PHOTO

Group Net Profit in FY 2025

- Robust core operations and successful merger fuel strong earnings growth

- Solid capital base positions the Group to confidently embark on its next chapter of growth

- One month on, the megamerger unlocks new growth avenues and creates a balanced portfolio focused on Energy and Consumer

ABU DHABI – 2PointZero Group (ADX: 2POINTZERO), a leading Abu Dhabi-based investment holding firm, today announced its FY 2025 results, reporting impressive revenue growth of 311% to bring Group Net Profit for the year to AED 3.6 billion, reflecting only one month of consolidation following the mega-merger with 2PointZero and Ghitha Holding. The year also included the completion of the sale of PAL Cooling, which resulted in a net gain of AED 2.7 billion on disposal. The Group’s robust performance, despite including an impairment loss of AED 0.8 billion against Kalyon Enerji, resulted in adjusted EBITDA (excluding fair value changes and one-offs) of AED 3.0 billion, a considerable increase on the AED 1.7 billion seen for FY2024.

Net profit from the Group’s operating businesses increased by 158% YoY, driven by the consolidation of Tendam, 2PointZero and Ghitha in addition to solid growth across all verticals. Reported net profit of AED 3.6 billion includes AED 0.1 billion in unrealised revaluation gains arising from underlying investments and market fluctuations.

The Group continued to advance integration and digital transformation initiatives across its verticals, driving operational efficiency and sustained revenue momentum. Group revenue rose 311% year-on-year to AED 7.0 billion, fuelled by organic growth and the consolidation of Tendam, 2PointZero and Ghitha. The blended gross profit margin remained strong at 49%, underscoring continued profitability across the core portfolio.

2PointZero Group’s balance sheet remains robust, supported by a cash position of AED 9.2 billion and a debt-to-equity ratio of 0.25. Execution of its long-term strategy continues to deliver results, as the Group builds a diversified portfolio across core verticals and pursues high return opportunities through its investment arm.

The Investment Portfolio closed the year with a valuation of AED 64.1 billion, compared to an initial investment of AED 48 billion. Despite market fluctuations affecting the fair value of some assets, performance across the portfolio remain strong, underpinned by solid fundamentals and long-term potential.

Group Highlights

A number of significant strategic agreements underpinned the strong performance of 2025, with the formation of 2PointZero Group, in November 2025, being the most transformative. The formation was achieved through a share swap and merger combining Multiply Group, 2PointZero and Ghitha Holding into 2PointZero Group PJSC, creating a next-generation investment platform, focused on energy and consumer sectors, with more than AED 134 billion in assets.

Earlier in the year, presented in chronological sequence, the Group completed the initial acquisition and full consolidation of Maseera Holding, with plans to build an AI-driven digital financial services platform in emerging markets backed by up to US$1bn in committed investment. Subsequent buy-out of the remaining 5% stake, to reach 100% ownership, was completed in December.

A 40.62% stake in Abu Dhabi energy distributor Enterprise Holding Investment (EHC) was also acquired in February, strengthening 2PointZero’s EPointZero energy platform and advancing decarbonisation and smart infrastructure development across the UAE and the wider region.

The Group launched Al Ain Farms Group (AAFG) at Make it in the Emirates 2025 in May, consolidating five iconic UAE protein and beverage brands into a national food platform backed by Ghitha and Yas Holding, strengthening food security and regional growth ambitions.

July witnessed the completion of the first major European investment with the acquisition of a majority stake in Tendam, doubling operational EBITDA post-consolidation and expanding the Group’s global consumer platform through a leading omnichannel apparel business with 12 established brands and 1,800+ points of sale across 80+ markets.

Two agreements were inked in October: the sale of 100% of PAL Cooling Holding for AED3.87bn to Tabreed and CVC DIF, unlocking significant value and enhancing capital redeployment capacity across new and existing verticals, and the completion of a strategic investment in Mwasalat Holdings, with Emirates Driving Company (EDC) acquiring a 22.5% stake (and the option to increase to 50.6%), strengthening the Group’s mobility platform and supporting long-term growth, innovation, and regional expansion.

November also saw Multiply Media Group complete the 100% acquisition of London Lites, strengthening its UK footprint and expanding its global DOOH portfolio, alongside the launch of Innovation Labs in partnership with Aleria to accelerate AI-driven digital growth through advanced data science, model engineering, and new revenue streams enabled by Aleria’s agentic AI platform with priority access to NVIDIA’s AI infrastructure.

