PHOTO

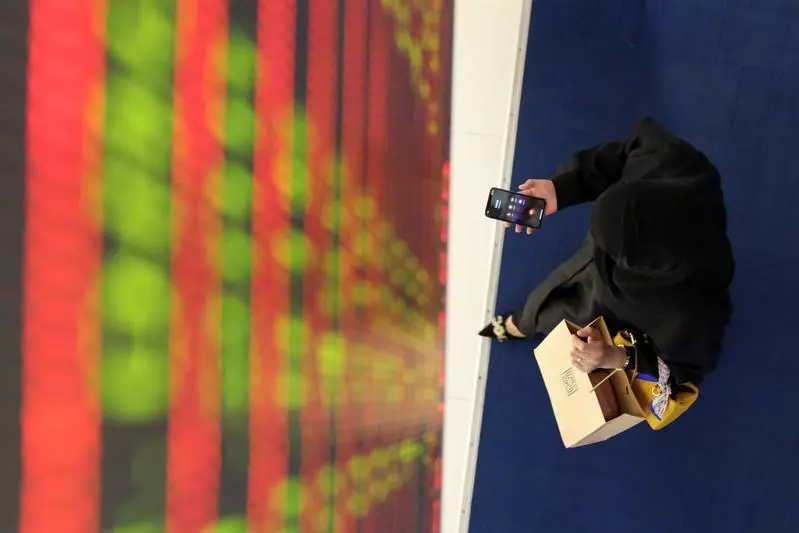

Major stock markets in the Gulf were mixed in early trade on Tuesday as concerns arose from U.S. President Donald Trump's criticism of Federal Reserve Chair Jerome Powell, which dampened risk sentiment, although, corporate earnings helped to limit the losses.

Trump said on Monday that the U.S. economy might slow down unless interest rates are lowered immediately. He reiterated his criticism of the Fed chair, who believes that rates should remain unchanged until it is clearer that Trump's tariff plans won't cause a persistent increase in inflation.

Dubai's main share index fell 0.2%, hit by a 0.8% fall in blue-chip developer Emaar Properties and a 0.6% decrease in toll operator Salik Company.

On the other hand, Emirates NBD (ENBD) rose 0.8%, after the top lender beat first-quarter profit estimates, supported by strong growth in loans and interest income.

ENBB - whose total assets surpassed the 1 trillion dirham ($272.26 billion) milestone - reported net profit of 6.2 billion dirhams for the first-quarter, beating analyst expectations of about 5.1 billion dirhams.

In Abu Dhabi, the index fell 0.3%.

Saudi Arabia's benchmark index edged 0.2% higher, helped by a 3.1% jump in the country's biggest lender Saudi National Bank as the bank surpassed analysts' expectations for first-quarter profit.

Elsewhere, Aldrees Petroleum and Transport Services advanced 2.9% after reporting a sharp rise in net profit for the three months ended March 31.

The Qatari index rose 0.2%, with the Gulf's biggest lender Qatar National Bank gaining 0.9% , while Vodafone Qatar climbed 1.6%, following a rise in quarterly net profit.

($1 = 3.6729 UAE dirham)

(Reporting by Ateeq Shariff in Bengaluru; Editing by Michael Perry)