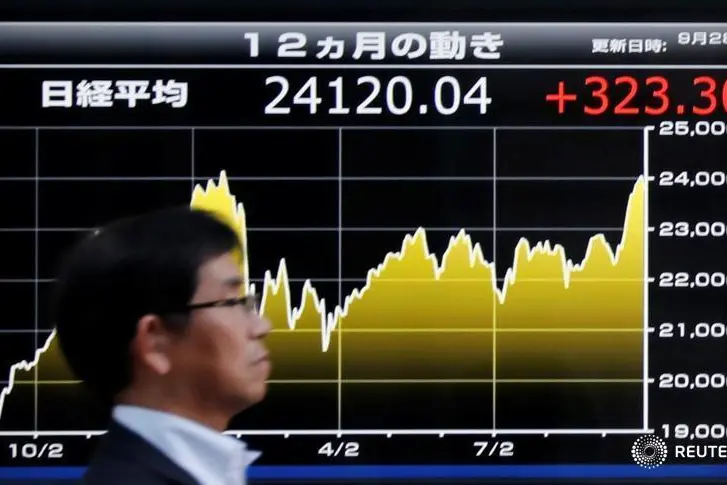

PHOTO

TOKYO - Japan's Nikkei share average rallied on Friday to the highest since August 1990, the country's so-called "bubble" era, driven by a confluence of positive factors from strong earnings to optimism over a U.S. debt ceiling deal.

The benchmark index jumped as high as 30,924.57 shortly after the open, on course for a seventh straight winning session, after smashing through the psychological 30,000 level on Wednesday for the first time in 20 months.

The broader Topix, which had reached the post-bubble milestone on Tuesday, extended its climb to as high as 2,171.37.

Japan's stock rally has been powered by an overall very strong earnings season, a weaker yen amid views that the Bank of Japan will keep stimulus for longer and an economy that is starting to show signs of a post-COVID consumption revival.

Foreign buying thanks to increased investment by Warren Buffett and a push for better corporate governance by the Tokyo Stock Exchange provided additional impetus.

The Nikkei's final push to a 33-year peak drew further momentum from gains in global stocks, as investors turned more optimistic that U.S. lawmakers can soon reach a deal to raise the debt ceiling and avert a potentially catastrophic default.

"Long-term fundamentals might have begun changing in Japan, and foreign investors do not want to miss this opportunity," said Masayuki Kichikawa, chief macro strategist at Sumitomo Mitsui DS Asset Management.

"As long as any U.S. slowdown is mild, the current level of Japanese equities in not overvalued. There is still room for a further rise."

Office equipment company Ricoh led Nikkei gainers with a 6.74% jump after announcing it was considering joining forces with a Toshiba unit to develop and manufacture copiers and printers. Toshiba Tec, which is not part of the Nikkei, surged 11%.

Among the Tokyo Stock Exchange's 33 industry sectors, services led with a 1.65% rise, followed by precision machinery and machinery with gains of about 1.1% each.

The Nikkei had rocketed 6.2% from the May 10 close to reach Friday's high. As of the midday recess, it was up 1.04% at 30,892.47.

The Topix had gained as much as 4.2% over the same period. It was 0.48% higher at 2,168.15.

'OVERHEATED'?

"Investors are going to spend today thinking hard about whether this Nikkei rally will continue," said Kazuo Kamitami, an equity strategist at Nomura Securities.

"The word 'overheated' is going to be very much front of mind."

A case in point was chip-related shares.

They had started the session very strongly amid a rally in U.S. peers overnight, but then went on to erase those gains or even turn sharply lower.

Chip-testing equipment maker Advantest climbed 3.35% at the open to hit a new record high, only to then plunge as much as 3.3% before entering the midday recess down 0.77%.

Financial shares also flashed warning signs, with the TSE's banking subindex retreating as much as 1.29% after reaching a more than two-month peak in Thursday's session.

(Reporting by Kevin Buckland; Editing by Himani Sarkar and Shri Navaratnam)