PHOTO

MUSCAT: BankDhofar is reinforcing its position as a leading enabler of sustainable development in Oman by aligning its financial services and operations with robust Environmental, Social, and Governance (ESG) principles. As Oman advances toward Vision 2040, the Bank continues to integrate sustainability into its strategy, supporting economic growth that is inclusive, responsible, and resilient.

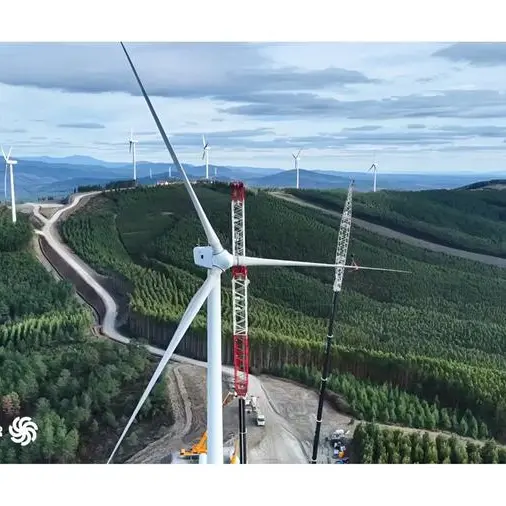

BankDhofar actively supports Oman’s transition to a low-carbon and resource-efficient economy by financing projects that promote environmental sustainability. The Bank has extended funding to renewable energy initiatives, energy-efficient infrastructure, and environmentally responsible industries, helping reduce carbon footprints while fostering long-term economic value.

Internally, BankDhofar is enhancing operational efficiency through digital banking solutions, paperless processes, and energy-conscious practices, reflecting its commitment to minimizing environmental impact across its operations.

Social responsibility remains central to BankDhofar’s mission. The Bank plays a key role in advancing financial inclusion by offering accessible banking products tailored to individuals, SMEs, and underserved communities. Through dedicated SME financing, women-focused banking initiatives, and youth entrepreneurship support, BankDhofar empowers economic participation and job creation across the Sultanate.

Beyond financial services, the Bank maintains a strong culture of community engagement. Its corporate social responsibility initiatives support education, health, environmental awareness, and community development, contributing to social wellbeing and national development priorities. Continuous investment in employee development, diversity, and wellbeing further strengthens the Bank’s social impact and reinforces a values-driven workplace culture.

BankDhofar’s ESG commitment is underpinned by a robust governance framework that emphasizes transparency, accountability, and ethical conduct. The Bank adheres to stringent regulatory standards and international best practices in risk management, compliance, and corporate governance. Its Board and senior management oversee sustainability integration, ensuring that ESG considerations are embedded in decision-making, credit assessments, and long-term strategy.

Cybersecurity, data protection, and customer trust are also key governance priorities, with continued investments in secure digital infrastructure to safeguard stakeholders and maintain confidence in the Bank’s services.

By aligning financial innovation with ESG goals, BankDhofar is not only responding to global sustainability expectations but actively contributing to Oman’s economic diversification and sustainable development agenda. Through responsible lending, inclusive growth initiatives, and strong governance, the Bank continues to deliver long-term value for customers, communities, and shareholders alike.