PHOTO

Riyadh, Kingdom of Saudi Arabia: Witnessed by His Royal Highness Prince Abdulaziz bin Salman, Saudi Minister of Energy, Acwa, the world’s largest private water desalination company, a leader in energy transition and first mover into green hydrogen, and Gulf Investment Corporation (GIC), today announced the signing of the Energy Conversion and Water Purchase Agreement (ECWPA) for the Az-Zour North Phase 2 & 3 Independent Water and Power Producer (IWPP) project in southern Kuwait for a period of 25 years, with the Ministry of Electricity, Water and Renewable Energy (MEWRE) of the State of Kuwait. The agreement marks a major project milestone and formally enables the development of one of Kuwait’s largest integrated power and water plants.

Mohammad Abunayyan, Chairman of Acwa, stated: “The signing of this agreement is a major step in strengthening Kuwait’s long-term energy and water security. Az-Zour North Phase 2 and 3 is a project of national importance and reflects Acwa’s strong commitment to supporting Kuwait’s development ambitions. By bringing together our scale, efficiency, and global best practices, we aim to deliver reliable power and water at competitive costs, while demonstrating how strong public-private partnerships can create lasting economic and social value.”

Ibrahim AlQadhi, Chief Executive Officer of GIC stated: "We are proud to contribute to the development of strategic infrastructure projects in Kuwait through this project, which represents a landmark investment in GIC’s portfolio. GIC is committed to ensuring the provision of sustainable electricity and water resources at competitive economic costs to support Kuwait’s social and economic prosperity." Mr. AlQadhi further added: “GIC is a leading investor in power and water projects and intends to continue to play a major role in utilities projects in the Gulf.”

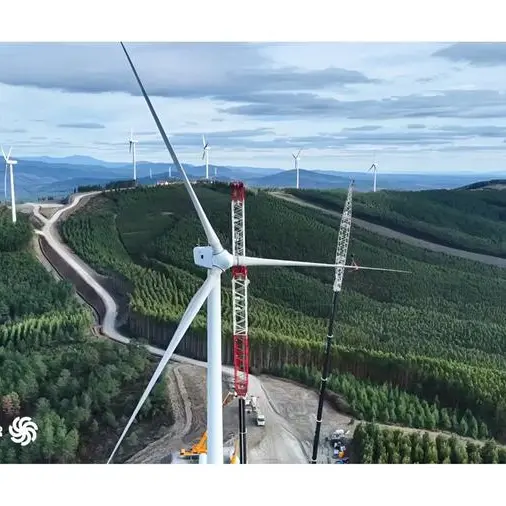

Az-Zour North Phase 2 & 3 will be developed on a Build-Operate-Transfer (BOT) basis under a 25-year agreement. Once completed, the project will deliver a net power generation capacity of +2,700 megawatts (MW) and up to 120 million imperial gallons per day (MIGD) of desalinated water per day, significantly reinforcing Kuwait’s electricity generation capacity and water security infrastructure.

The project is located approximately 100 kilometers south of Kuwait City, adjacent to the existing Az-Zour North Phase 1 facility, along the southeastern coastline of the State of Kuwait near the Kuwaiti-Saudi border. It will comprise a combined cycle gas turbine (CCGT) power plant fueled by natural gas, with gasoil back-up, alongside a seawater reverse osmosis (RO) desalination facility.

The total investment for the project exceeds USD 4 billion. The project company will be jointly owned by Acwa and GIC with a combined 40% stake, while the Kuwait Authority for Partnership Projects (KAPP) will hold the remaining 60%. Fifty percent of total shares will be offered for public subscription to Kuwaiti citizens once the project becomes fully operational and is listed on the Kuwait Stock Exchange.

Under the ECWPA, MEWRE will purchase the entire net dependable power capacity and net dependable water capacity of the plant, supporting the State of Kuwait’s long-term plans to meet growing electricity and water demand through large-scale, efficient and reliable infrastructure projects.

The project will be executed by an international and local EPC consortium led by SEPCO-III, and the project’s gas turbines will be supplied and serviced by GE Vernova, while Acwa Operations will be responsible for the long-term operation and maintenance of the project throughout its 25-year term.

About Acwa

Acwa (TADAWUL: 2082) is a Saudi-listed company and the world's largest private water desalination company, the first mover into green hydrogen, and a leader in the global energy transition. Registered and established in 2004 in Riyadh, Saudi Arabia, Acwa employs over 4,000 people and is currently present in 15 countries in the Middle East, Africa, Central Asia, and Southeast Asia. Acwa’s portfolio comprises 111 projects in operation, advanced development, or under construction with an investment value of SAR 430 billion (USD 114.8 billion) and the capacity to generate 93 GW of power (of which 52GW is renewables) and manage 9.3 million m3/day of desalinated water. This energy and water are delivered on a bulk basis to address the needs of state utilities and industries on long-term, off-taker contracts under utility services outsourcing and public-private partnership models.

Learn more: www.acwapower.com

Acwa Media Contacts:

Halah Mohsen

Director Media Affairs & External Comms

hmohsen@acwapower.com

media.inquiries@acwapower.com

About Gulf Investment Corporation

The Gulf Investment Corporation (GIC) is a premier regional financial institution dedicated to fostering private sector development and driving sustainable economic growth across the member states of the Gulf Cooperation Council (GCC).

Headquartered in Kuwait since its establishment in 1983, GIC is equally owned by the governments of the six GCC member states. The Corporation focuses its investments on strategic projects within vital sectors, including financial services, telecommunications, petrochemicals, metals, and power and utilities.

GIC adheres to a disciplined methodology for managing its principal investment risks by ensuring geographical distribution across the GCC. In parallel, it maintains a robust presence in local and global capital markets, diversifying its portfolio across various asset classes and investment instruments to ensure the highest levels of financial stability,

Learn more: www.gic.com.kw

Contacts:

Khaled Al-Suraye

Department Head – Public Relations

kalsuraye@gic.com.kw