- FY 2021 revenue increased 6.9% to SAR 921.2 million compared to FY 2020 revenue of SAR 861.6 million excluding accounting construction revenue

- Net income decreased to SAR 57.9 million for FY 2021, reflecting one-off costs and reduced contribution from RSGT following partial strategic divestment

- Excluding the impact of one-off items, 12-month adjusted net income decreased by 2.3% year-on-year

Jeddah, Saudi Arabia: Saudi Industrial Services Company (“SISCO”, the “Company” or the “Group”), Saudi Arabia’s leading strategic investor in ports and terminals, logistics parks and services, and water solutions, has announced its financial results for the year ended 31 December 2021.

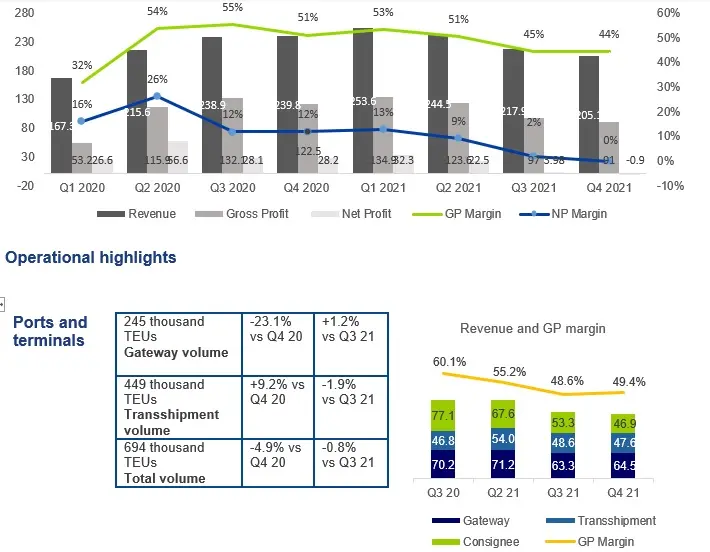

Full year revenue, excluding accounting construction revenue, increased by 6.9% year-on-year to SAR 921.2 million (compared to FY 2020 adjusted revenue of SAR 861.6 million) driven by strong performance in the ports and logistics segments. Revenue for Q4 2021 decreased by 14.5% to SAR 205.1 million compared to Q4 2020, due to pressure on gateway volumes across the Kingdom resulting from global logistics headwinds. Despite this, the ports segment increased its market share of gateway volumes in Jeddah Islamic Port and the Western Region.

Gross profit for FY 2021 increased by 5.4% to SAR 446.5 million, predominantly driven by revenue growth in the ports and logistics segment. Gross margins declined by 0.7% due to an increase in direct costs and a reduction in gateway volumes during the second half of 2021. Q4 2021 gross profit decreased by 25.7% from Q4 2020 mainly due to the decline in the ports business gross profit

Reported net income for the full year period decreased by 58.5% to SAR 57.9 million due to the impact of one-off items in 2021 of SAR 7.1 million and net income in 2020 included one-offs amounting to SAR 72.9 million. Excluding the impact of one-off items, 2021 adjusted net income was SAR 64.9 million which is broadly in line with 2020 adjusted net income SAR 66.5 million. Additionally, SISCO’s share of RSGT net income reduced from 60.6% to 36.36% during the period following the divestment of its direct equity stake.

Reported net income for Q4 2021 decreased to a loss of SAR 0.9 million compared to profit of SAR 28.1 million in Q4 2020, mainly due to the decline in margins as a result of lower gateway volumes in the ports segment, and a number of one-off items amounting to a net adjustment of SAR 6.5 million in Q4 2021. Adjusted Q4 2021 net income stood at SAR 5.6 million compared to SAR 20.1 million in Q4 2020.

Total shareholders’ equity increased to SAR 1,486 million as at 31 December 2021, from SAR 1,174 million for 2020.

Adjusted earnings per share for the full year period stood at SAR 0.80 as compared to SAR 0.81 for the same period in the prior year.

Mohammed Al-Mudarres, Chief Executive Officer at SISCO, said:

“On an adjusted basis, SISCO delivered strong top and bottom-line results in 2021, driven by market share growth in Jeddah Islamic Port for both gateway and transshipment volumes, and healthy performance in the logistics and water segments. In the fourth quarter, while revenue for the majority of our portfolio remained stable, our ports segment continued to be impacted by the weak container shipping market and global supply chain challenges.

In the second half of 2021, we announced our new growth strategy which aims to double SISCO’s revenues and improve margins over the next five years, by expanding logistics services with an emphasis on an asset light model, growing the ports segment beyond Saudi Arabia and driving the full potential of the existing portfolio. We are making good progress with the execution of this strategy and are optimizing our portfolio to deliver synergies with our existing logistics services division, fully in line with our strategy to expand our presence in this sector.

