PHOTO

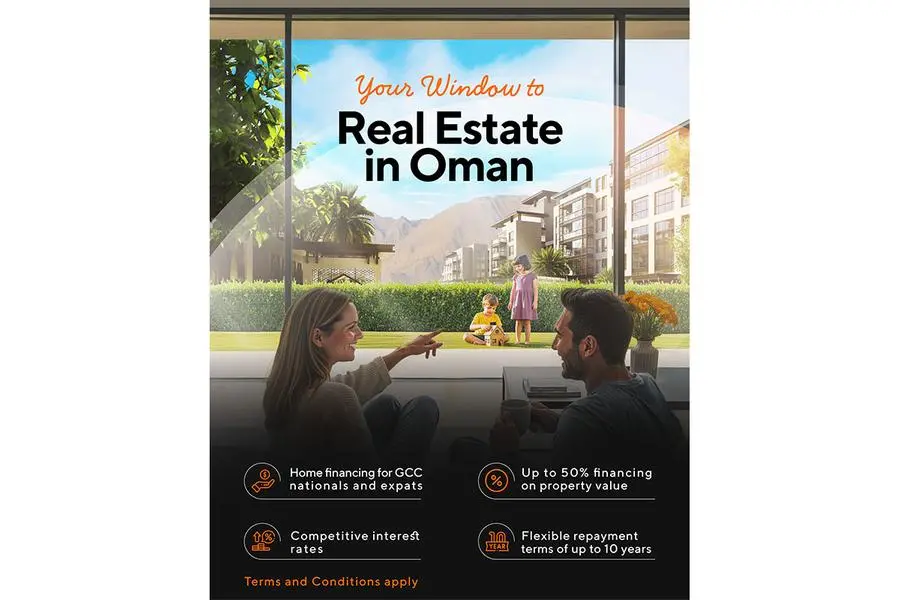

Muscat: In line with its commitment to providing affordable and accessible financial solutions, Sohar International and its Islamic banking Window – Sohar Islamic are pleased to announce a new Housing Finance product. This initiative is designed to facilitate home ownership and investment opportunities in Oman, making it easier for expatriates whether purchasing a house to live in or as an investment to achieve their goals with confidence.

The product extends housing finance services to GCC nationals and expatriates, both residents and non-residents, looking to invest in properties within Integrated Tourism Complexes (ITCs). Offering financing of up to 50% of the property, the new loan product ensures customers have access to practical, tailored solutions for purchasing completed or off-plan units in Ministry-approved ITC projects.

With affordability and flexibility at its core, the product provides financing of up to OMR 250,000 with a tenor of up to 10 years, including a grace period of 18 months for under-construction properties. Eligible applicants can choose between Conventional or Shariah-compliant Islamic financing, while also benefiting from a complementary credit card facility of up to USD 10,000 during the construction phase, adding further convenience and support.

Commenting on the launch, Abdulwahid Mohamed Al Murshidi, Chief Executive Officer of Sohar International said: "This product reflects our ongoing commitment to supporting both residents and investors by making home financing in Oman more accessible and affordable. We are here to facilitate and empower customers, ensuring they can invest with confidence in the country’s dynamic real estate sector. Importantly, this initiative is also in line with Oman Vision 2040, which emphasizes economic diversification, sustainable growth, and an attractive investment climate. By enabling more individuals to invest in housing and real estate, we are contributing to national development and helping drive long-term economic prosperity for the Sultanate."

This launch underscores the bank’s strategy to enhance financial inclusion, strengthen its housing finance portfolio, and contribute to Oman’s broader economic growth by offering customers a diverse and flexible range of financial solutions. As an active contributor to the nation’s development, this product is poised to encourage and attract investments in line with the economic diversification mandate of the 2040 vision, thereby accelerating economic growth and sustainability in Oman.

About Sohar International:

Sohar International is Oman’s fastest-growing bank, guided by a clear vision to become a world-leading Omani service company that helps customers, communities, and people prosper and grow. With a purpose to help people ‘win’ by delivering responsive banking for their ever-changing world, the bank offers innovative solutions across Commercial and Investment Banking, Wealth Management, Islamic Banking, and more. Operating with a strong digital-first approach and an expanding regional footprint including presence in the Kingdom of Saudi Arabia—Sohar International is committed to driving value through strategic partnerships and a dynamic customer experience. Learn more at www.SIB.om