PHOTO

-

The final offer price for the initial public offering (“IPO”) of 1,000,000,000 (one billion) ordinary shares of ALEC Holdings PJSC has been set at AED 1.40 per share, which is the top end of the previously announced price range.

-

The total size of the IPO is AED 1.4 billion (US$ 381 million) and the implied market capitalisation of ALEC Holdings PJSC upon listing on the Dubai Financial Market (“DFM”) will be AED 7.0 billion (US$ 1.91 billion).

-

The IPO was substantially oversubscribed, attracting strong demand from a broad range of high- quality investors across the United Arab Emirates (“UAE”), the wider Gulf Cooperation Council (“GCC”), and international markets, with aggregate demand of approximately AED 30 billion (US$ 8.1 billion), resulting in an oversubscription of more than 21 times across all tranches.

-

This is the UAE’s largest construction IPO ever by both valuation and size – and the first IPO in the sector in over 15 years.

-

The IPO recorded one of the highest levels of non-UAE investor participation among recent UAE government-related listings on the DFM.

-

The final offer price implies a dividend yield of 7.1% for FY 2026.

-

The strong level of investor interest is a powerful endorsement of ALEC Holdings PJSC’s differentiated investment proposition, strong market reputation, and attractive growth prospects.

-

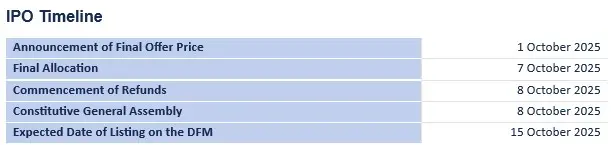

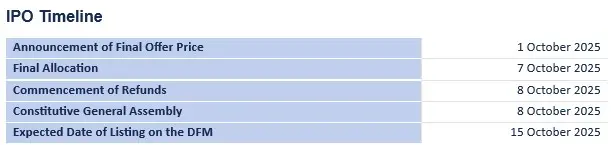

Admission of ordinary shares for trading on the DFM (“Admission”) is anticipated on or around 15 October 2025.

Dubai, United Arab Emirates – ALEC Holdings PJSC (“ALEC” or the “Company”), a market-leading diversified engineering and construction group, today announces that it has successfully completed the book building and subscription process for its IPO (the “Offering”) on 30 September 2025, and has set the final offer price at AED 1.40 per share, at the top end of the previously announced price range.

Details of the Final Offer Price

A total of 1,000,000,000 (one billion) ordinary shares (the “Offer Shares”), equivalent to 20% of ALEC’s share capital, were on offer by the Investment Corporation of Dubai (the “Selling Shareholder” or “ICD”), the principal investment arm of the Government of Dubai. Based on the final offer price, ALEC has successfully raised AED 1.4 billion (US$ 381 million), implying a market capitalisation of AED 7.0 billion (US$ 1.91 billion) upon listing on the DFM. Marking a historic milestone, this is the UAE’s largest ever construction IPO in terms of both valuation and size and the first IPO in the sector in over 15 years. All of the Offer Shares are existing shares currently held by the Selling Shareholder, and ALEC will not receive any proceeds from the Offering. Following the Offering, ICD will continue to hold a stake of 80% in the Company.

Pursuant to the Company’s dividend policy, which is available in the UAE Prospectus and the International Offering Memorandum, ALEC is expected to distribute a cash dividend of AED 200 million in April 2026, and a cash dividend of AED 500 million with respect to financial year 2026, with the first payment to be made in October 2026 and the second payment in April 2027. Based on the financial year 2026 dividend of AED 500 million and final offer price of AED 1.40 per share, the dividend yield will be 7.1% upon listing. Thereafter, the Company expects to distribute cash dividends on a semi-annual basis (in April and October of each year), with a minimum payout ratio of 50% of the net profit generated for the relevant financial period, subject to the approval of the Board of Directors and the availability of distributable reserves.

Details of the IPO Subscription

The Offering attracted considerable interest from a broad range of high-quality investors with a total gross demand of approximately AED 30 billion (US$ 8.1 billion), resulting in an oversubscription of more than 21 times across all three tranches. The IPO recorded one of the highest levels of non-UAE investor participation among recent UAE government-related listings on the DFM.

Investors that participated in the Individual Subscribers Offering (First Tranche) and Eligible ALEC and ICD Employees Offering (Third Tranche) will be notified of their allocation of shares via SMS on 7 October 2025, with refunds due to commence from 8 October 2025.

Barry Lewis, Chief Executive Officer of ALEC Holdings, said: “We are proud that ALEC’s IPO drew strong demand and significant interest from a diverse and high-quality investor base. This is a clear vote of confidence in ALEC’s distinct value proposition and disciplined operating model. The strong response also signals broader investor conviction in the region’s construction sector, underpinned by ambitious national agendas and a strong pipeline of transformational projects. We are deeply thankful to our new shareholders for placing their trust in ALEC, and we look forward to the journey ahead as we continue to scale, deliver, and grow value together.”