We plan to soon announce our dividend for the year along with our updated dividend policy for 2022-2024, which will demonstrate our ability and focus on generating long-term value for our shareholders built upon our robust cashflow position.”

Outlook and Strategy

SISCO continues to make progress on the implementation of its recently updated five-year strategy for growth, which aims to leverage existing capabilities in its core segments to invest in assets with a significant opportunity to be scaled-up and accelerate the returns timeline for SISCO and its shareholders. Key milestones during the year, in support of delivering on the strategy, including the part divestment of the Group’s direct equity stake in RSGT, ramp-up in logistics capacity expansion by subsidiary LogiPoint, and an important independent sewage water treatment plant win by Tawzea.

Financial performance highlights

- Total revenue, excluding accounting construction revenue, of SAR 205.1 million for Q4 2021, decreasing by 14.5% from Q4 2020, due to lower gateway volumes recorded by the ports segment. Full year revenue grew by 6.9% year-on-year, excluding accounting construction revenue.

- Q4 2021 gross profit of SAR 91.0 million decreased by 25.7% compared to Q4 2020. Full year gross profit increased by 5.4% to SAR 446.5 million.

- Net income decreased by 103% in Q4 2021 and 58.5% in FY 2021 as a result of margin contraction in the current year and the impact of the one-offs in the current and prior year. Excluding the impact of one-off items, adjusted net income decreased by 2.3% in FY 2021 compared to FY 2020 and decreased by 72.0% in Q4 2021 compared to Q4 2020.

- Total assets reached SAR 4,995 million as at 31 December 2021.

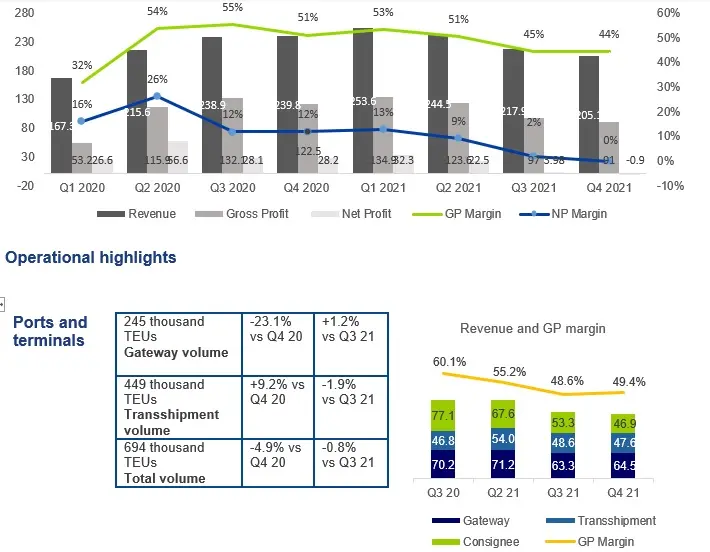

Ports and terminals delivered robust performance with revenue increasing 5.8% to SAR 724 million in 2021 compared to the previous year, driven by strong volume growth and an increase in tariffs. Despite increases in transshipment volumes, fourth quarter revenue was impacted by the global container shortage and supply chain constraints which led to Q4 2021 revenue declining 18.7% compared to the same period in the previous year. Subsidiary RSGT’s entire planned recruitment in 2020 was delayed to Q2 2021, due to a hiring freeze, leading to unusually high staff costs in the second half of the year.

