PHOTO

Disruptive themes are affecting traditional economic sectors in significant ways. These disruptions are already underway across several sectors, metamorphising economies and creating new frontiers for innovation.

Some of these new themes include robotics and AI, genomics and longevity, cloud computing and IoT (Internet of Things). Disrupted sectors include manufacturing, medicine, agriculture, transport, medicine and healthcare, and housing, amongst others.

Thematic industries lead disruption, transformation

Whilst innovation and disruption are not new in the business cycle, the prominence of disruption from the late 2010s is noteworthy for three reasons.

First, the scale and pace of the disruptions are collectively leading to the rise of the ‘new economy’, where consumers are now engaging with embedded finance, augmented reality and assisted driving or autonomous vehicles in ways that were unheard of 10 years ago.

Second, the rise of ‘thematic industries’ is transforming whole swathes of the economy by promoting new synergies and collaborations across previously siloed environments.

Third, thematic industries themselves have emerged as bona fide investment themes, as evidenced by the steep rise in thematic ETFs’ AUM and total number. Whilst the story of the ‘new economy’ is still being written, it is reasonable to assume disruption will be a regular feature.

Islamic finance and disruption

Tech-enabled disruption has reached Islamic financial services as well. It has the potential to transform OIC economies by increasing financial inclusion via new channels that give consumers access to solutions across the lifecycle of their financial needs. However, Islamic fintech is still at a relatively nascent stage, and partnerships with incumbent Islamic banks are still key to developing the ecosystem further.

Evidence from conventional finance and fintech suggests that partnerships are key to corporate and investment banking. Data from McKinsey Global Institute suggests that digital finance in the developing world may have a significant impact on those economies, including several OIC nations.

It is time to re-think old economic paradigms

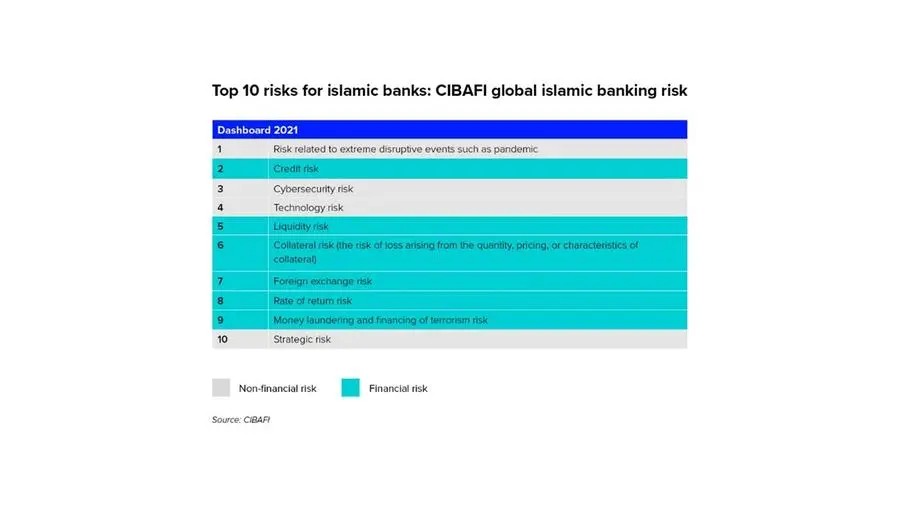

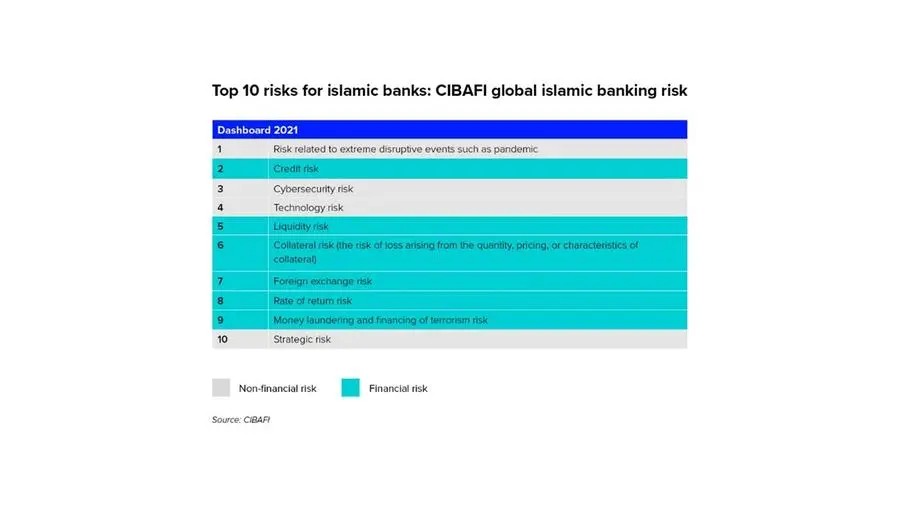

In 2021, four of the top 10 risks for Islamic banks were non-financial, indicating the growing interplay between megatrends and the risks they pose to these financial institutions, according to CIBAFI, an international non-profit organisation founded by the Islamic Development Bank (IDB) and a number of leading Islamic financial institutions.

Moreover, the unprecedented macroeconomic environment, with continued historic low interest rates, supply chain gluts and risk of stagflation, along with the dawn of widespread industry disruption, invites us to re-think old economic paradigms.

For more insights and key findings, read the report.

(Reporting by Tayyab Ahmed; editing by Seban Scaria)