Vertical updates

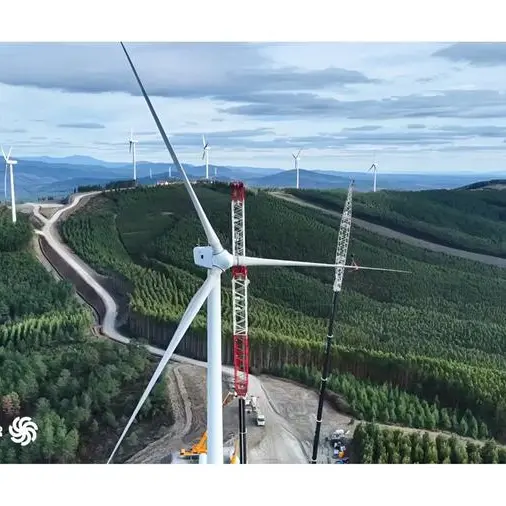

ENERGY

Mining

International Resources Holding (IRH) completed the acquisition of a 56% majority interest in Alphamin Resources Corp in Mauritius. The transaction, which marks a strategic expansion of IRH’s industrial metals portfolio into one of the world’s highest-grade tin assets and underscores its commitment to securing critical mineral supply chains, was closed in July 2025, and reflects IRH’s long-term investment focus on high-quality mining operations such as the Bisie tin mine in the Democratic Republic of the Congo.

Trading

The global trading arm of International Resources Holding (IRH) secured a significant three-year agreement with the Egyptian General Petroleum Corporation (EGPC) for the supply of Liquefied Natural Gas (LNG), starting in January 2026, in a landmark agreement that underscores IRH’s commitment to supporting energy security and stability in key regional markets. IRH also signed a 20-year Heads of Agreement (HoA) with Delfin LNG LLC and Vitol Inc. for the purchase and sale of 1.0 million tonnes per annum of liquefied natural gas from Delfin’s export facility in the United States.

District Cooling

2PointZero Group completed the sale of its 100% stake in PAL Cooling Holding to a consortium led by Tabreed and CVC DIF for AED3.87 billion, marking a significant exit from that business. This transaction is part of the Group’s broader strategy to unlock value from its portfolio and strengthen its ability to redeploy capital into other high-growth areas and verticals.

Infrastructure & Utilities

The Group acquired a 38% stake in Abu Dhabi energy distributor Enterprise Holding Investment (EHC), strengthening 2PointZero’s EPointZero energy platform and advancing decarbonisation and smart infrastructure development across the UAE and the wider region.

EHC Investment, through its safety arm, Emirates International Firefighting (EIFF), fully acquired Tamouh Fire and Safety, a leading provider in the field. The move expands EHC’s safety footprint, strengthens national fire protection infrastructure and accelerates its smart integration and expansion across critical sectors. EHC also successfully completed its majority acquisition of Sonic Tech, reinforcing its drive to lead the tech industry with future-ready, sustainable solutions.

Elsewedy Electric for Electrical Products marked significant milestones in 2025 with new partnerships, expansions and developments. A new Bi-post Overhead Distribution Substation in Peru, forming a key part of a broader modernisation strategy to enhance electricity distribution in rapidly urbanising zones, will reinforce the company’s role as a reliable partner in infrastructure development. Elsewedy also inked an agreement to supply high-quality cables and transformers to Helios Towers for a major telecommunications project in Malawi, underscoring the company’s increasingly prominent role in supporting the development of critical infrastructure across the African continent, and began high-voltage (HV) cable accessories production at its Riyadh-based factory. This strategic move marks a notable expansion in the company’s local capabilities, reinforcing its commitment to delivering reliable and internationally compliant energy solutions and positioning Elsewedy Electric KSA as a fully integrated provider of cable accessories tailored to the region’s growing energy demands.

CONSUMER

Retail & Apparel

Following the completion of the acquisition of a majority stake in Tendam, the company continued to make progress against its strategic priorities, with a focus on brand portfolio optimisation, disciplined expansion across key markets, and the continued development of its omnichannel capabilities. The business advanced initiatives aimed at enhancing customer engagement, improving operational efficiency, and strengthening its digital and data-driven capabilities, supporting the long-term resilience and scalability of the platform.

Media

The Group consolidated its media assets under Multiply Media Group (MMG), bringing together BackLite Media, Viola Media and Media 247 to form a unified, UAE-headquartered, tech-enabled media platform. MMG also completed the 100% acquisition of London Lites, securing full ownership of one of London’s most prominent digital Out-of-Home (DOOH) operators through a long-term partnership with the UK’s Wildstone. This transaction provides MMG with an immediate, scaled presence in London’s premium advertising market, with assets commercialised and operated under its BackLite Media brand.

