PHOTO

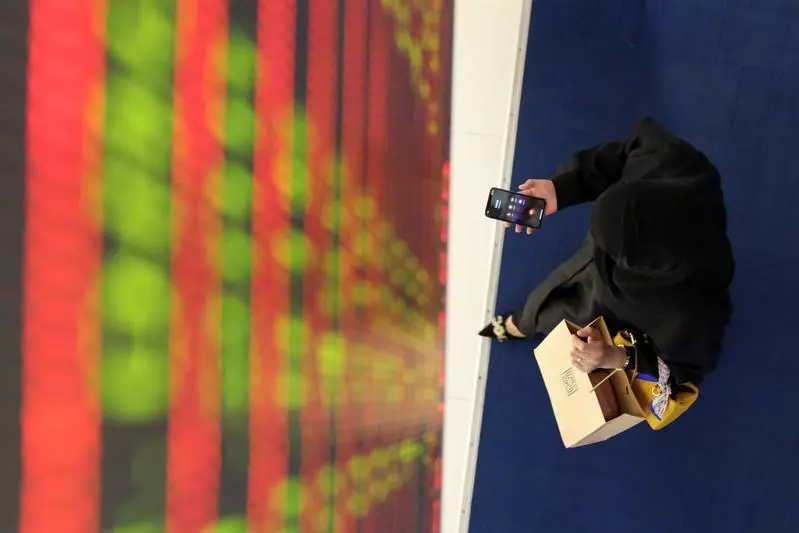

Most stock markets in the Gulf were subdued on Wednesday amid volatile oil prices, as investors remained cautious ahead of a crucial OPEC+ meeting to decide output policy in the coming months.

Oil prices - a key catalyst for the Gulf's financial markets - rose 1.2% on Wednesday with Brent trading at $82.69 a barrel by 1340 GMT, as supply disruption caused by a storm in the Black Sea and lower U.S. inventories drove buying.

The OPEC+ group comprising the Organization of the Petroleum Exporting Countries (OPEC) and allies is scheduled to meet online on Thursday to decide oil output levels for 2024, according to a draft agenda seen by Reuters on Monday.

The Qatari index was down for a sixth consecutive session and ended 0.2% lower, weighed down by a 1.3% drop in Commercial Bank and 1.8% decline in Dukhan Bank.

Dubai's benchmark index fell 0.2%, snapping three consecutive sessions of gains, with most sectors in the red. Emirates Central Cooling Systems Corp declined 1.8% and Emirate's largest lender Emirates NBD lost 0.7%.

Saudi Arabia's benchmark index gained marginally, with Etihad Atheeb Telecom rising 1.3% and Saudi Pharmaceutical Industries and Medical Appliances Corporation surging 8.3%. However, Lumi Rental and Elm Company dropped 3.2% and 1.2%, respectively.

In Abu Dhabi, the benchmark index was up for a second consecutive session, ending 0.1% higher, helped by a 2.5% surge in conglomerate Alpha Dhabi and 1.9% gain in Abu Dhabi National Oil Co for Distribution.

Outside the Gulf, Egypt's blue-chip index fell for a second consecutive session and ended 1.4% lower, with all sectors in the red. Commercial International Bank declined 2.7% and Misr Fertilizer slumped 3.6%. Fertilizers and petrochemicals maker MOPCO reported a decrease in third-quarter consolidated net profit.

- SAUDI ARABIA added 0.02% to 11,103

- KUWAIT dropped 0.6% to 7,238

- QATAR lost 0.2% to 9,992

- EGYPT declined 1.4% to 24,759

- BAHRAIN lost 0.4% to 1,943

- OMAN was up 0.5% to 4,655

- ABU DHABI added 0.1% to 9,553

- DUBAI lost 0.2% to 4,000

(Reporting by Md Manzer Hussain; Editing by Krishna Chandra Eluri)