PHOTO

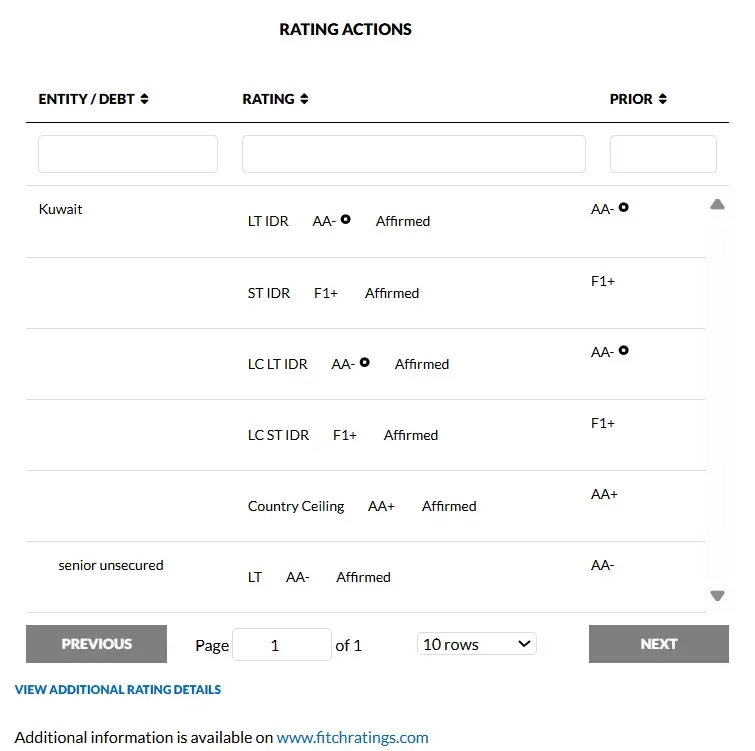

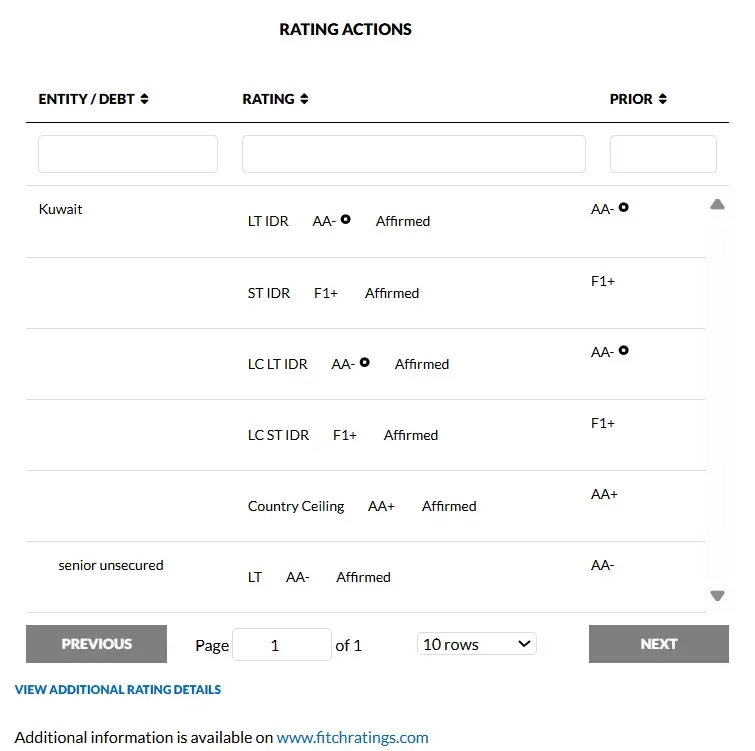

Fitch Ratings - London: Fitch Ratings has affirmed Kuwait's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'AA-' with a Stable Outlook.

A full list of rating actions is at the end of this rating action commentary.

Key Rating Drivers

Credit Fundamentals: Kuwait's 'AA-' rating is supported by its exceptionally strong fiscal and external balance sheets. The rating is constrained by Kuwait's weaker governance than peers, heavy dependence on oil, and its generous welfare system and large public sector, which could be a source of long-term fiscal pressure. Prospects remain unclear for meaningful fiscal adjustment to address long-term challenges and legislation to allow debt issuance and improve fiscal financing flexibility, although there are emerging signs of progress.