Mobility

Emirates Driving Company reported revenues reaching AED 770 million, alongside continued progress across all key financial indicators. EDC’s acquisition of a 22.5% equity stake in Mwasalat Holdings and the establishment of Chargepoint EV Charging Stations Management and Operation L.L.C. in Abu Dhabi marked EDC’s expansion into smart and sustainable mobility infrastructure and further strengthened its position in the regional mobility sector.

Food

Ghitha Holding delivered double-digit revenue growth to AED 5.6 billion and a 39.4% increase in operating profit in FY25. A key milestone was the formation of the Al Ain Farms Group, the UAE’s newly established national food champion, which brings together five leading brands (Al Ain Farms, Marmum, Al Ajban Chicken, Al Jazira, and Saha) under a unified operating platform. The integration of Al Jazira Poultry and Arabian Farms further strengthened Ghitha’s dairy & protein capabilities, enhancing scale, improving coordination across operations, and unlocking synergies across key categories. In parallel, the consolidation of poultry operations, particularly within the eggs division, improved capacity utilization and supported stronger operating leverage.

In parallel, Ghitha continued to optimize its agriculture and fresh produce operations through NRTC Group, including the sale of Agrinv (Al Hashemeya) to NRTC and NRTC’s subsequent acquisition of Ripe Organic in Q4-2025. The addition of Ripe Organic strengthens the Group’s fresh and organic offering, deepens relationships with local farming partners, and enhances farm-to-market integration across the value chain.

Beauty

Omorfia Group continued to advance its transformation agenda, supported by ongoing digital initiatives that enabled the successful centralisation of shared services, operational right-sizing and optimised service delivery across its portfolio. Omorfia now operates a combined footprint of 149 owned, operated and franchised salons across five countries, including the UAE, KSA, Qatar, the UK and Canada.

INVESTMENT AND FINANCIAL SERVICES

Beltone Holding

Beltone Capital, a wholly owned subsidiary of Beltone Holding, has signed a Share Purchase Agreement with a majority of Baobab Group’s shareholders to acquire a stake in Baobab Group, subject to customary regulatory approvals. Beltone Holding, a leading financial services group listed on the Egyptian Stock Exchange, brings extensive regional expertise and a diversified portfolio of financial solutions across the MENA region. The transaction marks a major milestone for Baobab, expected to accelerate its growth, innovation, and digital transformation, while strengthening its ability to deliver long-term value to customers and stakeholders and further advance financial inclusion for underserved SMEs across Africa.

Lunate

Lunate recently announced a series of significant milestones highlighting its accelerating global growth, a strategic partnership with Blackstone to launch the GCC-focused logistics platform GLIDE, and the launch of its 20th ETF, the Boreas S&P AI Data, Power & Infrastructure UCITS ETF.

Corporate social responsibility

2PointZero Group continued to build on its CSR strategy in 2025 through community support, aligned with the UAE’s Year of Community and the Group’s long-term social impact agenda.

Standout initiatives included Read to Lead, the continuation and expansion of the flagship education program launched in 2024. In 2025, the initiative provided portable libraries containing more than 2,000 Arabic books, distributed across 15 charity schools in the UAE, reaching over 11,000 students. The program also sponsored compact libraries for Palestinian children from the Gaza Strip in Abu Dhabi and reinforced access to learning for displaced communities.

In parallel, Read to Lead expanded its regional reach, delivering over 5,300 books across Lebanon and Palestine, supporting NGO partners in distributing books to schools, libraries, universities, community centers, and refugee programs.

In 2025, 2PointZero Group introduced Grow or Go, a group-wide learning initiative that encourages individuals to continuously build new capabilities, especially in AI, that enhance performance, generate impact, and are scaled through knowledge-sharing across the Group. The initiative reinforces our belief that sustained performance and long-term relevance come from investing in people who are committed to evolving with the pace of change.

Finally, the Group’s Ramadan and Zayed Humanitarian Day campaign involved the creation of a Ramadan Iftar tent to serve iftar meals each day to those in need, as well as daily iftar box distribution to the less fortunate.

ABOUT 2POINTZERO GROUP

2PointZero Group PJSC is a next-generation investment powerhouse focused on energy and consumer, two multi-trillion-dollar sectors that power everyday life and form the foundation of the new economy. Its AI-enabled, diversified portfolio is built for efficiency, synergy, and compounding returns. Anchored by market-leading businesses, 2PointZero drives sustainable growth through disciplined capital allocation, operational excellence, and digital integration, creating a resilient platform that delivers sustained performance and long-term value for its shareholders.

For more information, visit www.2PointZero.com

Media contacts

Wassim El Jurdi

2PointZero Group

E: wassim@2pointzero.com

Rawad Khattar

Weber Shandwick

E: rkhattar@webershandwick.com