PHOTO

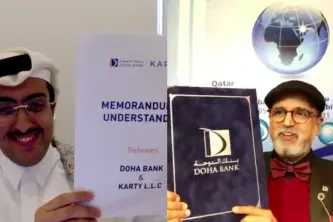

Doha, Qatar: KARTY – QFTH Startup, a tailored financial services provider from Doha, Qatar, announced signing a strategic partnership agreement with Visa, and a Memorandum of Understanding with Doha Bank . The partnership with Visa is part the FinTech fast-track program in the Central and Eastern Europe, Middle East, and Africa (CEMEA) region by Visa, the world's leader in digital payments. Meanwhile, the MoU with Doha Bank paves the way to providing content and services to the Qatari community.

Hosted by Qatar FinTech Hub (QFTH), a QDB Incubator, the Virtual Partnership Signing Ceremony began with a welcoming speech by Mr Mohammed El-Gaili Suleiman, Co-Founder of KARTY, followed by the strategic partnership announcement between KARTY and Visa. Subsequently, a fireside chat panel was conducted and moderated by Mr. Hasan Askari, Director of Financial Services Advisory, Africa, India, Middle East – Ernst and Young, in relation to the importance of FinTech industries and how it will help the Qatari market and consumers to harness the power of digital financial services for a better life experience. The event concluded with the MoU signing between KARTY and Doha Bank.

“QDB and QFTH believe in the power of partnerships. This is why, as part of our commitment to offering world-class expertise and opportunities to startups, QFTH has collaborated and cooperated with key stakeholders in the FinTech ecosystem and supportive corporations such as Visa and Doha Bank to ensure FinTechs have access to the broader financial community. SMEs are a primary component of a liberal and stable economy, and today, we applaud our joint efforts to make this plan materialize,” said Abdulrahman Hesham Al-Sowaidi, Acting CEO of QDB.

The agreement is considered a major milestone for KARTY as they launch their payment solution platform and attempt to scale their business to become the leading lifestyle payments app in the region.

“Alex McCrea, Vice President and Head of Digital Partnerships & Ventures in CEMEA at Visa, said: “Visa is committed to partnering with and supporting the next generation of payment innovators. We are delighted to welcome KARTY to Visa’s Fintech Fast Track program and launch next generation customer experiences powered by Visa credentials and Visa Developer APIs.”

During the Virtual ceremony, Doha Bank, one of the largest commercial banks in Qatar, signed a Memorandum of Understating with KARTY to provide straightforward, digestible content suitable for all ages and languages related to money management, financial crimes, and other topics that people may find interesting or valuable in their everyday lives.

“KARTY has earned its name and place among one of the region’s most promising fintech startups, and more importantly, as a homegrown player with deep insight into the local financial market’s needs and gaps. We are proud to be joining forces with such a promising startup and like-minded partner to drive a sector-level transition and consumer behavioral shift towards a financially inclusive, digital economy in Qatar" said Raghavan Seetharaman, CEO of Doha Bank.

KARTY is a QFTH FinTech which has graduated from Wave 2 of the Incubator and Accelerator Programs. The company’s digital solution will enable users to spend, save, and manage their finances in one app by providing complete financial visibility loaded with multiple features. The comprehensive suite of swift and safe FinTech services will cater for all financial transactions without the need to visit branches or have any in-person interaction.

During the event, Mohammed El-Gaili Suleiman, Co-Founder of KARTY, elaborated on the services offered by KARTY and expressed his excitement about the partnership and MoU. “We are thrilled to be here today to celebrate this huge milestone. I would like to thank QDB and QFTH as well as Doha Bank and Visa for their confidence in our ability to bring unique financial services to the market. We are eager to work together and launch our services in Qatar, and to follow with all GCC countries and the Middle East region.”

QFTH was launched by Qatar Development Bank (QDB), with the support of Qatar Central Bank (QCB), to advance and enhance innovation in the financial sector. Since its inception, QFTH has been QDB’s arm in supporting the local FinTech sector, nurturing Qatari entrepreneurs, and growing this important industry field.

About KARTY:

Founded in 2021, by two co-founders Mohammed Suleiman & Abdulaziz Al-Marri. KARTY is a Qatar FinTech Hub Incubator, part of the Wave 2 of the QFTH Incubator and Accelerator Programs. It is a financial hub where users SPEND, SAVE, MANAGE their finances in one app—providing complete financial visibility loaded with multiple features, enabling a lifestyle where our customers get the best of everything they do. In addition, the partnership will facilitate an expedited launch to market before the FIFA World Cup 2022. KARTY was the finalist in Qatar National Entrepreneurship Competition (Al-Fikra) organized by Qatar Development Bank. It won the first place in Qatar Science & Technology Park Accelerator program (XLR8). In addition to being one of the winners of Digital Incubation Center Idea Camp 2021, and Won Qatar FinTech Hub Hackathon and offered fast-track into the incubation program.

About Doha Bank:

Doha Bank is the largest private commercial bank in the State of Qatar.Through innovative technologies and the ingenuity of its people, Doha Bank provides individuals and commercial, corporate, and institutional clients across Qatar and even internationally, new and better ways to manage their financial lives. It was incorporated in 1978 and commenced its domestic and international banking services in Doha, Qatar on March 15, 1979. As one of Qatar’s leading financial services companies, Doha Bank is committed to making banking work for customers and clients like it never have before. DB aims to be recognized as a dynamic, modern bank with enduring age-old values. The bank has achieved very impressive results in over two decades of its history. This has been a combined result of the management’s foresight, employee dedication, and tremendous customer response.

About Visa:

Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable, and secure payment network - enabling individuals, businesses, and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network, and scale to reshape the future of commerce. For more information, visit About Visa, https://usa.visa.com/visa-everywhere/blog.html, and @VisaNews.

About QFTH:

QFTH was established by Qatar Development Bank (QDB) and key stakeholders in the country in line with the Qatar National Vision (QNV) 2030 and Qatar Central Bank’s (QCB) FinTech Strategy to advance and enhance financial innovation. As part of its commitment to offering world-class expertise and opportunities to startups and scaleups, QFTH is collaborating and cooperating with the key stakeholders in the FinTech ecosystem and large corporations such as Visa, Microsoft, Amazon, ProgressSoft, and Vodafone. Qatar FinTech Hub invested in KARTY during their participation in the Incubator and Accelerator program with an estimated $100K of in-kind support and funding.

Since its establishment, less than 2 years ago, QFTH, as a QDB Incubator, has enriched the local FinTech ecosystem, spurring Qatar’s growth in this field and contributing to the achievement of the QCB FinTech Strategy. The Hub has seen many of its FinTechs achieve notable successes in the region and across the world. Local companies have already started enriching the local market by providing B2B services and B2C ones too (My Book Qatar, Active.ai, CrowdToLive), while international ones have increased Qatar’s share in the FinTech global market (Nium).

© Press Release 2022

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.