PHOTO

- Aramex continues to steer decisively through the challenging economic environment and delivered a resilient performance in H1 2023. Revenue was AED 2.8 billion, a decline of 5% Year-on-Year.

- The Company's astute cost management is further highlighted by the notable 12% decline in the Group’s organically consolidated Selling, General, and Administrative Expenses (SG&A) in Q2 2023, showcasing Aramex’s agility in cost control.

- In H1 2023, Net Income was AED 42.8 million, compared to AED 91.9 million in H1 2022. Q2 2023 also saw a 57% decline. This was due to increased financial expenses and a downstream impact from topline softening, coming from the International Express product. Currency devaluation in certain markets have further impacted the Company’s financial performance.

- Aramex’s Domestic Express volumes were resilient, while International Express volume trends remained challenging. Industry rates in Freight-Forwarding continued to decline globally.

- Aramex’s diversified geographic footprint supported the Company’s solid performance in its home markets, with the GCC accounting for 39% of total Revenues, and reporting 3% growth in Gross Profit in Q2 2023.

Dubai, UAE: Aramex (DFM: ARMX) a leading global provider of comprehensive logistics and transportation solutions, announced its financial results for the second quarter (“Q2”) and first half (“H1”) ending 30 June 2023.

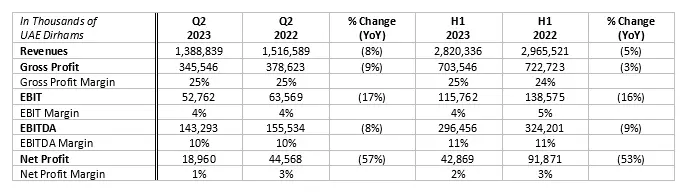

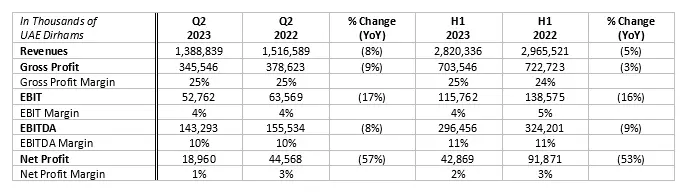

Financial Performance Commentary

Demonstrating resilience and remaining profitable in the face of weak market conditions including FX headwinds, Aramex reported Revenues of AED 2.8 billion in H1 2023, a 5% decline YoY. In line with the global industry trend of softening volumes, the Q2 2023 Revenue also declined by 8%. However, excluding the currency exchange impact, the Q2 Revenue fell by 5%. Worth noting that Q2 2023 had fewer working days, mainly due to the shift of Islamic public holidays observed in certain markets during the quarter, compared to the same period of last year where these public holidays fell during Q3 2022.

Aramex maintained a robust Gross Profit Margin of 25% over both the half year and second quarter periods, despite a 3% and 9% YoY reduction in Gross Profit for H1 and Q2 2023 respectively. This tenacity reflects Aramex’s consistent investments in efficiency-maximizing initiatives and cost optimization strategies, enabling the Company to navigate economic cycles with strength.

The Company’s prudent cost management was further evident as the consolidated Group Selling, General, and Administrative Expenses (SG&A) decreased by 3% YoY through the Q2 2023 period. Additionally, organic SG&A, which excludes MyUS, experienced a notable decline of 12% during the same quarter, showcasing Aramex’s agility in cost control.

Net Profit of AED 42.8 million was reported in the first half of 2023, compared to AED 91.9 million in H1 2022, with a similar decline of 57% for Q2 2023. This decrease is attributed to a trickle-down impact from topline softening, as well as an increase in finance expenses associated with the MyUS acquisition, which is in line with Company’s strategy to leverage the balance sheet.

Aramex maintained a robust balance sheet position with Net Debt-to-EBITDA ratio of 2.6x and a healthy cash balance of AED 502 million as of 30 June 2023.

Othman Aljeda, Chief Executive Officer of Aramex, said: “Reflecting on Aramex’s financial results for the first half of 2023, we performed robustly, despite continued challenges in an environment characterized by cost inflation, lower freight rates, softening shipment volumes and FX fluctuations. Therefore, our focus in the second half of the year will remain firmly on cost reduction and further efficiencies on Operating Expenses and SG&A, so that we can continue to be a very well-positioned, disciplined and agile business, with a strong balance sheet and key competitive strengths for the long-term.

As a leading logistics provider, we recognize the need for agility and adaptability in today’s ever-evolving landscape. We continue to strategically invest in cutting-edge technologies, optimize our operations, and enhance our service offerings to meet the diverse and changing needs of our valued customers. This is evidenced by the productivity gains in our courier services and the doubling of our Pick-Up and Drop-Off (PUDO) network across the region. We will continue to reposition the business to higher margin accounts, including specialized verticals and more B2B business. We continue to focus on quality revenues and strategic growth to create long-term value for our stakeholders.

