PHOTO

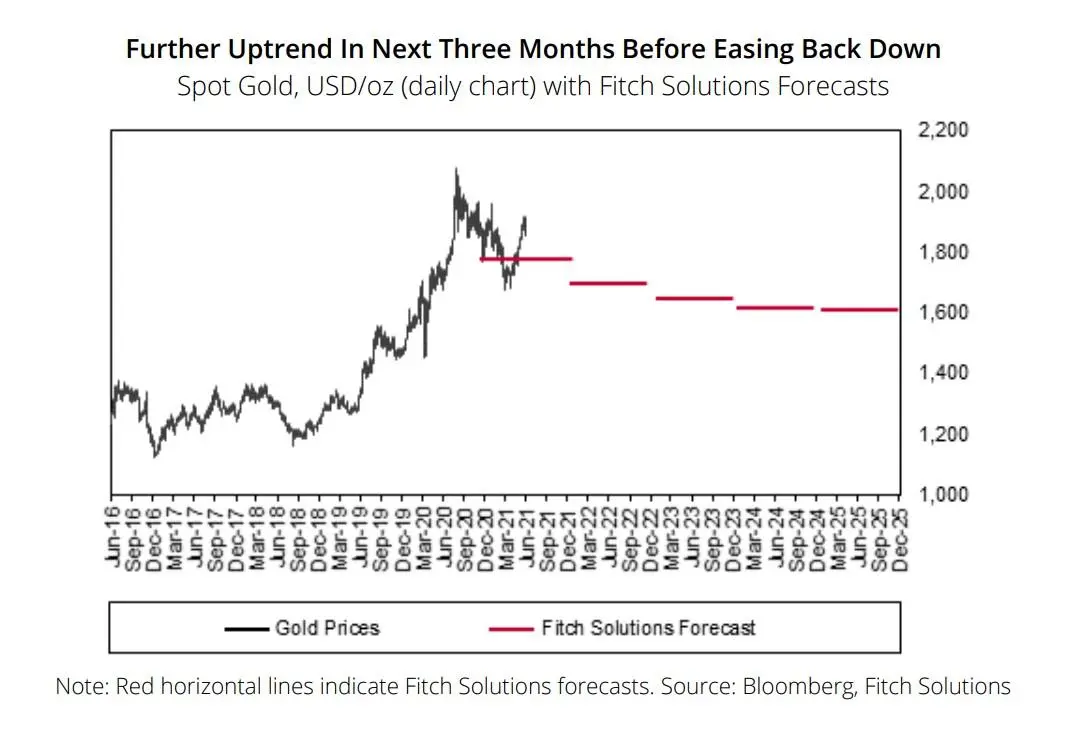

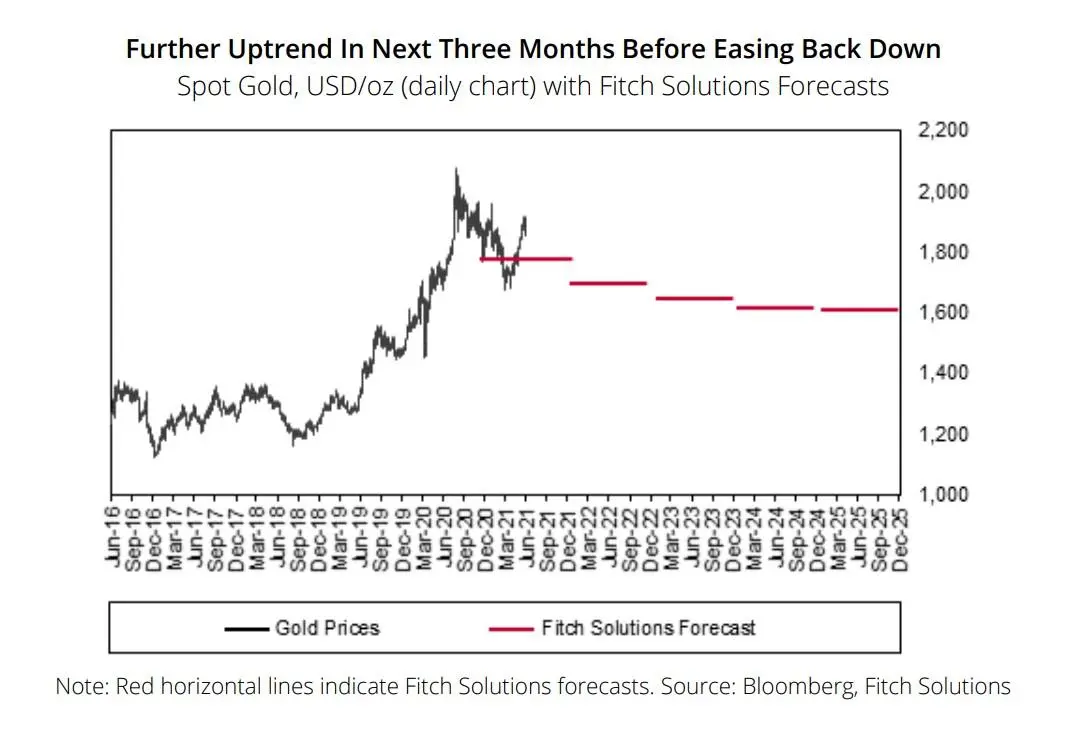

Gold prices have been rising since April and there is further upside in the next few months thanks to a weak dollar and inflationary pressures.

Country risk and industry research house Fitch Solutions expects the yellow metal to gain tailwind from rising inflation pressuring US treasury real yields, a weak US dollar and renewed waves of COVID-19 infections gripping countries across the world.

Rising global inflation is expected to remain a key driver of gold prices in the coming months.

"We now argue that inflation pressures could take longer than previously thought to recede, supporting gold for longer than we initially expected. For now, we maintain our 2021 gold price forecast of $1,780/oz, with prices having averaged $1,804/oz in the year to date and hovering around $1,900/oz at the time of writing," Fitch Solutions noted in its report.

"On one hand, we believe prices are likely to face significant resistance at the all-time high of $2,075/oz. On the other hand, there is strong support at the $1,730/oz mark and we believe prices should remain firmly above this level for most of H221," the report said.

Strong base effects and persistent supply constraints will maintain inflation above target across many, if not most, economies in the next few months, Fitch Solutions said.

"This helps to underpin our view for gold prices to remain supported in the near term, as gold is traditionally seen as a hedge against inflation," the report noted.

Additionally, economic data coming out of the US will stoke volatility in gold. For instance, a smaller than expected rise in US non-farm payrolls for May provided significant tailwind to gold.

Gold prices held steady on Wednesday morning as bond yields remained under pressure. Spot gold was up 0.1 percent at $1,893. 89 per ounce.

Looking forward, inflation and tightening concerns will be important drivers of gold in the near term, with the upcoming Fed and European Central Bank meetings in the spotlight, Goldhub said in its monthly gold market commentary.

Long-term view

Fitch maintains its 2022 gold price forecast of $1,700/oz and believes prices will start to decisively weaken towards the later part of 2021 and into 2022.

Bond yields trending higher amidst a continued economic recovery from Covid-19 will reduce the appeal for gold heading into 2022. While gold prices might start 2022 at a higher base than we initially thought due to lingering inflation pressures in H221, central banks could start tightening earlier than planned in this environment, weakening the appeal for gold.

The main headwind denting gold's appeal in 2022 and beyond will be the easing of inflationary pressures as well as the normalisation of monetary policy, the report said.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021