Exceptionally Strong External Assets: Kuwait's external balance sheet remains the strongest of all Fitch-rated sovereigns. We forecast its sovereign net foreign assets will rise to 601% of GDP in 2025, from an estimated 582% of GDP in 2024, more than 10x the 'AA' median. The bulk of the assets are held in the Future Generations Fund managed by the Kuwait Investment Authority (KIA), which also manages the assets of the General Reserve Fund (GRF), the government's treasury account.

Reform Efforts Pick Up: The recently-appointed government has initiated reforms aimed at reducing reliance on oil revenue, improve government efficiency, and rationalise spending, capping it at KWD24.5 billion (about 51% of GDP). These goals mirror those of previous administrations that were hindered by parliamentary gridlock, an obstacle that was removed in May 2024 when the Amir dissolved parliament. The government has introduced a 15% domestic minimum top-up tax (DMTT) on multinational companies, effective from 1 January 2025, in line with OECD Pillar 2 requirements. Political deadlock between Kuwait's parliament and previous administrations had contributed to delays in this initiative.

The government anticipates that the DMTT will generate about 0.5% of GDP (KWD250 million) annually, with collections expected to commence by 2027. There are plans to introduce the long-delayed excise tax in the fiscal year ending March 2026 (FY25), although further delays are possible. Fitch views the pick-up in reform efforts as positive. However, a significant overhaul of generous public wages and welfare spending (79% of total expenditure; 40% of GDP) is unlikely in the short term, given the state's deep-rooted generosity towards Kuwaiti citizens and still favourable oil prices.

Liquidity Law Advancing, Timeline Uncertain: The government aims to pass a liquidity/debt law, a goal that previous governments also pursued. The draft law is under discussion with the Council of Ministers, but the implementation timeline remains uncertain. Enacting this law would enable Kuwait to raise new debt, following the expiry of the previous debt law in 2017. Our forecasts assume that a liquidity law will be passed in FY25, although delays are possible. Even without a liquidity law, the government would still be able to meet its financing obligations in the coming years, given the substantial assets at its disposal.

Budget Position to Deteriorate: Fitch expects the budget position to deteriorate in FY25, despite spending rationalisation efforts. The 2025/26 budget proposes expenditure of KWD24.5 billion, broadly unchanged from FY24, with wage increases offset by cuts in subsidies, capex and other expenses. We expect expenditure to remain high but on track, largely reflecting continued capex under-execution. Revenue will continue to decline due to oil revenue loss from lower oil prices, exacerbated by OPEC+'s delay in unwinding oil production quotas. Assuming that OPEC+ decides to unwind quotas from 2Q25, we expect this to mitigate oil revenue loss.

We expect non-oil revenue to grow modestly in FY25, but to fall short of the government's target of KWD2.9 billion (6% of GDP) despite reform efforts. Underperformance in non-oil revenue continued in 10MFY24, which we estimate at 29% below target on a pro rata basis. Under the government's convention, which excludes investment income, we expect the budget deficit to widen to 10% of GDP in FY25 (from about 5% in FY24) and 10.8% in FY26. Under Fitch's convention, which includes its own estimates of KIA's investment interest income not included in official data, we project a surplus of 4.9% of GDP in FY25 (from 6% in FY24) and 4% of GDP in FY26.

Continued Reliant on GRF Financing: Our FY25 forecast assumes that the government will resume borrowing, which will finance about 30% of the deficit. This follows our FY24 assumptions where the government continued to rely on GRF's assets to cover its budget deficit and meet domestic maturities.

Oil Assumptions: We forecast Kuwait's average oil price at USD69.4/bbl for FY25, down 12% from FY24, and a rise in crude oil output to 2.495mmbbl/d as OPEC+ eases constraints. Under this scenario, we anticipate a nearly 4% rise in oil production in FY25 compared with FY24. We estimate Kuwait's fiscal break-even oil price (including investment income) at USD58/bbl in FY25-FY26, with the non-oil primary deficit at 70% of non-oil GDP, significantly worse than regional peers.