Our strategically balanced geographical presence remains a pillar of strength, with solid performance in key markets, including the GCC region, accounting for 39% of total Revenues, while continuously reinforcing revenue performance in Europe and North American outbound markets.”

Business Performance

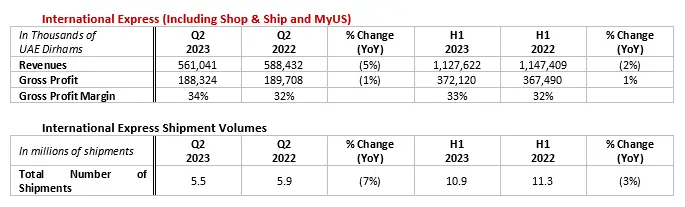

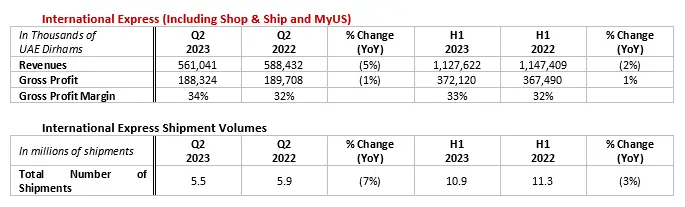

International Express business reported AED 372 million in Gross Profit for H1 2023, a YoY increase of 1%. The corresponding Gross Profit Margin increased to 33% benefitting from MyUS, operational efficiency and improvements in linehaul costs.

In Q2 2023, the International Express product handled a total of 5.5 million shipments, experiencing a YoY decline of 7% in line with the global industry’s overall performance. Amidst the challenging market conditions, there were positive signs of stabilization, with a noteworthy 2% growth in shipments during Q2 2023 compared to the first quarter of the year, signaling an encouraging trend in the post-pandemic environment.

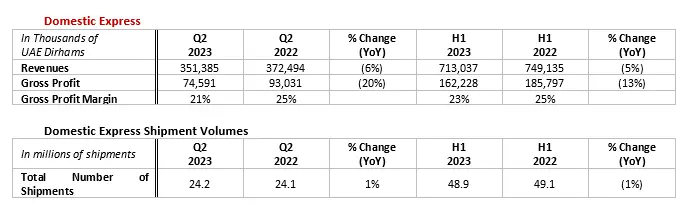

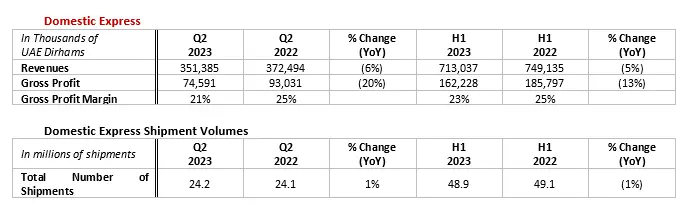

The YoY Revenue and Gross Profit for the Domestic Express business faced downward pressures during both the half-year period and Q2 due to foreign exchange translation. Excluding foreign exchange impact, Revenue grew 3% during the second quarter of the year. The corresponding Gross Profit Margin for Q2 and H1 2023 was recorded at 21% and 23% respectively, demonstrating Aramex’s commitment to optimize performance even amidst currency fluctuations.

In Q2 2023, Aramex’s Domestic Express shipments reached a total of 24.2 million, displaying a stable growth of 1% YoY. When excluding Oceania, where a restructuring plan is in progress, Domestic Express volumes grew by 2% in Q2 2023 compared to the same period last year. This growth was primarily driven by robust volume performances in the GCC, MENAT, and Asia countries.

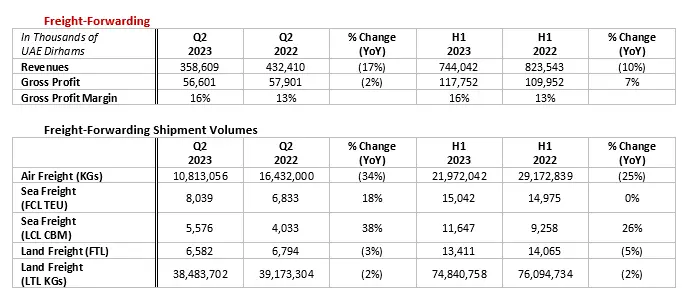

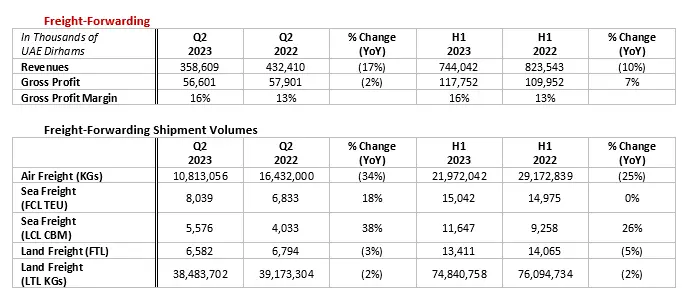

While Revenues declined by 17% in Q2 2023, the Freight-Forwarding business demonstrated a robust performance, reaching a 7% increase in Gross Profit for the half year period.

