PHOTO

The GCC capital markets could see another major year for public and follow on offerings in 2025, said a senior EFG Hermes executive. Marking a deal value of $19.7 billion from 17 deals, the investment bank led the equity capital market (ECM) league table across the MENA region, fortifying its position as the preferred partner for issuers and investors.

"We are going to continue to build on 2024. We have a very active pipeline built from last year to engage in 2025. Across the region, Saudi and UAE will be incredibly active," said Ali Khalpey, Head of ECM at EFG Hermes. "Private and government sectors will participate in the market for IPOs early on."

Last year, EFG Hermes helped raise $7.2 billion from 11 IPOs across Tadawul, ADX, DFM and Boursa Kuwait and $12.5 billion from six secondary offerings. The investment bank was part of Aramco's secondary offering, the largest follow-on offering (FMO) in the GCC, and also a bookrunner for Saudi-based Nice One, which marked the first unicorn listing on Tadawul.

EFG Hermes acted as a joint bookrunner on the transaction, which involved the divestment of 20% of Delivery Hero's stake, valued at approximately $2 billion, making it the largest UAE IPO of 2024.

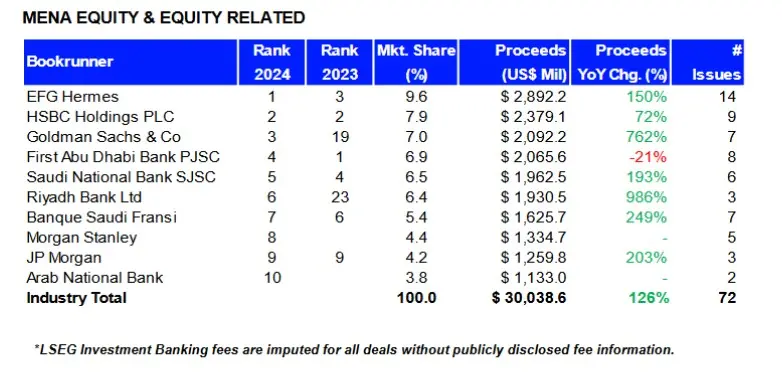

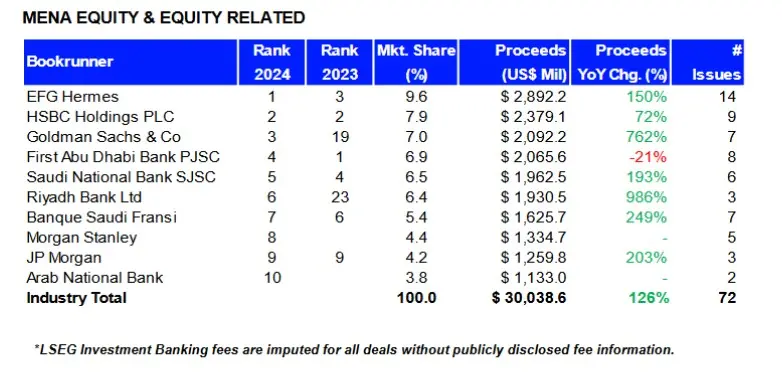

According to LSEG data, MENA equity and equity-related issuance totalled $30 billion during 2024, a 126% increase from year-ago levels and the highest annual total in the region since 2019.

The number of issues increased 16% from year ago levels. IPOs accounted for 41% of activity, while follow-on issuance accounted for 59%. A total of 54 IPOs were recorded during 2024, six more than in 2023 and the highest annual total since 2007.

EFG Hermes took first place in the MENA ECM underwriting league table during 2024, with a 9.6% market share. HSBC Holdings and Goldman Sachs came in second and third with a market share of 7.9% and 7%, respectively.

Saudi leads in ECM

Khalpey is particularly bullish on the Saudi market for IPOs, which he thinks is the most mature in the MENA.

"I think, given the domestic liquidity in Saudi, deal sizes could be from as small as $175 million to as much as $2 billion. I think we will see a broader spectrum of deals in the kingdom. Though there may not be mega IPOs this year, we will certainly see share sales worth $500 million to $1 billion," he said.

"We are expecting to see many more private sector companies looking to engage and come to the market to raise capital on the back of the successful IPOs such as Nice One, Fakheeh and Miahona," Khalpey added.

EFG Hermes was a joint bookrunner for the Saudi healthcare group Dr. Soliman Abdel Kader Fakeeh Hospital Co., which secured $91 billion in orders. It was also the joint bookrunner for the $148 million IPO of Miahona, one of the first developers of water and wastewater infrastructure under the public-private partnership (PPP) in the kingdom.

‘Pricing is an art’

As far as the UAE private IPOs were concerned, some of them plunged during the listing day, perhaps owing to high price or issuers upsizing at the last minute. Spinneys, Lulu and Talabat, which upsized the retail portion, also plunged on the debut trading.

"I think pricing is an art. When you do these transactions, there are so many factors to consider. In the course of last year, given how well the market has been performing, perhaps pricing has been a little on the upper end of the valuation range. But long-term investors are patient, and look at total shareholder return, accounting for dividends in addition to share price appreciation," Khalpey said.

"Upsizing is a tool that benefits the issuer and defines the success of the IPO. It is always positive because it demonstrates that the transaction has more demand than expected. So, if your valuation expectations are met and you have an opportunity to sell that little bit more, you may take advantage of that," he added.

EFG Hermes is expecting a very busy Q2 this year, with more consumer-focused companies coming into the market this year. "Q1 is typically a quiet quarter. Last year we did Parkin and Spinneys. Q2 is going to be an incredibly busy quarter compared to last year," Khalpey said, adding “Last year was a big thematic year for healthcare and the retail sector. I think we will continue to see consumer- focused companies looking to come to the market to continue to take advantage of the growth profile that Saudi, UAE and the wider GCC have to offer.”

(Reporting by Seban Scaria; editing by Daniel Luiz)