Low Government Debt: Gross government debt/GDP remains low, at an estimated 2.9% in FY24. Assuming the passage of a liquidity law in FY25, along with projected deficits and lower oil prices, we forecast government debt/GDP will rise to 6% in FY25 and 9.2% in FY26, despite a USD4.5 billion Eurobond maturing in March 2027. Nonetheless, we expect debt levels to remain well below the projected 2026 'AA' median of 51% of GDP.

Regional Stability Risks, Oil Dependence: Ongoing conflicts in the Middle East and disruptions to Red Sea shipping have had a minimal impact on Kuwait, which has large government assets that provide an important buffer to support the economy if tensions were to escalate. However, hydrocarbon dependence weighs on Kuwait's rating, rendering budgetary outcomes highly sensitive to oil prices. A USD10/bbl change in our oil price assumption for 2025 would affect the budget balance by about 4% of GDP, all else being equal. A change of 100,000bbl a day of production affects the budget by 1.4% of GDP.

Governance Challenges: While the dissolution of parliament has eased gridlock, it could also negatively affect voice and accountability. Uncertainties over the implementation of a transparent and sustainable financing strategy weigh on the rating.

ESG - Governance: Kuwait has an ESG Relevance Score (RS) of '5[+]' for Political Stability and Rights and the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Kuwait has a medium WBGI ranking at 54, reflecting low scores for voice and accountability, and middling scores across other governance indicators.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

-Structural Features/Public Finances: Signs of sustained pressure on GRF liquidity, for example, due to the continued absence of a new liquidity law and of alternative measures to ensure that the government can continue to make good on its payment obligations, including but not limited to debt service.

-Public and External Finance: Significant deterioration in fiscal and external positions, for example, due to a sustained period of low oil prices or an inability to address structural drains on public finances.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

-Structural Features/Public Finances: Strong evidence that Kuwait's institutions and political system can tackle long-term fiscal challenges, for example, through actions to implement a deficit reduction resilient to lower oil prices and adopt a transparent and sustainable government funding strategy.

Sovereign Rating Model (SRM) and Qualitative Overlay (QO)

Fitch's proprietary SRM assigns Kuwait a score equivalent to a rating of 'AA+' on the Long-Term Foreign-Currency (LT FC) IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM to arrive at the final LT FC IDR by applying its QO, relative to SRM data and output, as follows:

- Structural: -1 notch, to reflect continued lack of meaningful progress in enacting key economic reforms and addressing structural fiscal challenges stemming from heavy oil dependence, a generous welfare state and a large public sector, and adopting a transparent and sustainable financing strategy.

- Public Finances: -1 notch, to reflect our expectation of continued budget deficits (excluding investment income) and rising debt that are subject to risk from a sustained period of lower oil prices, notwithstanding large government assets that provide an important buffer.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

Country Ceiling

The Country Ceiling for Kuwait is 'AA+', two notches above the LT FC IDR. This reflects strong constraints and incentives, relative to the IDR, against capital or exchange controls being imposed that would prevent or significantly impede the private sector from converting LC into FC, and transferring the proceeds to non-resident creditors to service debt payments.

Fitch's Country Ceiling Model produced a starting point uplift of two notches above the IDR. Fitch's rating committee did not apply a qualitative adjustment to the model result.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

The following limitations were identified and addressed:

KIA's assets are not officially reported by the government.

Fitch estimates these assets by compounding the government's transfers into the KIA, using assumptions about returns and asset allocations that are informed by discussions with the KIA. Fitch benchmarks government transfers into the KIA and KIA investment income against the balance of payments.

The data used was deemed sufficient for Fitch's rating purposes because it expects that the margin of error related to the estimates would not be material to the rating analysis.

ESG Considerations

Kuwait has an ESG Relevance Score of '5[+]' for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Kuwait has a percentile rank above 50 for the respective Governance Indicator, this has a positive impact on the credit profile.

Kuwait has an ESG Relevance Score of '5[+]' for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Kuwait has a percentile rank above 50 for the respective Governance Indicators, this has a positive impact on the credit profile.

Kuwait has an ESG Relevance Score of '4' for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver. As Kuwait has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Kuwait has an ESG Relevance Score of '4[+]' for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver for Kuwait, as for all sovereigns. As Kuwait has a track record of 20+ years without a restructuring of public debt and captured in our SRM variable, this has a positive impact on the credit profile.

The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3' means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores.

VIEW ADDITIONAL RATING DETAILS

Additional information is available on www.fitchratings.com