PHOTO

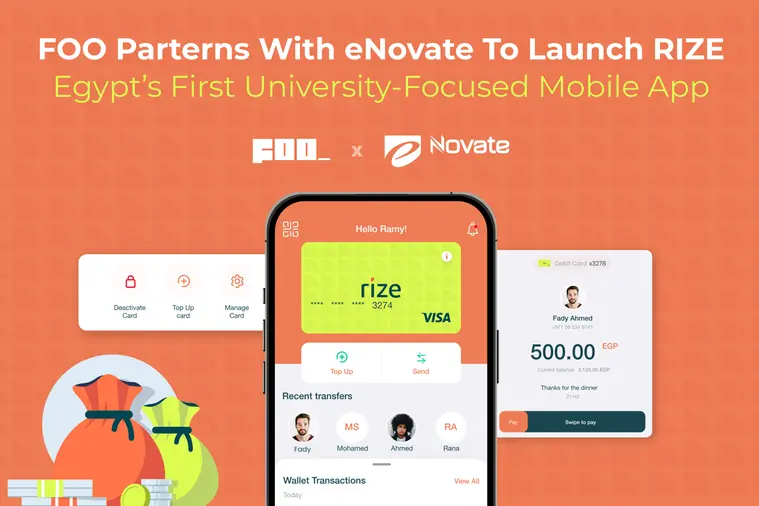

Dubai, UAE: FOO, the award-winning B2B Software as a Service (SaaS) solutions provider, has partnered with eNovate, a subsidiary of eFinance Investment Group, a leading provider of innovative digital payment solutions, to launch the country’s first white-labeled mobile application tailored specifically for university students. This groundbreaking solution blends financial literacy, digital payments, and gamified experiences into one lean, mobile-first ecosystem.

The application launches with core features such as digital student ID issuance, mobile wallet top-up and bill payment functionality. Designed with a lean, mobile-first approach, the app offers students a smart, secure and engaging financial experience that fits seamlessly into their daily lives. The digital student card also serves as an official university ID, enabling campus access and identity verification without the need for a physical card. By combining essential financial services with interactive, youth-oriented features, the app speaks directly to the needs and expectations of the Gen Z demographic.

This first-of-its-kind mobile solution was made possible through the strategic collaboration between FOO and eNovate. While FOO led the app development, user experience and digital architecture, eNovate brought its deep expertise in secure card issuance, financial enablement and integration with national infrastructure. As a subsidiary of the government-backed eFinance Investment Group, eNovate ensures the platform adheres to the highest standards of compliance, scalability and security - hosting all FOO intellectual property on the eFinance cloud, within Egyptian borders.

This partnership is more than technical, it represents a shared vision to digitally empower Egypt’s youth, combining the agility of a fintech innovator with the trust and reach of a government-aligned institution.

A unique aspect of the app is its integrated gaming platform, allowing students to purchase in-game cards and content—an engagement strategy designed to resonate with the Gen Z audience.

In the coming months, the app will expand to include a loyalty program where users can earn points and access rewards - further deepening user engagement and financial behavior education.

“FOO chose to partner with eNovate due to its strategic importance as Egypt’s only government-certified card processor and enablement platform,” said Ghady Rayess, Managing Director at FOO .“This partnership ensures the app’s infrastructure is fully compliant, scalable, and secure.”

All of FOO’s intellectual property is hosted within eFinance’s secure cloud infrastructure, reinforcing the importance of this partnership in enabling the app’s existence and functionality.

“Traditionally, we were focused on card production,” said Nashwa Kamel, CEO of eNovate but with this partnership, we’ve expanded into full digital banking experiences, including onboarding, payments, and secure mobile transactions. This is more than a banking app, it’s a lifestyle tool for students”.

This first-of-its-kind solution supports the government’s vision of a digitally empowered youth, offering real-world tools that make financial literacy both accessible and rewarding.

The partnership marks a significant step in driving financial inclusion and literacy among youth, combining real-world payment tools with a digital-first experience that reflects the lifestyle of the next generation.

About FOO

FOO is an award-winning, B2B Software as a Service (SaaS) solutions provider, headquartered in the UAE, that specializes in empowering businesses through digital transformation. FOO provides innovative fintech solutions, built entirely in-house, that optimize digital capabilities for clients across diverse industries and enable them to deliver an unparalleled user experience.

FOO works with banks, fintech companies and key retailers across the MENA region, including Mastercard, Visa, Benefits, Zain Group, PwC and MAF. FOO’s innovative platform is modular, built on digital micro-services that can be assembled to meet the specific requirements of each client. This approach, coupled with extensive regional experience, enables FOO to create super personalized digital products with a fast time to market. FOO’s key products include solutions for remittances, digital wallets, tokenized transactions, fully automated micro-lending and BNPL.

About eNovate

eNovate, a subsidiary of eFinance Investment Group, is a leading provider of innovative digital payment solutions, with over 15 years of industry expertise and the largest personalization center in Africa. The company manages the manufacturing, personalization, and processing of millions of transactions annually for partners including Meeza, VISA, and Mastercard—positioning itself at the forefront of the digital payment revolution.

Originally focused on banking card issuance for financial institutions and government entities, eNovate has evolved into a comprehensive fintech enabler. Its offerings now span white-label wallet applications, digital onboarding, and financing solutions—designed to meet the dynamic needs of today’s financial ecosystem.

With a robust digital infrastructure and advanced technology stack, eNovate delivers unmatched speed, security, and convenience, ensuring seamless customer experiences across touchpoints. As a fully accredited provider, it empowers businesses to streamline operations and unlock new growth opportunities in a digitally driven era.

eNovate remains committed to shaping the future of financial inclusion by delivering tailored solutions that help individuals and organizations thrive in an increasingly connected world.

Media Contact

Eliane Chalhoub

Eliane@jwi-global.com