also maintain sizable store networks, each with over 200 locations.

However, except for Little Caesars, the report shows that only the top five brands have established store networks in Tier 5 cities, which encompass cities with populations ranging from 50,000 to 100,000 residents. In cities with less than 50,000 residents, the store networks of the tracked brands are relatively limited. Typically, these smaller cities only have stores present if there is an additional significant driver of sales beyond its residents, such as a major passing highway, a tourist precinct, or more.

GapMaps’ first Fast Food and Quick Service Restaurant Retail Network Report for Saudi Arabia in 2023 illustrates the sector's notable growth opportunities for brands looking to expand their store networks in the region. Moreover, favourable economic climate is anticipated to accelerate this growth and open the door for more brands to emerge and thrive in the country.

To access a copy of the latest report please email subscribe@gapmaps.com or visit the GapMaps website here.

-Ends-

About GapMaps

Founded in 2013, GapMaps is an Australian built- and owned company that makes it easy for businesses to make better location decisions by integrating the latest socio demographic, economic, customer and competitor intel on one simple-to-use platform called GapMaps Live. GapMaps Live can be found in 23 countries, with more than 500 clients across Fast Food, Cafe, Health & Fitness and many other sectors using it every day to inform their network growth or optimisation strategies. GapMaps Advisory experts can also offer additional help with market planning and location intelligence strategies if needed.

For further information, please contact:

Orient Planet Group (OPG)

Email: media@orientplanet.com

Website: www.orientplanet.com