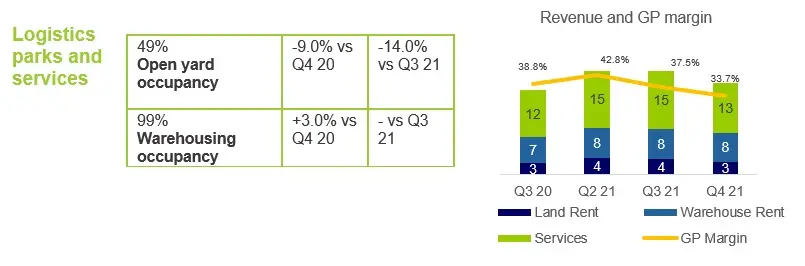

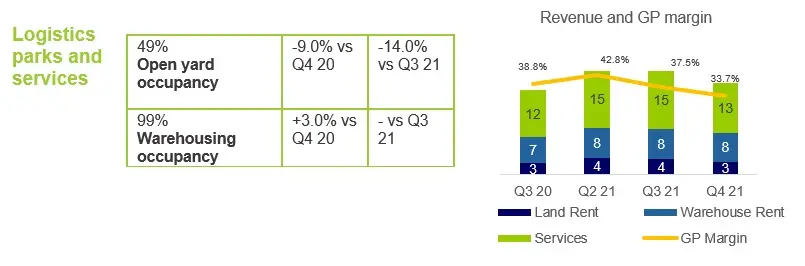

Logistics parks and services delivered revenues of SAR 100 million in 2021, up 18.7% compared to the previous year, as warehouse capacity was fully utilized in the first half. In Q4 2021 warehouse utilization remained healthy, but open yard –occupancy was impacted by the global container shortage, impacting margins for the period. Q4 2021 revenue declined 4.7% compared to the same period in the previous year.

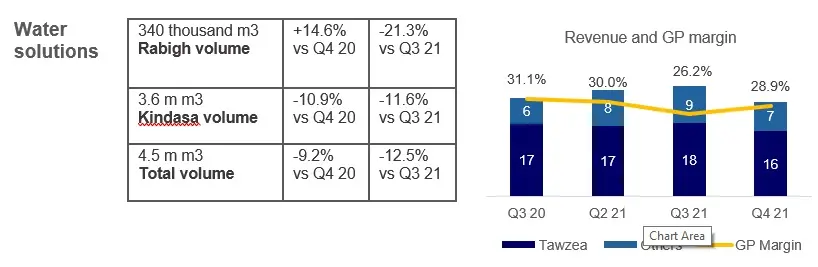

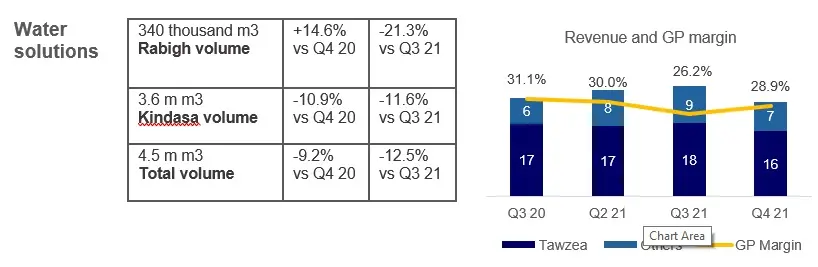

Water solutions’ performance was broadly stable during the year. Revenues for 2021 were SAR 97.4 million in 2021 compared to 93.0 million in 2020. Fourth quarter revenues were largely flat compared to the same period in the previous year due to lower volumes.

-Ends-

About SISCO

Saudi Industrial Services Company (“SISCO”) is an investment holding company with a diversified portfolio of unique assets spanning ports, industrial parks and services, and water solutions. The Company was established in 1988 and is the first private sector developer of a bonded re-export zone in Saudi Arabia. SISCO’s portfolio includes 6 subsidiaries/ associates, supported by a team of more than 3,000 employees. SISCO provides strategic support to portfolio companies with a clear and long-term investment philosophy to unlock growth opportunities.

Contact

Investor relations

E: ir@sisco.com.sa

Media

E: rahul.ravisankar@teneo.com

Analyst call and earnings presentation

SISCO will be hosting an analyst call on the Company’s full year 2021 results on 9th March 2022 at 2:00 Pm Saudi time. For conference call details, please email ir@sisco.com.sa. The earnings presentation will be hosted on the company website in due course: http://www.sisco.com.sa/poverview.php

Disclaimer

This communication has been prepared by Saudi Industrial Services Company (“SISCO”) and reflects the management’s current expectations or strategy concerning future events that are subject to known and unknown risks and uncertainties. Some of the statements in this communication constitute "forward-looking statements” that do not directly or exclusively relate to historical facts. These forward-looking statements reflect SISCO’s current intentions, plan, expectations, assumptions, and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside SISCO’s control.

Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. SISCO undertakes no obligation to revise any such forward-looking statements to reflect any changes to its expectations or any change in circumstances, events, strategy or plans. Because actual results could differ materially from SISCO’s current intentions, plans, expectations, assumptions and beliefs about the future, you are urged to view all forward-looking statements contained in this presentation with due care and caution and seek independent advice when evaluating investment decisions concerning SISCO.

No representation or warranty, express or implied, is made or given by or on behalf of SISCO or any of its respective members, directors, officers or employees or any other person as to the accuracy, completeness or fairness of the information or opinions contained in or discussed in this communication. This communication does not constitute an offer or invitation to purchase any shares or other securities in the Company and neither it nor any part of it shall form the basis of, or be relied upon in connection with, any contact or commitment whatsoever.