Underlining Aramex’s resilience and ability to achieve operational efficiencies, the gross profit margin improved three percentage points, reaching 16% in both Q2 2023 and the first half of the year.

Global sea freight rates declined further this year, driving a shift in volumes from air freight back to sea freight. Aramex reported double digit growth in sea freight volumes, and a double-digit decline in air freight volumes during Q2 2023, also driven by less aircraft chartering in Q2 2023 compared to the same period last year. Road freight volumes were relatively stable during the same quarter, showcasing the strength of the Aramex trucking fleet in the GCC and wider MENA region.

As Aramex continues to strengthen its Freight offerings and capitalize on growth opportunities, the Company remains committed to delivering efficient and reliable freight solutions to its valued customers.

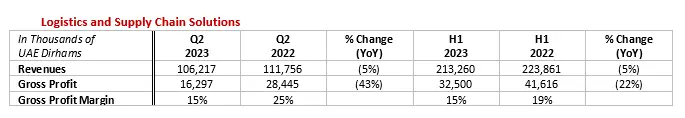

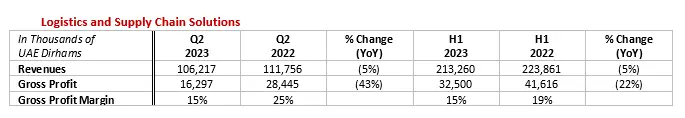

Logistics and Supply Chain Solutions Revenues decreased by 5% both in H1 and Q2 2023. Excluding the FX impact, Revenues grew 2% in Q2 2023. Gross Profit Margin for the Logistics product remained stable at 15% in Q2 2023, aligned with the average margin recorded in 2022 and in Q1 2023. A decrease in utilization during Q2 2023, compared to the same period last year, impacted the GP margin, which is expected to recover over the next few quarters as utilization in the new warehouses is building up.

Q2 2023 performance was supported by the Industrials vertical, which won a significant contract in Houston, USA during the second quarter. The Company also opened new facilities in Saudi Arabia and India, and continues to focus on quality revenue and high-growth verticals, including industrials and retail.

Furthermore, Aramex achieved an average utilization rate of 82% across 784K sqm of facilities during the quarter, optimizing operational efficiency and meeting customer demands effectively.

As Aramex advances into the future, the Company remains committed to driving sustainable growth, embracing innovation, and delivering exceptional logistics solutions to its valued customers worldwide.

-Ends-

About Aramex:

Aramex, established 40 years ago, has emerged as a global leader in logistics and transportation, renowned for its innovative services tailored to businesses and consumers. As a listed company on the Dubai Financial Market (DFM) and headquartered in the UAE, our strategic location facilitates extensive customer reach worldwide, bridging the gap between East and West.

With operations in 600+ cities across 70+ countries, Aramex employs over 16,000 professionals. Our success is attributed to four distinct business products that provide scalable, diversified, and end-to-end services for customers. These products are:

- International Express, encompassing Aramex's Parcel Forwarding Business (Shop & Ship and MyUS).

- Domestic Express

- Freight Forwarding

- Logistics & Supply Chain Solutions

Sustainability is at the core of our vision and mission. To build a truly sustainable business, we leverage our core competencies to make a positive impact as responsible members of the communities we serve. Through partnerships with local and international organizations, we strive to expand our reach and benefit more individuals through targeted programs and initiatives. To address environmental concerns and combat climate change, we have committed to the Science Based Targets initiative (SBTi), renowned globally. This commitment propels us to accelerate our climate action goals, aiming for Carbon-Neutrality by 2030 and Net-Zero emissions by 2050.

For more information, please visit us: www.aramex.com

For more information, please contact:

Aramex

Mohammad Al Qassem

Head of Corporate Communications

mohammadalah@aramex.com

Anca Cighi

Investor Relations Director

Investorrelations@aramex.com

Edelman Smithfield

Shruti Choudhury

Account Director

E: Aramex@edelmansmithfield.com

Shraddha Sundar

Account Manager

E: Aramex@edelmansmithfield.com