Admission and Price Stabilisation

The completion of the Offering and Admission are currently expected to take place on 15 October 2025 under the symbol “ALEC” and ISIN “AEE01710A255”, subject to market conditions and obtaining relevant regulatory approvals in the UAE, including approval of Admission to listing and trading on the DFM.

Pursuant to an underwriting agreement entered into between the Company, the Selling Shareholder, and the Joint Bookrunners on 23 September 2025 (“Underwriting Agreement”), the remaining ordinary shares held by the Selling Shareholder following Admission shall be subject to a lock-up which starts on the date of Admission and ends 180 days thereafter, subject to certain permitted transfers as set out in the Underwriting Agreement. The Company will also be subject to a 180-day lock-up period following the date of Admission pursuant to the terms of the Underwriting Agreement.

In connection with the Offering, the Selling Shareholder will allocate proceeds from the sale of up to 100,000,000 (one hundred million) Offer Shares to xCube LLC, a DFM-authorised price stabilisation manager. These proceeds may be used, to the extent permitted by applicable law, regulations and rules, to effect stabilisation transactions on the DFM. The Joint Bookrunners and their respective directors, officers, employees, agents, and affiliates will not be involved in, responsible for, or benefit from any such transactions, which will be carried out solely by xCube LLC.

Shariah Compliance

The Internal Shariah Supervision Committee of Emirates NBD has issued a pronouncement confirming that, in their view, the Offering is compliant with Shariah principles.

Emirates NBD Capital PSC (“Emirates NBD Capital”) and J.P. Morgan Securities PLC (“J.P. Morgan”) have been appointed as joint global coordinators and joint bookrunners (the “Joint Global Coordinators”), and Abu Dhabi Commercial Bank PJSC (“ADCB”) and EFG-Hermes UAE Limited (“EFG Ltd.”) acting in conjunction with EFG Hermes UAE LLC (“EFG LLC” and together with EFG Ltd., “EFG-Hermes”) have been appointed as joint bookrunners (together with the Joint Global Coordinators, the “Joint Bookrunners”). Moelis & Company UK LLP DIFC Branch has been appointed as independent financial adviser (the “Independent Financial Adviser”).

Emirates NBD Bank PJSC has been appointed as the Lead Receiving Bank. Abu Dhabi Commercial Bank PJSC, Abu Dhabi Islamic Bank PJSC, Al Maryah Community Bank, Commercial Bank of Dubai PJSC, Dubai Islamic Bank PJSC, Emirates Islamic Bank PJSC, First Abu Dhabi Bank PJSC, Mashreq Bank PJSC and Wio Bank PJSC have also been appointed as Receiving Banks. Emirates NBD Bank PJSC’s IPO call centre can be reached at 800 ENBD IPO (800 3623 476).

Details of the Offering are available in the UAE Prospectus with respect to the First Tranche and Third Tranche and the English-language International Offering Memorandum with respect to the offer to Professional Investors (Second Tranche). The UAE Prospectus and the International Offering Memorandum are available at www.alec.ae/ipo.

INVESTOR ENQUIRIES

ALEC

ipo@alec.ae

MEDIA ENQUIRIES

Brunswick Group

alec@brunswickgroup.com

INDEPENDENT FINANCIAL ADVISER

Moelis & Company UK LLP DIFC Branch

JOINT GLOBAL COORDINATORS AND JOINT BOOKRUNNERS

Emirates NBD Capital PSC

J.P. Morgan Securities PLC

JOINT BOOKRUNNERS

Abu Dhabi Commercial Bank PJSC

EFG-Hermes

LEAD RECEIVING BANK

Emirates NBD Bank PJSC

RECEIVING BANKS

Abu Dhabi Commercial Bank PJSC

Abu Dhabi Islamic Bank PJSC

Al Maryah Community Bank

Commercial Bank of Dubai PJSC

Dubai Islamic Bank PJSC

Emirates Islamic Bank PJSC

Emirates NBD Bank PJSC

First Abu Dhabi Bank PJSC

Mashreq Bank PJSC

Wio Bank PJSC

About ALEC

ALEC, part of the Investment Corporation of Dubai, is a leading diversified engineering and construction group operating in the UAE and KSA. The Company builds and provides construction solutions that set industry benchmarks for innovation, quality, reliability and operational excellence.

ALEC offers its clients complete turnkey solutions in construction, MEP, fitout, marine, oil & gas, modular construction, energy efficiency and solar projects, heavy equipment rental, technology systems and asset maintenance. With these capabilities, the Company successfully serves a diverse range of sectors including airports, retail, hotels & resorts, high-rise buildings, and themed projects.

For more information, please visit https://alec.ae/.